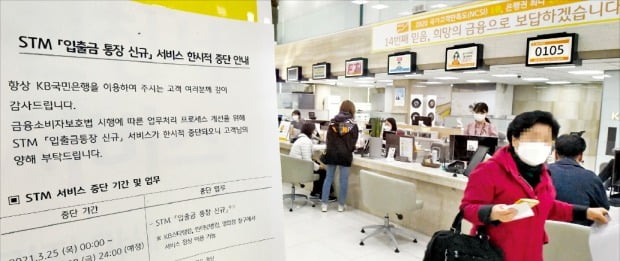

On the 25th, the first day of the enforcement of the Financial Consumer Protection Act, a notice was installed at Kookmin Bank in Yeouido, Seoul stating that it is impossible to sign up for a deposit and withdrawal passbook through’Smart Teller Machine (STM)’ for a while. As product explanations and recording obligations were strengthened, visitors took a lot of time to look at the counter work on this day. Reporter Huh Moon-chan [email protected]

#One. “I’m signing up for a product, but what more are there? Can’t I just explain what I heard now?”

On the morning of the 25th, the voice of A, a man in his 40s at a bank branch in Yeouido, Seoul, resonated. In the process of signing up for the fund, the explanation of the employee continued for nearly an hour. Mr. A sighed, saying “I don’t have time” throughout the consultation, but “I’m sorry. I only heard the answer that the law has changed and I can’t help it.”

#2. On this day, a notice was posted on a smart kiosk at a bank in Myeong-dong, Seoul, notifying the suspension of product subscription. When I clicked the sign-up button, a message appeared stating that the service will be temporarily suspended in order to improve the business processing process according to the enforcement of the Anti-Social Law. Some visitors looked around and headed for the window.

On the first day of the enforcement of the Financial Consumer Protection Act (Money Soo Act), severe confusion arose at front-line banks. As the time it took to sign up for a product increased drastically, conflicts between employees and customers arose in various places. There are also concerns that consumers can easily withdraw (cancel contracts) if they want to subscribe to financial products, which will intensify the confusion at the counter for the time being.

○ 5 minutes → 30 minutes for deposit and savings

The law enforced on that day expanded the ‘6 major sales regulations’ that were applied only to some financial products (the principle of conformity, the principle of adequacy, the duty to explain, the prohibition of unfair business practices, the prohibition of unfair solicitation, and the prohibition of false exaggerated advertising) to all financial products. This is the main point. When signing up for an investment product, the number of questions for analysis of investment propensity has more than doubled from 7 to 15, and sellers are obligated to record the entire sales process. Even if you sign up for deposit and savings, you must print out and deliver both the product description and terms and conditions. Consumers can withdraw the contract even with a simple change of mind within 7 to 15 days of signing up for the product.

It is intended to protect financial consumers, but there have been fewer cases of inconvenience in the field. First of all, the time it takes to sign up for financial products has increased significantly. For example, in the past, when signing up for a deposit or savings account, it was only necessary to fill out one deposit transaction application form. From this day on, even if you take one savings, you must fill out the three steps (confirmation of subscription invitation, deposit transaction application, deposit-related product contract). The bank clerk is obligated to read the information such as the procedure for handling civil complaints, protect depositors, interest rates, and restrictions on use one by one to make sure they understand it.

A bank clerk said, “When writing a contract, we have to explain the details of contract termination and the procedure for handling complaints once again.” “The time required to sign up for deposit and savings products has increased to more than 30 minutes, which ended in 5 minutes.” I complained. An official from a bank branch in Guro-gu, Seoul said, “I was surprised that I had to provide printouts, such as product instructions and terms and conditions, not only when signing up for a new period deposit but simply re-depositing.” There were also customers who complained, “Do you give me a lot?”

○ If you join the fund, the waiting line will increase.

For investment products that have the potential to lose money, such as funds, the sign-up process has become more complicated. The number of questions in the analysis of investment propensity has increased significantly, and the time to explain each item has also increased. An official at a commercial bank branch in Songpa-gu, Seoul said, “Even when signing up for a savings fund, the time for analyzing investment propensity increased and the consultation time per customer increased by more than 20 minutes. I did.”

Banks say that the confusion at the bank’s counter will inevitably increase for a while. Under the new law, consumers can withdraw their loans if they change their mind within 14 days of the loan’s execution date. However, you must indicate your intention to withdraw and repay principal and interest and expenses (document issuance fee, etc.). From May 10, the fund can cancel the contract with a simple change of mind. However, this applies only to cases classified as’high-difficulty financial investment products’. The definition of’high difficulty product’ is expected to come out in May. Industry forecasts that stock price-linked securities (ELS) and stock price-linked funds (ELF) will be the targets.

An official from a commercial bank said, “Because it is possible to withdraw a loan or fund subscription with a simple change of mind, the bank cannot prevent it even if it withdraws after signing up for the product, saying that the interest rate of another bank is better or the external economic conditions such as the stock market are worsening. “If the number of customers who abuse this increases, the banking site will inevitably cause confusion,” he said. The financial authorities plan to give a six-month grace period for sanctions, such as imposing fines, taking into account the lack of preparation of the financial sector and the period of adaptation.

Reporter Jeong So-ram/Oh Hyun-ah [email protected]