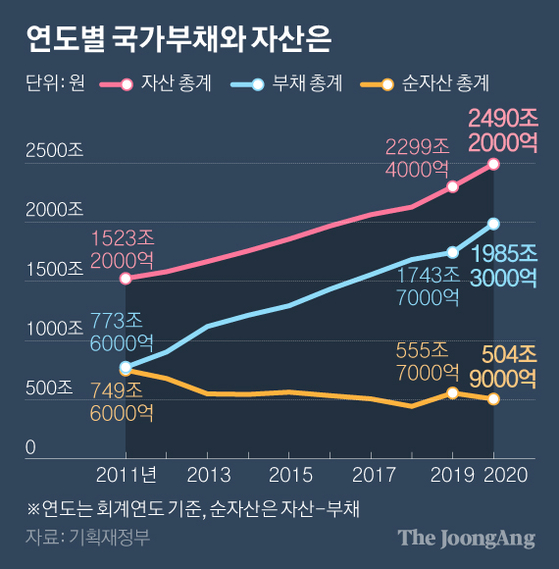

The national debt has approached 2,000 trillion won on the’Unvisited Road’. Last year, it surpassed 241 trillion won and recorded 1985 trillion won. It is the best of all time, both in scale and at the rate of growth. For the first time, it surpassed the annual gross domestic product (GDP).

This is due to the debt of largely increased government spending in the crisis of the novel coronavirus infection (Corona 19). The provision for the pension for civil servants and military personnel also exceeded 1,000 trillion won for the first time, contributing to the emergence of national debt.

Country liabilities and assets by year. Graphic = Reporter Park Kyung-min [email protected]

This is the content of the ‘2020 National Accounting Report’ that was resolved at the State Council on the 6th. National financial statements are full of depressing numbers. Last year’s national debt was 1985 trillion and 300 billion won. This is the largest amount since the change in national accounting standards in 2011. It increased by 24.46 trillion won (13.9%) in one year, which is also the largest increase.

The national debt also surpassed the scale of Korea’s GDP (1924 trillion won) last year. This is the first time.

State debt is calculated by adding the total amount of pensions (pension provisions) to be paid to former and current public officials and soldiers to the debt (state debt) owed by the government. It is a debt in a broad sense calculated by pulling the money that the state has to pay in the future.

According to the settlement report, last year the government collected 47.8 trillion won (total income) and spent 54.9 trillion won (total expenditure). The government’s total revenues increased by only 5.7% compared to 2019, while total expenditures soared 64.9%. This is a record increase in spending of national money in conjunction with last year’s Corona 19. Last year alone, it saw a deficit of 71.2 trillion won (based on the integrated fiscal balance). If the effect of the Social Security Fund, which has more money coming in than outgoing money, is removed (managed fiscal balance), the deficit will reach 112 trillion won. It is also the maximum amount.

At the plenary session of the National Assembly on the 25th of last month, a 15 trillion won extra bill is being passed for the 4th disaster support payment. Reporter Oh Jong-taek

Most of the deficit was filled by issuing government bonds. As much as it is issued, it is considered as a national debt. Kang Seung-joon, the Finance Officer of the Ministry of Strategy and Finance, said, “In the process of overcoming the Corona 19 crisis, due to the increase in issuance of government bonds, the fixed debt increased by 111.6 trillion won.”

State debt is largely divided into fixed debts that have a fixed amount and time to pay off and non-confirmed debts that do not. The state debt is defined as the debt and the pension provision is the non-determined liability. In fact, last year’s national debt increased by more than 241 trillion won, and unconfirmed liabilities such as pension provisions (an increase of 130 trillion won) contributed more than fixed debts such as state debt.

Last year, the provision for civil servants and military pensions amounted to 1044 trillion won last year. In one year, it increased 10 trillion won and exceeded 1,000 trillion won for the first time. The size of the pension provision debt, which was 752 trillion won in 2016, has risen close to 300 trillion won in four years. A number of factors were attributable to low interest rates, increasing numbers of public servants, and a longer pension period due to an aging population.

Pension provision liabilities. Graphic = Reporter Park Kyung-min [email protected]

Unlike the national pension, the pension for civil servants and soldiers must be compensated for with national pensions as deficits occur according to the law. With the Moon Jae-in administration, the number of public servants is rapidly increasing, and it is growing as a variable that will threaten the national finances in the future. Aging and low interest rates fueled this.

Kim Sun-gil, head of the Accounting and Settlement Division of the Ministry of Finance, said, “Because we simply estimated the amount of annuity that the government should pay in the future at the present value, there may be a difference from the actual amount to be paid.” You can’t see the entire amount as a debt alone.” Instead, Kim added, “a figure that shows how much the financial risk from pensions is growing.”

Professor Kim So-young of the Department of Economics at Seoul National University said, “The scale of national debt is also a problem, but it is a bigger problem that the rate of increase is too fast.” did. Professor Kim emphasized that “the government should hurry up with concrete measures on how to restore fiscal soundness after Corona 19”.

Settlement debt status for fiscal year 2020. Graphic = Reporter Park Kyung-min [email protected]

Not as much as the state debt, but also the total national assets. It was 249 trillion won last year, an increase of 19 trillion won (8.3%) from a year ago. The booming domestic and overseas stock markets was largely influenced by the increase in the investment income of the national pension by 122.6 trillion won. There is also a reason why the value of land and buildings owned by the government increased (21.700 billion won) due to the surge in real estate prices.

Meanwhile, the Gyeongbu Expressway boasts the most expensive value among state-owned property as of the end of last year. With a book value of 12,3123 billion won, it is the undisputed number one. Among the state-owned buildings, the first-level government building in Eojin-dong, Sejong City, is the first stage (429.7 billion won). The first place among state-owned items was the disaster safety communication network wireless repeater (16.1 billion won) owned by the Ministry of Public Administration and Security.

Sejong = Reporter Cho Hyun-sook [email protected]

![]()