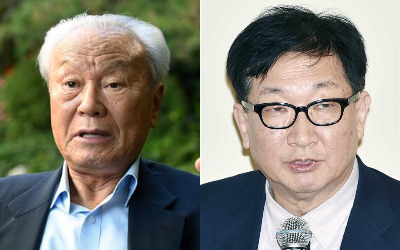

“It is unlikely that annual consumer prices in the US and Korea will exceed the central bank target of 2% this year. Inflation concerns are excessive” (Park Seung, Former Bank of Korea Governor)

“As prices are rising, workers may be demanding more wages to maintain real wage levels. It is difficult to rule out the possibility of trending inflation in the US and Korea.” (An Dong-hyun, Professor of Economics, Seoul National University, former president of the Institute of Capital Markets)

On the 10th, Korean economic scholars joined the’inflation debate’ that is shaking the global market interest rate and asset markets. On the one hand, it was thought that the current rising prices would sink within this year. The main reason is that as the unemployment rate is high, inflation will be slowed down. According to the theory of the’Philips Curve’ proposed by British economist Phillips in 1958, the unemployment rate is still high, so inflation concerns are not so great.

On the other hand, they objected to the situation, saying that the possibility of inflation is high given that the liquidity sprayed by central banks will boost inflation. They predicted that the trend of raising wages and product prices for workers and companies could continue as expectations of rising prices spread.

Former Governor Park assessed that inflation concerns were excessive. Governor Park emphasized, “As international oil prices and other commodity prices have risen and the economy is improving, prices are temporarily rising.” “There is not much concern about inflation as the recovery without employment is complete.” Past Governor Park said, “The central bank is holding the face of the inflation controversy,” he said. “Although easing monetary policy will continue this year, liquidity needs to be adjusted in appropriate circumstances.”

Some argue that the inflation debate itself is premature because the economic recovery is uncertain. Kim Jeong-sik, professor of economics at Yonsei University (44th president of the Economics Association) said, “The development of Corona 19 and the economic flow are very uncertain.”

It has also been pointed out that the recent rise in inflation is only a’shiny effect’ that has appeared as consumption suppressed by Corona 19 has recovered somewhat. Professor Lee In-sil (49th president of the Economics Association) said, “It is not known whether household income will decrease and consumption will continue to increase,” he said. “As consumption increases, inflation will not exceed the level of concern.”

The counterargument that the likelihood of inflation is higher than ever is tough. Professor Ahn said, “The US Central Bank (Fed), which supplied 3 trillion dollars to the market in 2008-2014, poured out 3 trillion dollars in two months immediately after the Corona 19 incident.” In addition, the expected inflation (consumer inflation rate reflecting expectations of future sentiment) will rise.” He said, “If a worker asks for a wage increase reflecting the expected inflation, it can push up the expected inflation again, and inflation may increase.”

Young-ik Kim, a professor at the Graduate School of Economics at Sogang University (former head of Hana Financial Management Research Institute) said, “The scale of US economic stimulus measures worth 1.9 trillion dollars is so great that inflation will result. Looked out. He said, “In the 2000s, China, which has been pushing inflationary pressures by supplying cheap goods to the US while absorbing dollars, has recently been consuming high wages and is consuming internally produced goods. The decrease in the dollar has increased the likelihood of realizing inflation in the US.”

Reporter Kim Ik-hwan/No Gyeong-mok [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution