According to the insurance industry on the 23rd, the Financial Services Commission informed each insurance company on the previous day (22nd) an opinion on the increase rate of real-life insurance premiums.

The Financial Services Commission said that for first-generation real-life insurance (before standardization) sold before October 2009, 80% of the increase rate suggested by insurance companies, and second-generation real-life insurance (after standardization) sold from October 2009 to March 2017. About 60% was suggested. However, the third-generation real loss insurance, so-called’good loss’, introduced in April 2017 requested a freeze of premiums.

According to the opinion of the Financial Services Commission, premiums are expected to rise to 15-17% for first-generation real-life insurance and 10-12% for second-generation real-life insurance.

Earlier, insurers predicted a 20% premium increase for customers who renewed their premiums in January. This is because it is calculated that a 20% increase is necessary when considering the loss ratio.

|

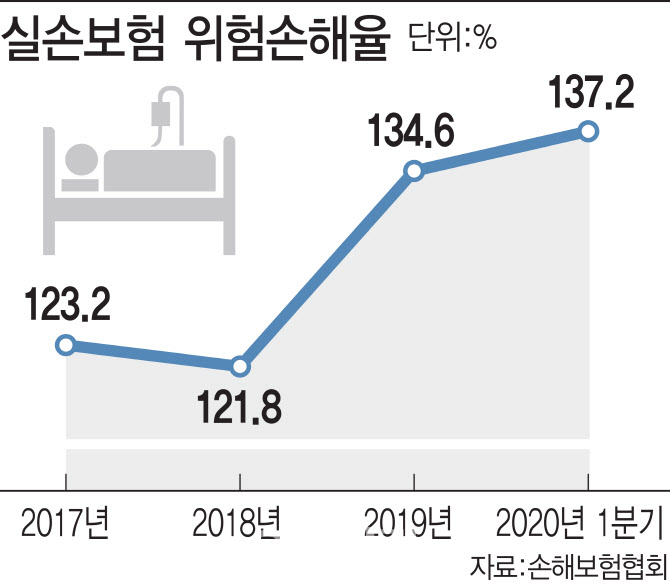

Last year, the risk loss rate of real-life insurance was 134%. The risk loss rate refers to the ratio of insurance premiums to risk insurance premiums. The risk loss ratio in the third quarter of this year has also exceeded 130%.

In principle, insurance premiums are determined by the insurance company. However, the financial authorities are implicitly involved in the annual increase rate because it is insurance that the majority of the people subscribe to. From 2017, the’Corporate Insurance Policy Council’ composed of the government and private insurance-related organizations has been formed to reflect the reflected profit of’moon care’ in the calculation of actual loss insurance premiums. However, it is popular in the insurance industry that the effect is insignificant.

An insurance industry official said, “A meeting of the consultative body is scheduled on the 24th, but the fact that the feedback on the increase rate of ineligible loss insurance was delivered prior to this means that the reflected profit is insignificant.” I said.