Deadline for fiscal year 2020

It was confirmed that the national tax revenue in 2020 was 285 trillion won, down 7.91 trillion won compared to the previous year (293 trillion 4543 billion won).

Ahn Il-hwan, the second vice minister of the Ministry of Strategy and Finance, closed the total revenue and expenditures for the 2020 fiscal year at the Korea Financial Information Service, attended by audit committee member Kim Jin-guk of the Audit Office.

As a result of the closing, the finalized total revenue was 465 trillion won, the total expenditure was 453.5 trillion won, the difference in settlement surplus was 11.07 trillion won. did.

Last year’s national tax revenue was 285 trillion won, down 2.7% from the previous year.

It decreased compared to the previous year due to the delay in economic recovery due to Corona 19, but the extent of the decline was partially offset by an increase in asset-related taxes.

Corporate taxes decreased by KRW 16.7 trillion due to poor corporate performance, and tariffs (-0.8 trillion KRW) and liquor tax (-0.5 trillion KRW) decreased due to the contraction of economic activity.

With the increase in real estate and stock transactions, the transfer tax increased by KRW 7.6 trillion, the securities transaction tax increased by KRW 4.3 trillion, and the inheritance and gift tax increased by KRW 2 trillion.

The increase in local consumption tax rate (15→21%), etc. reduced the VAT by KRW 5.9 trillion.

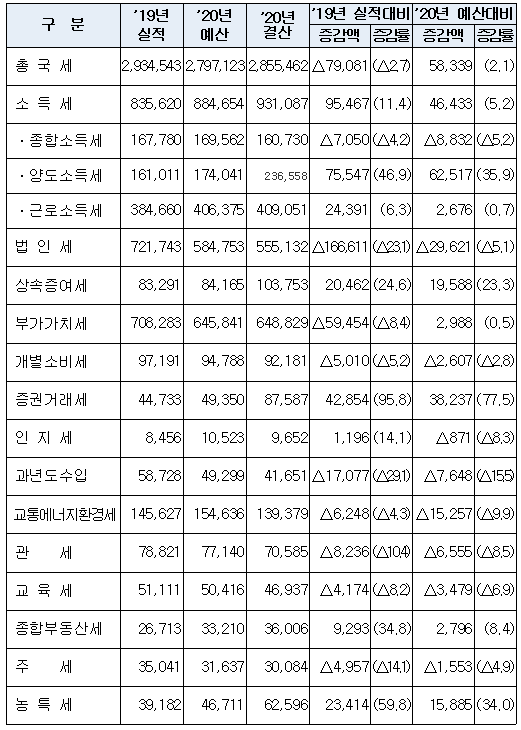

○ Performance of national tax revenue by tax category (Unit: KRW 100 million, %)

|

division |

’19year Performance |

’20year budget |

’20year settlement |

’19Compared to annual performance |

’20Against annual budget |

||

|

Increase or decrease |

Increase/decrease rate |

Increase or decrease |

Increase/decrease rate |

||||

|

Total national tax |

2,934,543 |

2,797,123 |

2,855,462 |

△79,081 |

(△2.7) |

58,339 |

(2.1) |

|

Income tax |

835,620 |

884,654 |

931,087 |

95,467 |

(11.4) |

46,433 |

(5.2) |

|

ㆍComprehensive income tax |

167,780 |

169,562 |

160,730 |

△7,050 |

(△4.2) |

△8,832 |

(△5.2) |

|

ㆍCapital gains tax |

161,011 |

174,041 |

236,558 |

75,547 |

(46.9) |

62,517 |

(35.9) |

|

ㆍEarned income tax |

384,660 |

406,375 |

409,051 |

24,391 |

(6.3) |

2,676 |

(0.7) |

|

Legal person tax |

721,743 |

584,753 |

555,132 |

△166,611 |

(△23.1) |

△29,621 |

(△5.1) |

|

Inheritance and gift tax |

83,291 |

84,165 |

103,753 |

20,462 |

(24.6) |

19,588 |

(23.3) |

|

VAT |

708,283 |

645,841 |

648,829 |

△59,454 |

(△8.4) |

2,988 |

(0.5) |

|

Individual consumption tax |

97,191 |

94,788 |

92,181 |

△5,010 |

(△5.2) |

△2,607 |

(△2.8) |

|

Securities transaction tax |

44,733 |

49,350 |

87,587 |

42,854 |

(95.8) |

38,237 |

(77.5) |

|

Personage three |

8,456 |

10,523 |

9,652 |

1,196 |

(14.1) |

△871 |

(△8.3) |

|

Past year income |

58,728 |

49,299 |

41,651 |

△17,077 |

(△29.1) |

△7,648 |

(△15.5) |

|

Transportation Energy Environment Tax |

145,627 |

154,636 |

139,379 |

△6,248 |

(△4.3) |

△15,257 |

(△9.9) |

|

Customs |

78,821 |

77,140 |

70,585 |

△8,236 |

(△10.4) |

△6,555 |

(△8.5) |

|

Education tax |

51,111 |

50,416 |

46,937 |

△4,174 |

(△8.2) |

△3,479 |

(△6.9) |

|

Comprehensive Real Estate Tax |

26,713 |

33,210 |

36,006 |

9,293 |

(34.8) |

2,796 |

(8.4) |

|

Week three |

35,041 |

31,637 |

30,084 |

△4,957 |

(△14.1) |

△1,553 |

(△4.9) |

|

Agricultural special tax |

39,182 |

46,711 |

62,596 |

23,414 |

(59.8) |

15,885 |

(34.0) |