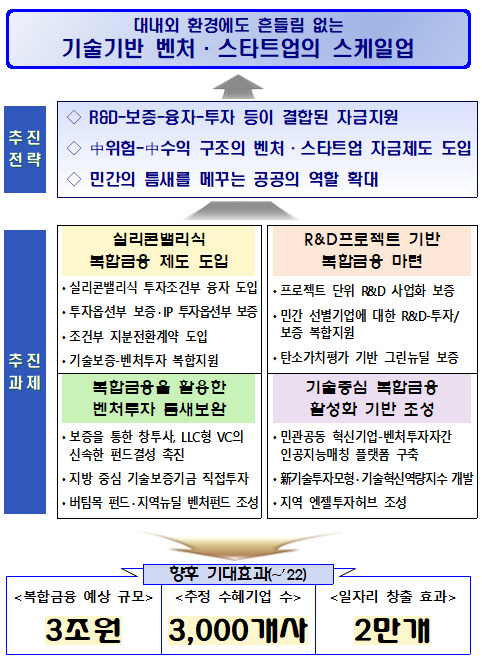

Announcement of’Technology-Based Venture and Startup Complex Finance Support Plan’

Consists of 4 strategies and 23 initiatives including the introduction of complex finance

Technical support-investment-guarantee-financing combined’one-stop’ support

[세종=뉴스핌] Reporter Jeong Seong-hoon = Silicon Valley-style investment conditional loans for technological innovation start-ups and venture companies are introduced. To this end, a customized complex financial system was established that combines technology development (R&D), investment, guarantee, and loan. The government aims to create 20,000 jobs by providing 3 trillion won by 2022.

The Ministry of SMEs and Startups established the’Technology-Based Ventures and Startups Complex Financial Support Plan’ to enable technology-based start-ups and ventures to grow into unicorn companies, and on the 13th, the 26th Emergency Economy Central Countermeasure Headquarters Meeting and 9th It was announced at the second Korean version of the New Deal Ministers’ Meeting.

This plan targets technology-based innovative start-ups and venture companies. Although the technology is excellent, the key is to reduce the risk of funding institutions in consideration of the characteristics of companies that involve high risk when providing funding.

The plan consists of 23 detailed implementation tasks for four strategies, such as ▲Introduction of Silicon Valley-type compound finance system ▲Preparation of compound finance based on R&D project ▲Complement of gap in venture investment utilizing compound finance ▲Establishment of foundation for complex finance activation.

◆ Silicon Valley-style complex financial system introduced

First, the government will amend the Venture Investment Act this year to promote the introduction of the’Silicon Valley Conditional Investment Loan’ system in Korea.

‘Investment Conditional Loans’ is a system in which a lender receives a small amount of equity acquisition rights instead of giving low-interest loans to companies that have already received venture investment and have high potential for follow-up investment.

|

| Concept of conditional loan system [자료=중소벤처기업부] 2021.01.13 [email protected] |

From the standpoint of lenders, loans to companies with high potential for follow-up investment increase the chances of recovery, and in addition, through the right to acquire shares, the company can earn higher than the interest rate when the company grows. From the perspective of a company, it is possible to increase the possibility of subsequent investment while growing the company by receiving a loan, and because it is a loan rather than an investment, it is possible to prevent the diluting of the equity of the founder, etc.

After the revision of the law, the Ministry of SMEs will conduct a pilot operation through a policy loan from the Small and Medium Venture Business Corporation, and plan to spread it to other public funds and private financial institutions in the future. Prior to the revision of the law, the Technology Guarantee Fund, which has an effect similar to that of conditional investment loans, will be expanded to 200 billion won annually.

In particular, a new’Patent Investment Option Guarantee’ is also introduced, in which a part of the guarantee amount is converted into a patent (IP) share (loan repayment). In the case of an investment option guarantee, similar to an investment conditional loan, a guarantee institution can convert a portion of the deposit amount into a share of the company subject to guarantee.

In addition, the’Convertible Note’ system used in Silicon Valley, etc., is also introduced to promote venture investment and diversify investment methods for early start-ups.

