[금융감독원 제공. 재판매 및 DB금지]

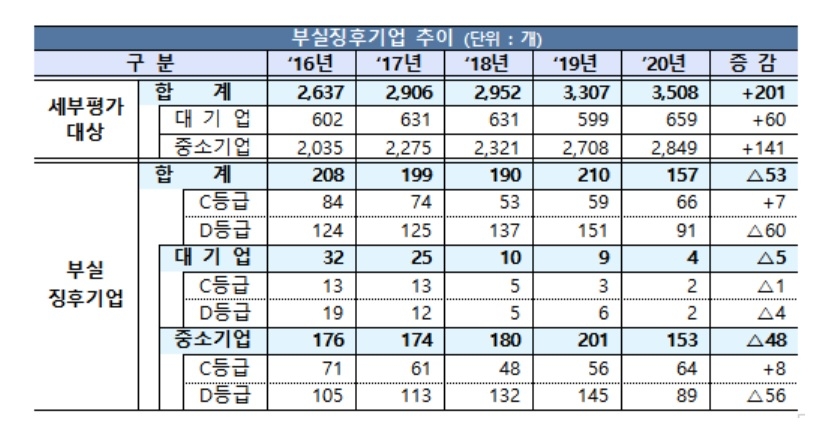

(Seoul = Yonhap News) Reporter Da-Hye Kim = 157 companies that need restructuring due to signs of insolvency were counted this year.

Despite the new coronavirus infection (Corona 19), the number decreased by 53 from last year. This is because there were many companies that temporarily passed the liquidity crisis thanks to large-scale financial support.

The Financial Supervisory Service announced on the 28th that as a result of the credit risk assessment of 3,508 companies by creditor banks, four large companies and 153 small and medium-sized enterprises were identified as companies with signs of insolvency. Compared to last year, there were 5 large companies and 48 small and medium-sized enterprises, respectively.

It has been three years since 2017 that the number of SMEs after insolvent signs has decreased.

Among all companies with signs of insolvent, D-grade, which is evaluated as having a small possibility of normalization, decreased by 60 from last year to 91, and C-grade, which is likely to normalize, increased by seven to 66.

The Financial Supervisory Service explained, “The delinquency rate of corporate loans fell and the number of companies that applied for rehabilitation decreased due to the liquidity support effect of the financial sector related to Corona 19.”

The scale of financial support such as loans, maturity extensions, and guarantees for SMEs, small business owners, and personal debtors affected by Corona 19 amounted to 261.1 trillion won from February this year to the last 4 days.

However, the Financial Supervisory Service added, “It is estimated that the credit risk assessment excludes temporary effects from Corona 19 and that corporate performance is recovering from the third quarter.”

If the economic recovery is delayed due to the prolonged Corona 19 and financial support is terminated in the future, there is a concern that potential credit risk will surface.

Looking at the companies with signs of insolvent selected this year by industry, there are 17 metal processing, 13 wholesale and product brokerages, 13 real estate, 12 rubber and plastics, 12 mechanical equipment, and 12 automobiles.

The mechanical equipment, electronics, real estate, and automobile industries decreased by 23, 8, 6 and 5 respectively from last year, while the steel, rubber and plastic industries increased by 3 and 2 from last year.

[금융감독원 제공. 재판매 및 DB금지]

As of the end of September, the financial sector’s credit contribution to companies with signs of insolvent was 2.3 trillion won (700 billion won for large companies and 1.6 trillion won for SMEs). Of these, the amount of credit contributions from banknotes accounted for 1.8 trillion won (78.3%).

The Financial Supervisory Service estimated that if the bank sooner or later reclassifies the asset quality of loans to these companies with signs of insolvent, it will need to accumulate about 235.5 billion won as a provision for bad debts.

An official from the Financial Supervisory Service said, “Considering the ability of domestic banks to absorb losses, the impact on the soundness of the bank will not be significant.” It is expected that the points will fall.”

The Financial Supervisory Service plans to promptly promote restructuring for companies with signs of insolvent, and instruct creditor banks to strengthen follow-up management for companies that do not apply for a workout.

If you are a company experiencing a temporary business crisis, you can get help through fast financial support and free workout programs from bond banks.

[금융감독원 제공. 재판매 및 DB금지]

Unauthorized reproduction-prohibition of redistribution>

2020/12/28 12:00 sent