Enter 2021.02.23 12:00 | Revision 2021.02.23 15:52

Donghak ant craze… Securities and other brokerage companies’the largest ever’

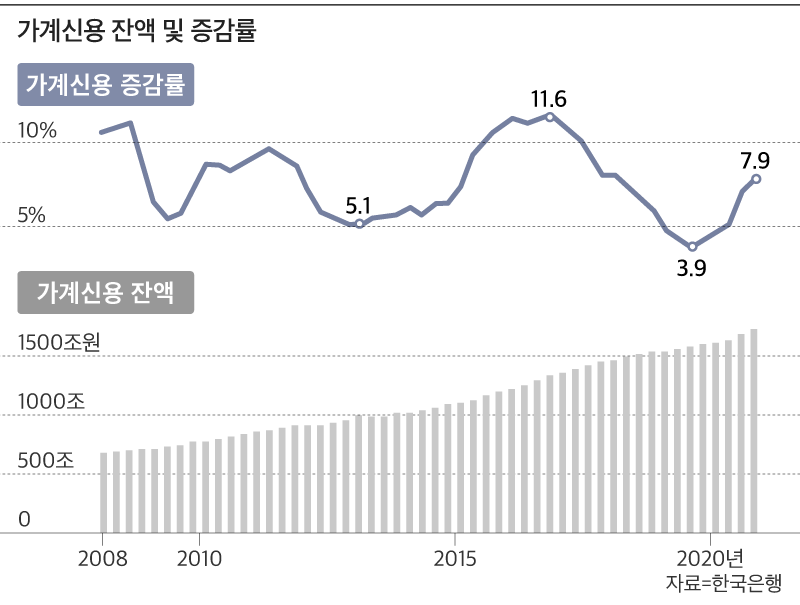

Korea’s household debt reached 1726 trillion won at the end of last year. In the second half of last year, debt increased by nearly 90 trillion won as demand for’debt investment and spirit’ in real estate and stocks rushed. Other loans, including credit loans, have increased to the maximum since statistics began. This is in contrast to the amount of credit card used in the aftermath of a novel coronavirus infection (Corona 19).

According to the’Household Credit for the 4th Quarter of 2020 (provisional)’ released by the Bank of Korea on the 23rd, the balance of household credit as of the end of last year was totaled at 1726 trillion KRW. Household credit refers to a comprehensive debt obtained by adding loans (household loans) received by Korean households from financial institutions such as banks and insurance companies and the amount of credit card usage (sales credit).

Among household credits, household loans excluding sales credit recorded 163.2 trillion won at the end of last year. The annual increase amounted to 12.5 trillion won (8.3%). In particular, the increase of 44.5 trillion won in the three months since the end of September. This is also the largest ever.

The reason that household debt increased significantly last year was because demand for investment in assets such as real estate and stocks rose sharply through loans. Other loans, including credit loans, increased by 57 trillion won last year, the largest increase ever. As of the fourth quarter, it also increased by 2.4 trillion won, recording the highest quarterly increase. As a result, the balance of other loans at the end of last year exceeded 700 trillion won at 719 trillion won.

Mortgage loans also maintained a high trend. At the end of last year, it increased to 910 trillion won, an increase of 67.8 trillion won (8.0%) in one year. In the fourth quarter, it increased by 20 trillion won, the largest increase since the fourth quarter of 2016 (24 trillion won).

Looking at household loans by institution, the annual increase of 12.5 trillion won (10.7%) to deposit banks. It has more than doubled compared to last year (57 trillion won). In the fourth quarter alone, it increased by 28.900 trillion won. Both quarterly and annual growth are all-time highs. The increase in mortgage loans expanded and other loans also increased significantly from the previous quarter.

At non-bank deposit handling institutions, it increased by 7.6 trillion won, which is an increase from the previous year (-4 trillion won). Among other financial institutions, other financial brokerage companies, including securities companies, increased KRW 26.3 trillion annually. It reached a record high due to the increased demand for stock investment and the increase in credit contributions to securities companies.

On the other hand, at the end of last year, sales credit increased only 200 billion won per year. Compared to last year (5.6 trillion won), the scale is significantly reduced. In the fourth quarter, it decreased by 200 billion won. This is the aftermath of a decrease in card usage as consumption declined due to the re-proliferation of Corona 19.