Input 2020.12.29 12:20 | Revision 2020.12.29 12:37

It was found that the number of single houses who paid the comprehensive real estate tax (deposit tax) last year was 19,2185, an increase of 50.9% from 2018 (12,7369). The ending tax they paid has more than doubled from 71.8 billion won in 2018 to 146 billion won last year. The number of multi-homed people (two houses or more) who paid the tax tax increased 22.2% from 265,874 in 2018 to 32,4935 last year, and the tax paid by them increased 117% from 3714 billion won to 806.3 billion won.

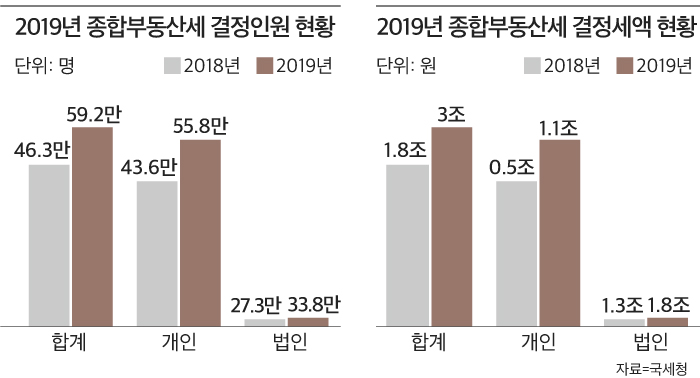

According to the 2020 National Tax Statistical Yearbook released by the National Tax Service on the 29th, a total of 592,000 people paid the comprehensive real estate tax last year, an increase of 27.7% from 2018. The amount of tax determined for the final tax was 3,72 trillion won, up 60.2% from 2018 (1,8773 trillion won).

A total of 517,120 people paid the tax on housing, an increase of 12,3877 people (31.5%) from the previous year (39,3243 people). The total determined tax amount was 952.4 billion won. By region, Seoul 57.1% and Gyeonggi 22.6% accounted for about 80% of the total taxpayers. The government has begun imposing tax on multi-homeowners through real estate measures announced on September 13, 2018.

The average transfer price of a house that reported a transfer tax due to the taxation of the transfer tax (below taxation, excluding tax for one-family, one-family house) was 348 million won, an increase of 2.3% from the previous year. The average transfer price by housing location was in the order of Seoul (78 million won), Gyeonggi (212 million won), and Daegu (299 million won).

A total of 19.1 million people reported year-end settlement of their earned income last year, an increase of 3.1% from the previous year (18.58 million people), and their average salary per person was 37,000 won. This is an increase of 2.7% from the previous year (36.47 million won).

The total salary exceeded 100 million won was 852,000, up 6.2% from the previous year (802,000), accounting for 4.4% of the total. This is the result of an increase of 0.1 percentage points over the previous year. Among those who filed for year-end settlement, 7.75 million people did not pay taxes due to low income, accounting for 36.8% of the total. It decreased by 2.1%p compared to the previous year (38.9%).

Last year, the number of comprehensive financial income taxable for filing a comprehensive income tax in excess of 20 million won was 159,000, an increase of 30,000 (23.6%) from the previous year. Their average income was 267 million won, a decrease of about 20 million won (7.1%) from the previous year. The number of people with financial income exceeding 500 million won was 4810, an increase of 5.6% from the previous year (4556), and the average per capita income was about 2.9 billion won, an increase of 4.4% from the previous year.

There were 7.46,000 daily wage earners, and their average gross income per capita was 8,07 million won, a slight decrease from the previous year (8.10 million won).