Input 2021.03.03 09:30

與 So Byung-Hoon initiated’The Act on Prohibiting Foreign Real Estate Mortgage Loans’

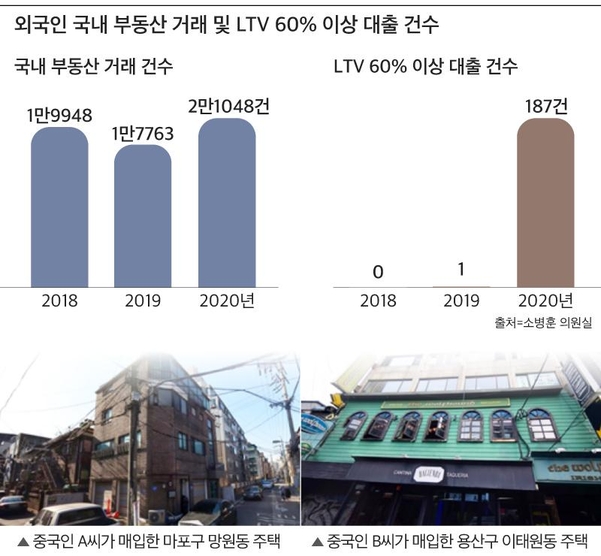

#Chinese A, who received a loan of 1.25 billion won (78% of the house price) from a domestic bank last October, bought a 1.6 billion won shopping mall in Mangwon-dong, Mapo-gu, Seoul. When Mr. A bought the Mangwon-dong commercial house, he had already owned one house. It is known that the purchased commercial housing is for rental purposes.

#B, a Chinese, bought a house for 7.8 billion won in Itaewon-dong, Yongsan-gu, Seoul, with a loan of 5.9 billion won, or 76% of the house price, from a domestic bank last year.

Of these, the number of home purchases by borrowing 60% of the home price from a domestic bank also increased sharply. There were only 0 cases in 2018 and 1 case in 2019, but it increased significantly to 187 cases last year.

The current mortgage loan ratio (LTV) is 40%, but a large portion of the house price was financed through loans aiming at the loophole that LTV is not applied to commercial houses. Rep. So Byung-hoon pointed out, “In the recent number of building transactions, the proportion of real estate purchases for commercial use, which are not subject to severe real estate loan regulations, is increasing.”

In order to solve this problem, Congressman So proposed the’Bank Act Partial Amendment Act (Act on Foreign Real Estate Mortgage Loans)’ that restricts foreigners without domestic income from receiving real estate mortgage loans from domestic banks.

The main idea of this amendment is that the bank prohibits real estate mortgage loans to foreigners who do not have domestic earned income within two years of the loan application date, and imposes a fine of not more than 100 million won in case of violating this. In addition, it contains content that requires banks to apply LTV and total debt service ratio (DTI) regulations in the same way as housing for commercial real estate.

Rep. So said, “If the Banking Act is revised in this way, it will be virtually impossible to buy domestic real estate by borrowing billions of billions from a domestic bank like Chinese A and B.” “The government needs to introduce appropriate regulations.”