Home> International> USA and Canada

‘38% stake’ Son Jung hits 21 trillion won with Coupang investment, 700% return

(Seoul = News 1) Reporter Park Hyung-ki |

2021-02-14 08:02 sent | 2021-02-14 08:21 Last updated

|

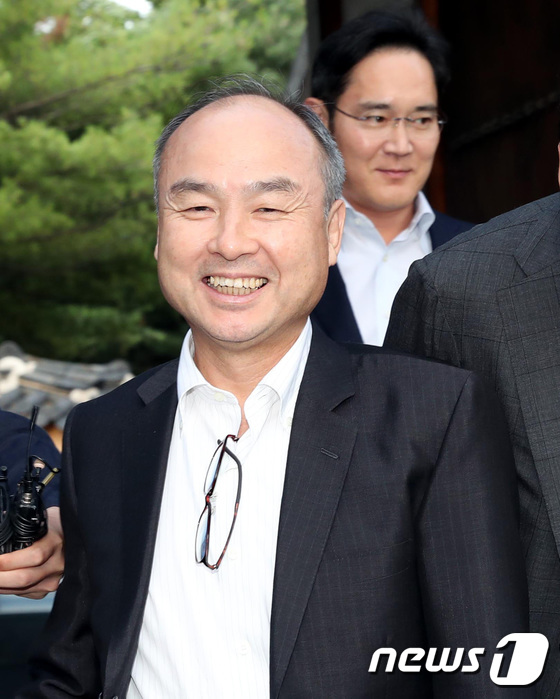

| Japan SoftBank Chairman Son Jeong-eui and Samsung Electronics Vice Chairman Lee Jae-yong are entering the Korean Furniture Museum in Seongbuk-gu, Seoul, where a dinner meeting with heads of domestic companies was held on the afternoon of the 4th. 2019.7.4/News1 © News1 Reporter Park Jung-ho |

SoftBank, led by Chairman Son Jeong-eui, is expected to hit the jackpot as Coupang begins full-scale work for listing on the New York Stock Exchange.

The foreign press predicted that Coupang’s listing will become the largest foreign company IPO since Alibaba Group in 2014, and that Coupang’s corporate value will reach 50 billion dollars (55 trillion won).

The Wall Street Journal (WSJ) reported that Coupang officially announced its listing on the New York Stock Exchange (NYSE) on the 12th.

At the time of the IPO, Alibaba recorded a market capitalization of 168 billion dollars (about 186 trillion won). WSJ said that experts view Coupang’s corporate value at over 50 billion dollars (about 55 trillion won).

WSJ selected SoftBank as the biggest beneficiary of the Coupang listing. Softbank’s Vision Fund held a 38% stake in Coupang with an investment of $2.7 billion twice in 2015 and 2018. If Coupang’s corporate value reaches $50 billion, SoftBank’s stake in Coupang is expected to reach $19 billion (about 21 trillion won).

It is expected to make $19 billion in profit by investing $2.7 billion. This is about 7 times more profitable.

Meanwhile, Bloomberg estimates Coupang’s corporate value at 30 billion dollars (about 33 trillion won). Inside Coupang, it is known to be estimated at 40 billion dollars (about 44 trillion won).

<저작권자 © 뉴스1코리아, 무단전재 및 재배포 금지>