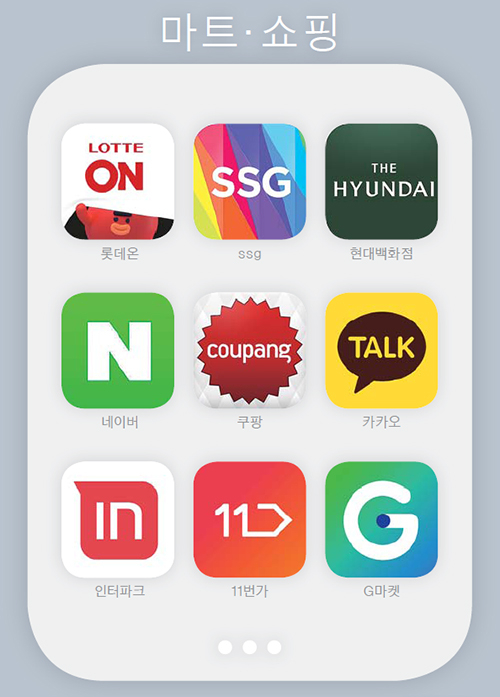

Shopping app

The battle in the domestic retail market, which is estimated at 475 trillion won (as of the end of 2020), is getting hotter. Coupang, which has grown into a large retailer with annual sales of 13 trillion won, has drawn the frenzy. As Coupang made a bigger investment and went on to go public on the New York Stock Exchange in the US to secure livestock. Existing distribution giants such as Lotte, Shinsegae, and Hyundai Department Store, which have watched Coupang’s growth so far, as well as information technology (IT) industry giants such as Naver and Kakao, are moving faster.

Big match over the 475 trillion won retail market

E-commerce indiscriminate advance

Kakao’s annual transaction amount is close to 6 trillion

Coupang aims to dominate the entire distribution industry

Offline Strong’s Counterattack

Shinsegae and Naver complement weaknesses in cooperation

Lotte prepares for reversal based on solid logistics

◆’Coupang’ for indiscriminate business expansion‘=Coupang aims to advance into neighboring industries beyond strengthening distribution competitiveness with the funds that will be obtained if it succeeds in listing on the US New York Stock Exchange. That would be the case, and the accumulated deficit has already reached 4.5 trillion won. It is difficult to build a position as desired based on profits from the distribution industry. In fact, it is difficult to say that it is number one in the online distribution industry. In terms of transaction amount, Naver ranks first with a slight difference. This is the reason why Coupang expanded its business scope to Korea’s distribution, grocery, food delivery, and travel markets through the listing declaration form.

◆Kakao aiming at the luxury market of’making a gift’= Kakao Commerce, which was regarded as a hidden power in the e-commerce industry, is also showing its claws. Last year, Kakao Commerce’s transaction volume increased by 64% compared to the previous year. The sales of the’Give Gift’ and’Maker’ services increased by 52% and 60%, respectively, during the same period, and the Talk Store for Shopping recorded a remarkable growth of 292% compared to the previous year. Thanks to this, the distribution price estimates that the annual transaction value of Kakao Commerce will reach 6 trillion won.

Domestic retail market size. Graphic = Kim Hyun-seo [email protected]

In the case of Kakao Commerce, most of the transactions are made through’gift’. It is a structure in which sales are generated in the form of gift certificates (vouchers) without establishing a separate logistics network. Unlike Coupang, etc., it has the advantage of incurring almost no logistics cost. Instead, Kakao Commerce aims to focus on strengthening its luxury lineup. The Yves Saint Laurent Monogram Kate Bag bag, which is still worth 2.75 million won, is sold through’Gift Gift’. Kakao Commerce said, “The percentage of online sales in the massige and luxury markets is less than 50%,” and “We plan to continue to enter luxury brands like Montblanc, Chanel Beauty, and Tiffany.”

◆ Naver and Shinsegae built the’United Front’= Naver and Shinsegae Group joined hands early. It is actually an alliance. It is symbolic that Jung Yong-jin (53), vice chairman of Shinsegae Group, met with Lee Hae-jin (54), Naver Global Investment Manager (GIO) at Naver headquarters in Seongnam-si, Gyeonggi-do last month to discuss concrete cooperation plans. Kang Hee-seok (52), E-Mart CEO, and others were present.

Naver has risen to the number 1 e-commerce company in Korea (20 trillion won as of 2019) beyond Coupang. Shinsegae also aims to expand into the e-commerce industry steadily after strengthening its capabilities offline with E-Mart. However, SSG, Shinsegae’s representative e-commerce company, only surpassed 4 trillion won last year. Naver is also the No. 1 company in terms of transaction value, but in fact, it is in the form of an open market, so there are limitations in product sourcing. The two companies are working together to make up for each other’s weaknesses. There is also a powerful weapon of simple payment through Naver Pay. The solidarity between these strong players can be a safety plate for each company as it often shakes the market like the listing of Coupang.

![On the 15th, when social distancing has eased, a notice informing about the extension of business hours is posted at a hypermarket. [뉴시스]](https://i0.wp.com/pds.joins.com/news/component/htmlphoto_mmdata/202102/17/aec3b07f-d68c-4ac6-b3bb-a260bf35f50b.jpg?w=560&ssl=1)

On the 15th, when social distancing has eased, a notice informing about the extension of business hours is posted at a hypermarket. [뉴시스]

◆Ebay urgently looking for owners=EBay Korea is in a hurry to find a new owner. In the market, the company’s ransom is estimated at up to 5 trillion won. EBay Korea recently held a briefing session on the sale to Lotte and Shinsegae. However, Lotte and Shinsegae are not yet responding. It is inevitable that eBay Korea continues to lose its market dominance due to coupang and others.

◆Lotte, if you decide which direction to go, you should turn 13=The worries of Lotte Shopping are also deep. This is because the online space has not been able to achieve such results. This is especially true of the group’s flagship Lotte Group Distribution BU (Business Unit). However, Lotte has a solid logistics infrastructure. It is the logistics infrastructure that Coupang, which is evaluated to have a corporate value of over 50 trillion won when listed, is the biggest strength. Coupang has established logistics bases in over 100 locations nationwide. However, Lotte Distribution BU, which has an annual transaction value of about 50 trillion won, already has logistics bases in 160 locations across the country, combining 51 department stores (51) and marts (113). This is why there is a constant prospect in the distribution industry, “If Lotte sets its direction, it will be able to overturn the current inferiority.”

Kim Jin-woo, an analyst at KTB Investment & Securities, said, “In the distribution industry, the penetration rate of Korea’s e-commerce market, which is currently 34%, is the initial phase for user expansion.” It means that the reorganization of the domestic distribution market begins from now on.

Reporter Lee Soo-ki [email protected]