The title of the white paper is the P2P electronic money system. In the first line of the summary of the white paper, Bitcoin is defined as’pure P2P electronic money that can be paid online without a financial institution’. It is a short thesis consisting of 12 items from introduction to conclusion. How to transact, how to prevent double payments, how to make coins, how to reward participants, what is the total amount of issuance, how to protect privacy, how to maintain the network, prevent hacking and maintain the stability of remittances. Explaining how to do it. For more information, you can easily find it by searching for’bitcoin white paper’ or’bitcoin white paper’.

Currency excluding financial institutions! That’s Bitcoin! What is the Fed. I’m the head of a financial institution. It is also the emperor who reigns over financial institutions around the world. Excluding financial institutions is a very bad or bad view of the Fed. The just-born electronic money has declared that it will play with individuals (P2P), excluding the Fed and financial institutions. In the conclusion of the white paper, I add another word.

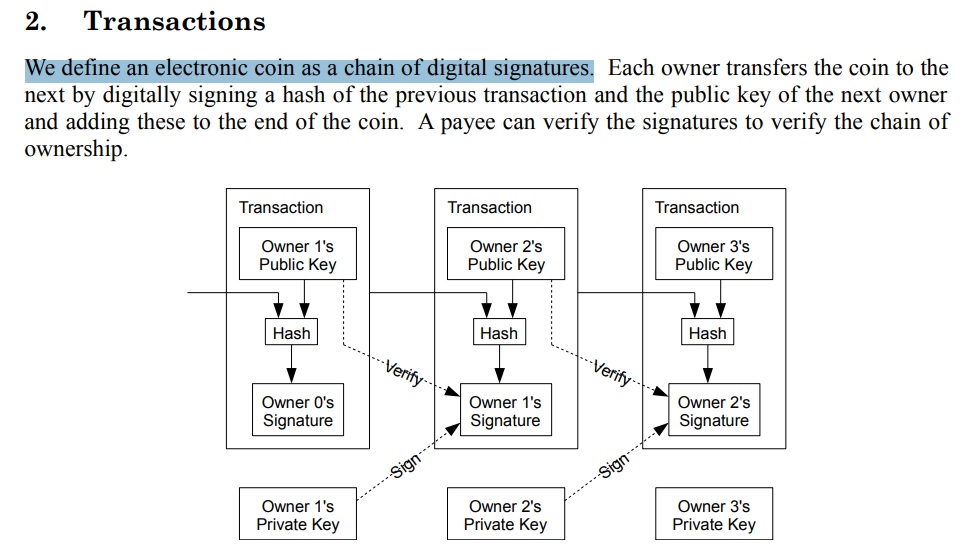

We proposed an electronic money system that is not based on trust. ‘We have proposed a system for electronic transactions without relying on trust”. TRUST. Here, trust includes financial institutions as well as the state. The currency issued by the central bank basically starts with trust in the state. You don’t have to trust! We are expanding the targets that are unnecessary in the monetary system to financial institutions, central banks, and countries.

In a word,’Dangranggeocheol’, a mantis blocks the cart. I didn’t know the dog was scary overnight. But that wasn’t it. More and more speculators (?) sympathize with the purpose of Bitcoin, and financial institutions from Wall Street, the Fed’s ally, are also joining the Bitcoin camp. Even players from the Fed side, whose sense of money is ghosts, are joining the Bitcoin camp.

The Fed can’t say a word. In the meantime, I didn’t even care about bitcoin or cryptocurrency, but now I have grown to the level that I need to worry about and say a word. I did this, but I didn’t do it very much. Summarizing the contents “It is a speculative asset. It will compete with gold, not dollar.”is. It’s not a one-sided bad story for Bitcoin.

Bitcoin’s growth is a big part of the Fed’s own initiative. The devastating dollar spread has deteriorated trust in the Fed and the dollar.

It’s the Fed’s balance sheet. It shows the amount of assets such as government bonds held by the Fed. It has increased from less than $1 trillion to $4 trillion since the 2008 financial crisis and is now approaching $8 trillion since the recent pendemic. The Fed buys assets by stamping dollars. They are sprinkling dollars. After the last financial crisis, bitcoin was released is the time to spread the dollar.

Can I loosen the money like this? The dollar still holds a strong position as a key currency. However, those who have the memory of hitting inflation with currency spread are anxious. The history of the key currency declined with the decline of the key currency country was repeated. American hegemony is not the same as it used to be. It occupies an absolute position, but the cracks and doubts about the dollar and the international financial system are growing little by little.

Powell’s remark,’I will compete with gold, not the dollar!’ sounds like a compromise, not excluding bitcoin.