A plan to extend loan maturity and deferring interest repayment by small business owners and SMEs will come out this month. The maturity of the 130 trillion won worth of loans has been extended twice since March last year to be 1 year and 6 months. In addition, even after financial support is over, it has also decided to prepare a’soft landing plan’ in which the principal and interest are paid off over a long period of time to reduce the burden on borrowers.

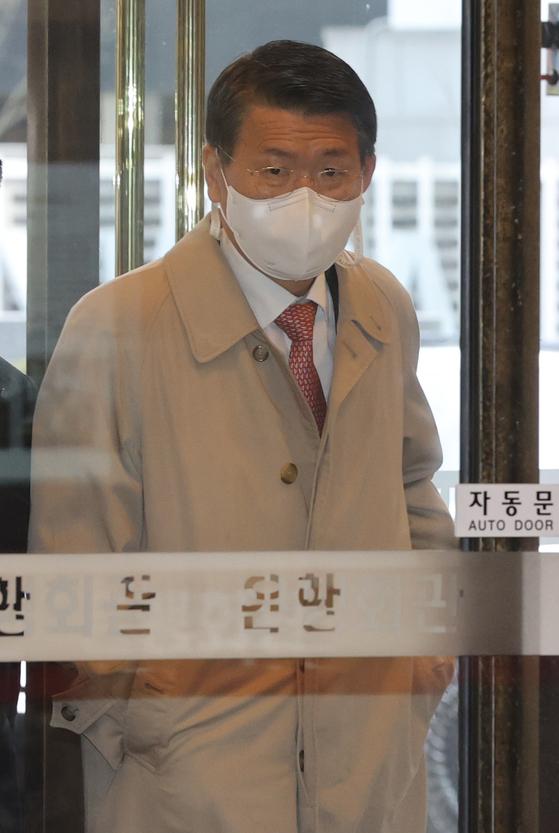

Finance Commissioner Eun Seong-soo is heading to the meeting chairman at the Bank Center in Jung-gu, Seoul on the afternoon of the 22nd to meet with the heads of the Banking Federation and other financial associations. yunhap news

The Financial Services Commission announced on the 22nd that it was necessary to re-extend the repayment of loans by small business owners and SMEs by holding a meeting with Eun Seong-soo, chairman of the Financial Services Commission, and the chairman of the Financial Association. The meeting was attended by Kwang-soo Kim, Chairman of the Banking Federation, Hee-soo Jung, Chairman of the Life Insurance Association, Jung Ji-won, Chairman of the Non-life Insurance Association, Joo-Hyun Kim, Chairman of the Credit Finance Association, and Jae-shin Park, Chairman of the Savings Bank. They gathered opinions on re-extending financial support for six months, taking into account the Corona 19 situation, the real economy, and the financial sector’s tolerability.

Earlier this year, the Financial Services Commission has announced that it will announce the final plan after collecting opinions from the financial sector after devising a plan to re-extend the maturity extension for six months through a work plan. Accordingly, Chairman Eun met with the chairman of the five major financial holding companies (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) and the head of a policy financial institution to seek cooperation in extending the maturity of loans. The re-extension is finished as the presidents of financial associations expressed consensus on the six-month extension.

Finance Commissioner Eun Seong-soo is holding a meeting with the heads of the Financial Association on the 22nd at the Bank Center in Jung-gu, Seoul. (Clockwise from left) Jae-sik Park, Chairman of the Savings Bank, Kwang-Soo Kim, Chairman of the Bank Federation, Hee-Soo Chung, Chairman of the Life Insurance Association, Joo-Hyun Kim, Chairman of the Credit Finance Association, Seong-Soo Eun, Chairman of the Financial Services Commission, Ji-won Jung, Chairman of the Non-life Insurance Association. yunhap news

At the conference on this day, it was decided to prepare a plan for a soft landing so that the burden of repayment would not be concentrated at a time after the grace period was over. To this end, ‘5 Principles of Support for Deferred Reimbursement for Soft Landing’ were prepared. The five principles are: ① Provide consulting on the optimal repayment plan considering the situation of the borrower ② Provide a repayment period longer than the grace period in case of amortization of deferred principal and interest ③ No interest imposed on the deferred interest ④ If the borrower wants to repay early, no interim repayment fee Possible ⑤ Decisions on the final repayment method and period consisted of choosing the borrower’s price. In fact, the loan maturity does not end at the end of September, but is increased by ‘6 months + @’because the payment period is given.

Based on this principle, financial associations such as the Banking Federation will propose various long-term and installment repayment methods in early March. The Financial Services Commission explained, “We will continue to manage soundness through close monitoring of changes in repayment capacity and preemptive provisions so that risks in the financial sector do not accumulate due to the delay of maturity and interest repayment.”

In the meantime, the financial sector has sympathized with the purpose of re-extension, but has expressed difficulty in re-extending interest repayment. This is because it is a marginal company that cannot pay interest other than the principal of loans, and the possibility of survival after the end of Corona 19 is slim. Looking at the loan maturity extension and repayment deferred (Financial Commission business report) for SMEs and small business owners, the amount of extension of maturity is 116 trillion won (350,000 cases), and the postponement of repayment of principal and interest in installments is 8,500 billion won (55,000 cases). Of these, 157 billion won (13,000 cases) that delayed repayment of interest, whether temporarily or divided, was. It is about 4 trillion won if you look at the loan principal hidden behind it. This means that about 130 trillion won in loans have been tied for one year and six months.

Reporter Ahn Hyo-seong [email protected]