|

Re-extension is possible when expiration arrives until September

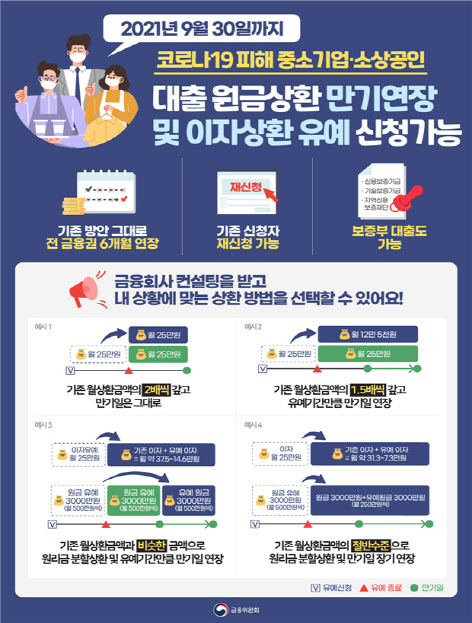

The Financial Services Commission announced on the 2nd that it will extend the loan maturity and defer interest repayment measures for SMEs and small businesses affected by Corona 19, which are scheduled to end on the 31st of this month. As a result, the extension of the corona loan, which started on April 1 of last year, will be applied until September 30. This is the third extension measure.

As of the end of January, the total maturity extension of commercial banks, policy financial institutions and the second financial sector was KRW 121,1602 billion (371065 cases), and the postponement of principal repayment was KRW 9.317 billion (57,401 cases). The amount of interest repayment deferred is 163.7 billion won (13,219 cases). The financial authorities estimated that the loan principal for this was about 3.30 trillion won.

Earlier, in the process of negotiations with the authorities, the financial sector requested that interest repayment is an important criterion for determining the ability to repay borrowers, and requested to be excluded from the extension, but was not accepted. The financial authorities emphasized that the number of interest deferrals is only 3% of the total maturity extension and repayment deferrals (44,1685 cases). In addition, regarding the concern that it would be difficult to detect signs of insolvent such as banks due to the delay in repayment of interest, he refuted that monitoring could be done through business closures or business closures or card usage.

The Financial Services Commission said, “With the prolonged Corona 19, difficulties for SMEs and small business owners continue, and the delay in interest repayment is not too burdensome given the financial performance.”

The extension measures apply to SME loans, including loans from private businesses. This includes loans with guarantees, policy funds, and contract loans agreed by the guarantor and funding institutions respectively. On the other hand, household loans such as mortgage loans are excluded. Loans related to industries such as real estate sales and rentals are also excluded.

Companies with annual sales of 100 million won or less can apply immediately because they are considered damaged companies without additional evidence. Companies with annual sales exceeding 100 million won can apply only by submitting sales reduction admission data, such as POS data, VAN company sales data, and card company sales data.

Borrowers can receive renewal when the loan maturity returns within the extended period until the end of September. For example, if the maturity reached in November of last year and was extended for six months until May of this year, the maturity can be extended until November of this year by reapplying in May.

|

Borrower’s choice of repayment method and period, etc.

A’soft landing’ after the end of the corona loan extension is also an important goal. In consideration of individual borrower repayment, the authorities believe that from April 1, various long-term and installment repayment methods will be selected.

To this end, five principles focused on minimizing the burden of borrowers were presented. First, the financial sector provides consulting on the optimal repayment plan considering the situation of the borrower, and gives a repayment period longer than the grace period when repaying the deferred principal and interest in amortization.

In addition, the total amount of interest accrued during the grace period is maintained regardless of the repayment method and period. No interest is charged on interest on deferred repayment. If the borrower wants to repay earlier than the original repayment plan, he can repay it without interim repayment fee. In particular, the borrower can decide the final repayment method and period.

In the example of the Financial Services Commission, the borrower can repay one or two times the existing monthly repayment amount after the grace period ends, or repay the previous half of the amount. Let’s take a case where a small business owner who received a loan with a fixed interest rate of 5% per year and a temporary repayment loan with a remaining maturity of 1 year received a six-month postponement for self-payment. After the deferred measure ends, repayment ends in six months if you pay 500,000 won each month, including 250,000 won of existing interest and 250,000 won of deferred interest (1.5 million won/6 months). The period can be extended to 2 years and 6 months to reduce the monthly repayment burden. In this case, the monthly repayment amount such as 250,000 won of existing interest and 50,000 won of deferred interest (1.5 million won/30 months) will be 300,000 won each month. An official from the Financial Services Commission said, “We believe that the repayment period should be given two to three times the grace period.” “The repayment period will be in the range of 2 to 5 years.”

The financial authorities will not sanction any insolvency, unless they are deliberate or gross negligence, on the aggressive measures of financial companies in relation to the extension of the corona loan or the application of a soft landing in the future.

“Decided in consideration of whether the end of September, quarantine, economic, financial stability, etc.”

This extension has put a considerable burden on the financial sector.

The risk management burden of financial companies may increase as borrowers have the right to choose specific repayment methods. After the deferred measure ends, the borrower who feels burdened with repayment may try to extend the period once. Banks, etc., should be more proactive in determining whether or not the borrower’s repayment deferred is in normal operation, the amount used by the card, loans to other financial companies, and delinquency in commerce.

In the financial sector, it is doubtful that this measure will be the last. Regarding whether the corona loan extension will end in September, the authorities said, “It is a matter to be decided after consultation with the financial sector in consideration of the quarantine situation, the real economy, and financial stability.” It does not rule out the possibility of a fourth extension measure, saying that it is necessary to see repayment at that time. An official from the banking sector said, “By then, it will be the most important whether the corona19 situation will end, but it is regrettable that the financial authorities did not properly express their willingness to end the extension measures.”

The financial authorities emphasize that it gave small businesses and SMEs time to return to their original trajectory. An official from the Financial Services Commission said, “We have devised a plan for a soft landing so that borrowers do not get hit by an interest bomb at once. It can be resolved if small business owners return to their daily business activities and pay the principal and interest.”

|