The Financial Supervisory Service’s Sanctions Deliberation Committee discussed the level of disciplinary action by proposing measures for sector inspections against Lime Fund sales companies Woori Bank and Shinhan Bank from 2 pm on the 25th. I didn’t.

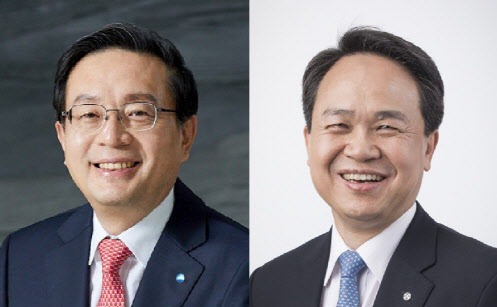

The sanctions review was conducted in a deep-judgment method in which bank officials such as Woori Finance Chairman Son Tae-seung and Shinhan Bank President Jin Ok-dong and the Financial Supervisory Service Inspection Bureau attended at the same time to answer questions of the sanctions judges.

This day, the first day of the sanctions hearing, focused on listening to the callings of both banks.

Earlier, the Financial Supervisory Service notified Woori Financial Group Chairman Son Tae-seung, who was the head of Woori Bank at the time of the Lime Fund sale, of a “job suspension” (a significant amount), and Jin Ok-dong, the head of Shinhan Bank, of the severe disciplinary action of the “cause warning”. Shinhan Financial Group Chairman Cho Yong-byeong was notified of a’cautionary warning’, which is a warning.

The sanctions for executives in financial companies are divided into five stages: △recommendation for dismissal △recommended job △cautionary warning △cautionary warning △caution. From the censure warning or higher, it is classified as severe disciplinary action, and employment of financial company executives is restricted for 3 to 5 years from the date of disciplinary notification.

If Chairman Son Tae-seung is suspended from office as originally planned, three consecutive terms are impossible. Shinhan Bank President Jin Ok-dong, who was notified of a censure warning in advance, also puts a brake on his three consecutive appointments as president and the challenge of Shinhan Finance Chairman.

The biggest concern for this sanctions review is whether the disciplinary levels of Woori Financial Group Chairman Son Tae-seung and Shinhan Bank President Jin Ok-dong will be reduced.

The Financial Supervisory Service held responsible for the two banks on the grounds that the two banks were responsible for the incomplete sale of lime funds, and the lack of’internal control’, such as the laws and enforcement ordinances on the governance structure of financial companies. On the other hand, banks reportedly confronted that lack of internal control was not a direct basis for imposing sanctions on management.

Woori Bank’s Lime Fund sales amounted to 357.7 billion won, and Shinhan Bank sold 2769 billion won.

In this sanctions review, the Financial Supervisory Service (Financial Consumer Protection Office) was present as a reference to express opinions on Woori Bank consumer protection measures and efforts to relieve damage. The opinions provided by the complainant may influence the level of disciplinary action.

The agency assessed that Woori Bank tried to correct the damages, such as accepting the FSS dispute settlement proposal and agreeing to hold a dispute settlement committee for funds with unconfirmed losses.

The agency did not attend the Shinhan Bank sanctions review. This is because the FSS Dispute Mediation Committee for Lime Funds sold by Shinhan Bank has not yet been held, making it difficult to make active compensation like Woori Bank.

It is known that Woori Bank was not aware of the Lime Fund’s insolvency during the sanctions review, and the Bank also protested that it was a victim of Lime Asset Management.

Inside and outside the financial sector, Chairman Son Tae-seung believes it will be difficult to avoid severe punishment. In order to be subject to disciplinary punishment, it is necessary to reduce the reduction by more than two stages compared to the current suspension of work, which has been notified in advance, because most cases have been reduced by one level in the light of disciplinary cases.