|

| © News1 |

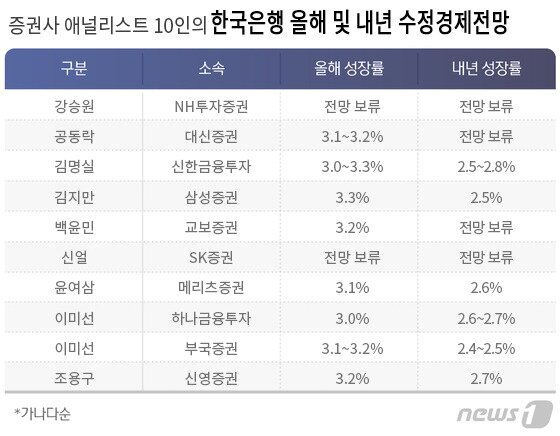

Many experts in the securities industry predicted that the Bank of Korea will raise its forecast for this year’s economic growth rate up to 0.3 percentage points (p) from 3.0% on the 25th. This is because exports are showing strong growth thanks to the recovery of world trade volume, while domestic demand will survive with the vaccine effect.

21 days <뉴스1>Ahead of the regular meeting of the Bank of Korea, which will be held on the 25th, a survey of 10 experts from domestic securities companies was conducted. As a result, 7 out of 10 observed that the BOK will raise the forecast for this year’s economic growth by up to 3.3%. The BOK previously announced its revised economic outlook in November last year and suggested 3.0% as an annual economic growth rate forecast for 2021.

A researcher at Daeshin Securities Co., Ltd. said, “The domestic demand is still bad, but the export economy is so good that there seems to be room for the BOK to increase the economic growth rate.”

Baek Yoon-min, a researcher at Kyobo Securities, said, “Because the economic growth rate in the fourth quarter of last year was better than expected, there is a high possibility that the BOK will also increase the economic growth rate this year.”

Regarding the BOK’s forecast for next year, four experts suggested that there is a possibility of an upward revision from 2.6% to as much as 2.8%. The forecast for the 2022 economic growth rate previously released by the BOK in November last year is 2.5%.

Shinhan Financial Investment Research Institute Kim Myung-sil said, “As the current spread of Corona 19 is maintained, even if the economic growth rate is raised, it will only be adjusted slightly,” he said. “Bank is expected to adjust 0.0~0.3%p both this year and next year.”

Conversely, some observations suggested that the forecast would be lowered to 2.4%.

Lee Mi-sun, a researcher at Bukuk Securities, explained, “Even if the BOK raises the economic growth rate this year by 0.1~0.2%p, there is room for the BOK to lower the previous forecast by 0.1%p from 2.5% due to the base effect in 2022.

Currently, there are four experts who said they would withhold the outlook because there are large economic variables to be considered.

Shineul, a researcher at SK Securities, said, “As the Corona 19 phase is maintained, we will have to watch more about how the BOK’s economic judgment will be.”

![[금통위 폴]② 70% of experts “The BOK will raise the forecast for this year’s growth rate” [금통위 폴]② 70% of experts “The BOK will raise the forecast for this year’s growth rate”](https://image.news1.kr/system/photos/2021/2/20/4630022/article.jpg)