|

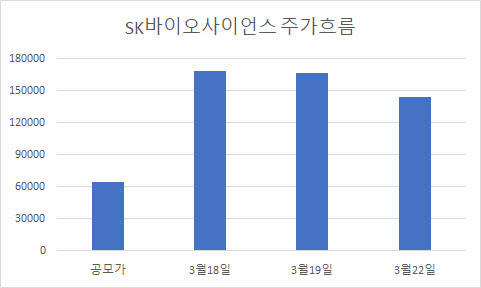

According to Market Point on the 22nd, SK Bioscience’s stock price closed at 144,000 won, down 13.51% (22,500 won) compared to the previous trading day. This is a figure that is only 10.7% (14,000 won) higher than the initial price of 130,000 won, which doubled the public offering on the 18th.

By supply and demand, individuals showed net buying for three consecutive trading days, while foreigners and institutions showed net selling during the same period. In particular, individuals showed net purchases on the first day of’Daesang’ and net purchases in the midst of a decline. This is interpreted as supply and demand, which is somewhat overlapping with expectations for buying and selling at low prices.

This decline is significantly less than the records of Kakao Games”Dad Sangsang’ and SK Biopharm’s’Dad Sangsang’. Considering that in the past, SK Biopharmaceuticals’ commitment to obligated holdings was 81.15%, SK Bioscience was unable to record consecutive caps even though distribution restrictions were placed at 88.4%.

Accordingly, the main background is that the atmosphere in the stock market is different from that of SK Biopharm in the past. This is because the KOSPI index has risen for three consecutive trading days since SK Biopharm was listed on July 2nd last year, but since SK Bioscience was listed on the 18th, the index has been unstable, falling for two consecutive trading days.

A researcher at a securities company who requested anonymity analyzed that “there is a side that has discussed the possibility of circulating volume in terms of supply and demand.”