|

| © News1 Designer Lee Ji-won |

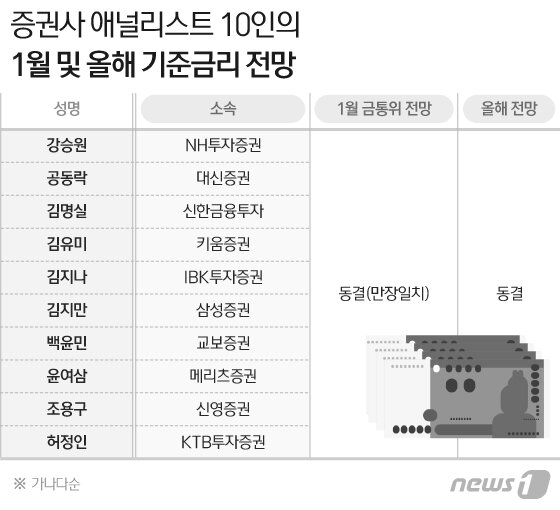

Ten economic experts from domestic securities companies agreed that the base rate will be frozen at 0.50% per year at a regular meeting in January of the Bank of Korea Financial Contribution Committee (hereinafter referred to as the Bank of Korea) on the 15th. Experts believe that it is difficult to raise the standard interest rate in a situation where economic uncertainty remains as it is not known when the new coronavirus infection (Corona 19) pandemic will end. In addition, there are opinions that the BOK can maintain the standard interest rate to support this as the government is planning to start stimulating the economy with an expanded fiscal policy this year.

However, at the press conference scheduled immediately after the FSC, there is much interest in how President Lee views the economic situation in accordance with the current progress of the Korosa 19 situation and whether he will make a remark on the regularization of the purchase of KTBs.

10 days <뉴스1>Before the regular meeting of the Bank of Korea’s Financial Services Commission in January, a survey of 10 experts from domestic securities companies predicted that all 10 of them would unanimously maintain the current rate of 0.50%. All of them expected the freeze to continue throughout the year. The BOK and BOK has maintained a freeze after lowering the standard interest rate by 0.25%p to 0.50% per year at a regular meeting in May last year.

Earlier, the BOK said in a report on the ‘2021 Monetary Credit Policy Operation Direction’, which was submitted to the National Assembly’s Planning and Finance Committee last month, “Relaxing financial conditions while maintaining the easing stance of monetary policy to support the recovery of the growth trend and stabilize the inflation rate at the target level.” He said, “We will pay more attention to the risk of financial imbalances such as the inflow of funds into the asset market and the increase in private credit.”

“This time, the KFTC expects a unanimous freeze,” said Kookrak Daishin Securities Research Institute. “Last year inflation was very low and oil prices fell to negative, so the base effect may result in a high inflation rate.” “Freeze this year, 4 next year. “I think we can raise the interest rate only after quarterly.”

Kang Seung-won, a researcher at NH Investment & Securities, said, “It is expected to raise the fiscal execution rate in the first quarter of this year, and because semiconductor-oriented exports are doing well, the BOK will not deviate from the economic growth trajectory expected in November.” “We will unanimously freeze the base rate and freeze the base rate throughout the year.”

Baek Yoon-min, a researcher at Kyobo Securities, said, “I don’t think there will be a big change in monetary policy this year. Until the middle and late last year, the focus of the BOK was on economic recovery, but from the end of last year it can be confirmed in the minutes that the financial imbalance is being held in check.” did. He added, “We expect that there will be no decision to regularize the purchase of KTBs for the time being.”

Yong-gu Cho, a researcher at Shinyoung Securities, said, “The Bank of Korea’s Financial Services Commission has shown luck about the regularization of KTBs in the Monetary Policy Direction Report.” It is expected that there will be no, and even if it is, it will only be mentioned.”

KTB Investment & Securities researcher Huh Jung-in said, “The upward risk of the economy has expanded due to the implementation of additional stimulus measures in the United States and the Korean disaster subsidy, but there is a limit to supplementing the structural changes in the economy after the pandemic, and the effect is likely to stop at once.” He said, “As there are economic downside risks such as the COVID-19 mutant virus, the BOK will respond by freezing while watching the government’s policy effects and the development of the corona.”

Researcher Huh said, “Apart from this, we will emphasize the importance of financial stability.” “Korea has the third highest household debt ratio among G20 countries (as of 2020, BIS data), and will maintain an easing trend for the time being, but at the same time We will be alert by emphasizing the debt buildup problem.”

![[금통위폴]100% of experts “freeze the base rate this year”… Pay attention to regular purchase of government bonds [금통위폴]100% of experts “freeze the base rate this year”… Pay attention to regular purchase of government bonds](https://image.news1.kr/system/photos/2021/1/8/4565783/article.jpg)