Input 2021.02.14 15:13

14.8 million customers…4.7 million paid members

Differential voting rights granted to Kim Bum-seok…listed in the U.S. with guaranteed management rights

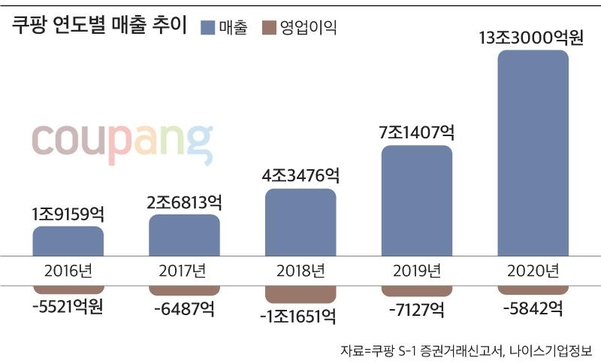

① Annual sales 13 trillion won

Last year, Coupang’s annual sales amounted to $11,67.34 million (about 13 trillion won), up 91% from 2019 ($6.273.26 million). In 2018, operating loss from $1.05241 million (about KRW 1.162.3 trillion) was reduced by nearly half in two years to $5273 million (about KRW 58 billion) last year. The net loss was also $474.90 million last year (about 525.7 billion won), which was significantly lower than the previous year (6980.8 million dollars). Sales nearly doubled, but the deficit decreased by about half. Lotte Shopping, the number one retailer in Korea, recorded 16 trillion won in sales last year.

② 14.85 million customers…32% are paid members

As of the end of last year, 14.8 million people bought more than one product in Coupang in the last three months. Compared to the end of 2019 (approximately 1,1791,000 people) and the end of 2018 (approximately 9163,000), it has increased by 62% in two years. The purchase amount per customer also increased. Coupang’s customers spent an average of 256 dollars per quarter (28,2718 won). It has doubled from 2018 ($127).

This is interpreted by the effect of’lock in’ of the paid membership system, which started in 2019. Coupang’s paid membership service,’Rocket Wow’, allows you to receive a variety of products for same-day or early morning delivery for 2,900 won a month. Recently, an online video service (OTT)’Coupang Play’ was newly established as a membership benefit. Last year, the number of Rocket Wow membership subscribers was 4.7 million, accounting for 32% of all users.

Coupang said it was’the second largest logistics company in Korea’ through the listing declaration. Coupang has more than 150 distribution centers in 30 cities. It covers a total floor area of 25 million square feet (approximately 703,800 pyeong) and covers 400 soccer fields. In addition, 70% of the people live within 11km (7 miles) of the Coupang Distribution Center.

.

The goods in the distribution center are carried by 15,000 people (as of the end of last year) of Coupang friends (formerly Coupangman, delivery man). Coupang hired 25 million new people last year. It also plans to create a total of 50,000 jobs by 2025.

Bum-seok Kim, chairman of the board of directors, said in the listing report, “We will compensate for up to 100 billion won worth of stocks to front-line and non-managerial employees. These are the foundations of the company and the reason for its success.”

④ Kim Bum-seok’s remuneration is 15.8 billion won, and the younger brothers and sisters also 800 million won

Chairman Kim, the founder of Coupang, received an annual salary of 886,000 dollars (approximately 980 million won) and a total of 14,411,229 dollars (equivalent to 15.8 billion won), including bonuses in the form of shares.

Among the key executives, Tuan Pam CTO, who was recruited to Coupang last year, was a former Uber Chief Technology Officer (CTO). He received a total of 27.46 million dollars (about 30.5 billion won), including stock bonuses worth 2743 million dollars.

Chairman Kim’s younger brother and wife also received a total of 800 million won. The younger brother is $279,000 to $475,000 since 2018, and the younger brother’s wife is $202,000 to $247,000 (about 220 million to 270 million won) during the same period. 10,000 won) was received. In the stock exchange report, Coupang stated that he hired Chairman Kim’s younger brother and wife as a’employer conflict of interest’. “We are receiving rewards and incentives.”

⑤ 29% differentiated voting rights are granted…Kim Bum-seok system maintained

In the process of listing, Coupang granted Class B common stock rights only to Chairman Kim. It is a’super stock’ that has 29 times more voting rights than Class A common stock issued to ordinary investors. After listing, Chairman Kim can exercise the voting rights equivalent to 58% of the stock at the general shareholders’ meeting even if he has only 2% of the stake, so he can maintain management rights.

It is interpreted in the industry that Coupang chose to list on the New York Stock Exchange because of this guarantee of differential voting rights. In Korea, differential voting rights in which multiple voting rights are exercised per share are not guaranteed. As a result, domestic startups and ventures tend to weaken the voting rights of startups as external investments increase.

Founders of major IT companies, such as Google and Airbnb, were also guaranteed 10-20 times differential voting rights per share when listed in this way.

Earlier, Coupang transfused a total of $3 billion (3.3 trillion won) from Softbank twice in 2015 and 2018. Through this, distribution centers were built nationwide and the market share was increased by direct purchase and rocket delivery through direct hiring of delivery personnel.

However, the cumulative deficit increased due to continued investment, and it is urgent to secure additional funds. As of the end of last year, Coupang’s cumulative deficit amounted to $4.118 billion (about 4.5 trillion won). Through this listing, Coupang plans to raise $1 billion (approximately 1.1 trillion won) to expand logistics and employment, as well as invest in new businesses such as food delivery services’Coupang Itz’ and’Coupang Play’.