The’Contingent Equity Conversion Contract’ is a type of contract that receives principal and interest during the investment period if follow-up investment is not carried out, and converts bonds under commercial law when follow-up investment is carried out.

◆ Preparation of complex finance based on technology development (R&D) tasks

The complex financial system to help commercialize government technology development projects is also expanded.

Representatively, the’Project Unit Technology Development (R&D) Commercialization Financing’, which supports both technology guarantee and commercialization fund loans by evaluating the possibility of commercialization of technology development success projects without looking at the company’s existing debts, is worth 500 billion won in 2021-2022. It is newly established.

In addition, support for investment-type technology development (’20 16.5 billion won → ’21 33.5 billion won) in connection with technology development and venture investment (’20 14.3 billion won → ’21 21 billion won) in connection with technology development and guarantees It will increase from a total of 30.8 billion won to 55.4 billion won this year.

|

| Investment-type technology development support concept [자료=중소벤처기업부] 2021.01.13 [email protected] |

In addition, the’carbon valuation-based Green New Deal Guarantee’, which supports finance by evaluating the amount of GHG reduction in green technology development projects in currency units, will also be implemented in earnest from this year.

It is expected to be provided in an annual amount of 450 billion won through cooperation between the Ministry of Industry and the Small and Medium Business Administration, such as contributions to the Technology Guarantee Fund of the Electric Power Industry Infrastructure Fund.

◆ Complementing the gap in venture investment using compound finance

The complex financial system will also be reinforced to compensate for the blind spot of venture investment.

First, we introduce a guarantee system for start-up investment companies. In order to form venture funds, start-up investment companies have usually invested about 10% of the funds formed in the fund.

However, venture funds have been operated for a long period of time for 7 to 10 years, so when forming additional funds in addition to the existing funds that have been operated for a long time, temporary liquidity problems often have difficulties in quickly forming funds. Accordingly, the government plans to provide guarantees to secure temporary capital for the rapid formation and execution of venture funds.

At the same time, the venture investment capacity of public institutions is focused on non-metropolitan companies. The Technology Guarantee Fund cannot currently invest in companies invested by the parental fund, but plans to make investments in non-metropolitan companies among the parental fund investment companies.

|

| Technology Guarantee Fund’s total investment limit [자료=중소벤처기업부] 2021.01.13 [email protected] |

In addition, the investment ratio of non-metropolitan companies, which is currently 45%, will be operated to be more than 65% of the annual investment by 2025.

For companies that are experiencing temporary difficulties due to Corona 19 or located in the non-metropolitan area, the company will invest 160 billion won in the’Strut Fund’ and up to 500 billion won in the’Local New Deal Venture Fund’ in four regions. The support fund will be invested in concerts with reduced face-to-face opportunities, travel and tourism, wholesale and retail, and export reduction companies. Regional New Deal Venture Funds will be expanded for each region after pilot creation in Busan.

◆ Laying the foundation for revitalization of technology-oriented complex finance

Finally, the ecosystem foundation is built so that the new complex financial systems can operate smoothly.

First, in order to resolve information asymmetry between companies and investors and to quickly invest in technology companies, corporate data held by public institutions is converted into big data, and the’venture investment artificial intelligence online matching platform (tentative name)’ will be established by next year. This allows companies and investors to explore and link investment possibilities.

In addition, two regional angel investment hubs will be established this year to revitalize initial investment for non-metropolitan companies, and induce investment expansion through a matching program between companies and investors.

Mid-term Minister Park Young-seon said, “Even in Corona 19, venture capitalists are playing a role in supporting the Korean economy, such as leading venture capitalists and venture-unicorn companies to lead the KOSPI 3000-KOSDAQ 1000.” It will be remembered as a year that showed the realization of the venture boom and the potential of the Korean venture ecosystem.”

At the same time, “To ensure that the second venture boom that has come next to us does not fade, the Ministry of SMEs and Industry will seamlessly implement the newly prepared complex financing for technology start-ups and venture companies. I will make it a support.”

|

| Technology-based venture start-up complex financing support plan goals and strategies [자료=중소벤처기업부] 2021.01.13 [email protected] |