Net profit of 100 billion units due to a surge in transaction volume such as the highest bitcoin price

The number of members such as Bithumb, Coinone, Upbit, and Kobit also surged, one stone two trillion

[서울=뉴스핌] Reporter Lee Jung-yoon = The bitcoin craze that started from the end of last year showed that the net profits of the four major domestic cryptocurrency exchanges in Korea surged by up to 1000% last year. Recently, as bitcoin has hit a high of 75 million won and other cryptocurrencies are attracting attention, expectations for the first quarter of this year are increasing.

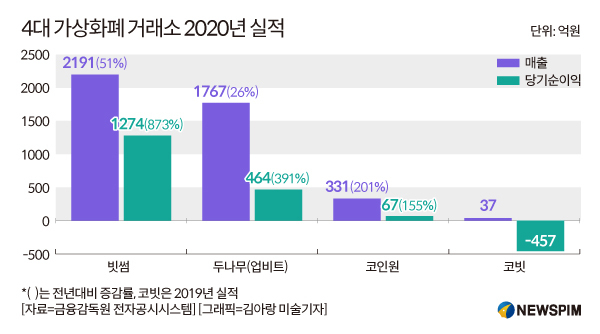

If you look at Bident’s 2020 business report, which was disclosed on the Financial Supervisory Service’s electronic disclosure system on the 5th, Bithumb Korea’s sales were 2191 billion won and net profit was 127.4 billion won. Compared to 2019 Bithumb’s sales of 144.7 billion won and net profit of 11.3 billion won, it is an increase of 51% and 873%, respectively, compared to the previous year.

In the past year, the number of new members of Bithumb has rapidly increased by 765%. In December of last year, the number of new members increased by more than 60% compared to the same period last year. In addition, as those who had been in dormant accounts resumed transactions, the number of users with transaction history soared 48% from the previous year in December of last year.

Bident owns a 10.3% stake in Bithumb Korea and a 34.2% stake in Bithumb Holdings, a holding company in Bithumb Korea. Bithumb Holdings is the largest shareholder of Bithumb Korea and holds a 76% stake. Due to its equity structure, Bident is a single company and is the largest shareholder of Bithumb.

Coinone posted a net profit of 6,6912 billion won in 2020. Coinone posted a net loss of 12 billion won in 2019 and 5.8 billion won in the second half of 2018. As a result, it has escaped the deficit for two years in a row and turned to a surplus. Coinone’s sales reached 33.1 billion won last year, more than three times higher than the previous year (11 billion won). In particular, commission sales accounted for most of the total sales at 33 billion won.

|

The performance of Dunamu, which operates Upbit, has also improved significantly. Dunamu recorded sales and net profit of 1767 billion won and 46.4 billion won, respectively, up 26% and 391% year-on-year, respectively. In 2019, sales were 140.2 billion won, and net income was only 9.4 billion won. Doonamu is also operating a domestic stock application, Securities Plus, and so on, but the share of Upbit is overwhelming.

These results are part of the business report of affiliates announced by Kakao last month, and Dunamu plans to disclose specific results of last year in the middle of this month. Kakao directly owns an 8.14% stake in Dunamu, an Upbit operator. In addition, Kakao directly owns 23% of the total of Doonamu, including 11.70% and 2.70%, respectively, of K Cube 1 Venture Investment, a fund operated by Kakao Ventures, a subsidiary specializing in information technology (IT), and the Kakao Youth Startup Fund respectively. · It is indirectly held.

Corbitt plans to disclose last year’s results on the 14th. Corbit’s sales in 2019 amounted to only 3,754.6 billion won, and net loss for the year was 45.7 billion won, which has been in the red for two consecutive years. However, last year is expected to make a surplus. An official from Corbit said, “The results are not yet accurate, but last year, it is expected to turn into a surplus in two years.”

Since Corona 19, the preference for risky assets such as bitcoin has increased, and virtual currency has been refocused. Since then, Visa and PayPal support cryptocurrency payment services, and Tesla CEO Elon Musk’s remarks in support of cryptocurrency began to increase interest from investors.

Bitcoin was in the range of 6 million to 7 million won in March last year, but surpassed 20 million won at the end of last November and 30 million won in December. On this day, it exceeds the record high of 45 million won.

In the first quarter of this year, the performance of the four major cryptocurrency exchanges is predicted to hit a record high. In fact, Corbit’s trading volume in the first quarter of this year increased 565% year-on-year, and the number of new subscribers increased 1128%.

Kim Chang-kwon, a researcher at Mirae Asset Daewoo, predicted that “Dunamubal Kakao’s earnings are expected to be surprised this year. If the virtual banking craze is maintained at the current level, this year’s equity-method gains contribution of Dounamu will be more than 100 billion won.”

He added, “Currently, Coinbase, a global virtual asset exchange based in the United States, is about to be listed on the NASDAQ. After listing, Kakao is expected to re-evaluate the value of its equity stake in Dunamu.”