Input 2021.02.22 11:25

Yong-jin Jung, received 8.22% gift from the late Chairman Myung-hee Lee…

Highest in dividends among food companies chaebol…

Experts “Achievement of private interests to large shareholders is a problem, excessive dividends hinder investment”

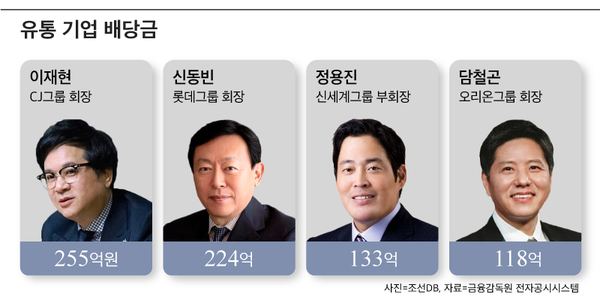

It was revealed that the chaebol owner who receives the most dividends in the distribution industry this year is Lee Jae-hyun, chairman of CJ Group.

As food companies enjoyed special benefits in the aftermath of last year’s coronavirus infection (Corona 19), the dividends received by the owners of these companies increased. Food companies recorded record-breaking performance last year as people who stayed longer at home increased their food consumption. This count is only for distribution companies that have disclosed their dividend details until the 19th.

Chairman Lee Jae-hyun is the number one dividend in the distribution industry. Chairman Lee is coming from March to April CJ(001040)It is expected to receive a dividend of about 25.5 billion won (based on last year’s settlement) from affiliates. This is an increase of about 2 billion won from 23.5 billion won last year. Chairman Lee receives KRW 24.6 billion from CJ, which owns 42.07%, and KRW 600 million from CJ ENM (1.82% stake), and KRW 300 million from CJ CheilJedang (0.43%). Chairman Lee’s share increased as the CJ dividend increased from 1850 won to 2,000 won.

Lotte Group Chairman Shin Dong-bin took second place. Chairman Shin receives a dividend of about 22.4 billion won from Lotte affiliates. It increased about 1.1 billion won from 21.3 billion won last year. Chairman Shin Lotte Holdings (004990)It receives 13.8 billion won from (13.04% stake), 8.1 billion won from Lotte Shopping (10.23%), 200 million won from Lotte Confectionery (1.87%), and 300 million won from Lotte Chemical (0.26%).

Lotte Group, the fifth place in the business world, was poor in performance last year due to the aftermath of Corona 19. Because of this, it is estimated that Shin’s dividend will also decrease. However, in July of last year, Chairman Shin inherited a stake in Lotte Holdings and Shopping from the late Lotte Group honorary chairman Shin Gyeok-ho and increased dividends.

Shinsegae Group Vice Chairman Jeong Yong-jin placed 3rd with a dividend of about 13.3 billion won. This is a 53% increase from the previous year (8.6 billion won). E-Mart (139480)And other affiliates performed well, but the dividend remained the same. However, Vice Chairman Jeong received 8.22% of E-Mart’s shares from Shinsegae Group Chairman Lee Myung-hee in September last year. Accordingly, E-Mart’s stake increased from 10.33% to 18.55%, and dividends also increased.

For each major affiliate, E-Mart will pay 10.3 billion won and Gwangju Shinsegae will pay 2.9 billion won to the vice chairman. Vice Chairman Chung is also a major shareholder of Samsung Electronics. As of 2018, Vice Chairman Chung held 245,000 shares of Samsung Electronics’ common stock (before the par value split). At that time, the valuation based on Samsung Electronics’ stock price (2.5 million won) was about 610 billion won. His current stake is not known, but it is expected to receive a huge dividend from Samsung Electronics other than the group.

Dongseo Food CEO Kim Seok-soo also signed a holding sign East-West (026960)Received a dividend of 13.3 billion won, and tied for third place. Chairman Kim owns a 19% stake in Dongseo. Dongseo holds a general shareholders’ meeting on the 26th of next month to decide a dividend of 700 won per common stock.

In fourth place is Dam Chul-gon, chairman of Orion Group. 11.8 billion won for 2 consecutive years (Orion Holdings (001800)11.7 billion won and Orion 100 million won) are paid out. BGF Group Chairman Hong Seok-jo ranked 5th, receiving 8.8 billion won. It decreased by 400 million won from the previous year (9.1 billion won).

Hyundai Department Store Group Chairman Ji-sun Ji-sun is expected to receive 6.6 billion won (4 billion won in department stores, 2.6 billion won for green food) from major affiliates in March and April as dividends. It ranked 6th in dividends with an amount similar to the previous year. The Hyundai Department Store Group has maintained its dividend for the second consecutive year despite a 53% decline in operating profit last year. It is pointed out that they have noticed the National Pension Service’s steadily increasing stakes and demanding shareholder return.

The joint 7th place is Nongshim Vice Chairman Shin Dong-won and GS Retail Vice Chairman Huh Yeon-soo (4 billion won). Next, LF Chairman Koo Bon-geol (3 billion won), Choi Jae-ho, Muhak Chairman (2.1 billion won), Kim Hong-guk Chairman Harim (1.3 billion won), Chae Hyung-seok, Aekyung Group Vice Chairman (800 million won), Yoon Young-dal, Crown Haitai Confectionery Chairman (600 million won), Kim Jeong-soo, Samyang Foods President KRW billion) in order.

Yoon Jin-soo, head of ESG at the Korea Institute for Corporate Governance, said, “If dividends increase, the profits returned to general shareholders increase, so it is positive for shareholder return”. “In a situation where corporate performance is bad and cash is exhausted, there will be a problem if the majority shareholder pays excessive dividends to achieve private profits. I can.” He added, “For new businesses that have not yet reached maturity, it is important to increase the corporate value by increasing investment,” he added. “Excessive dividends hinder investment.”

Global conglomerates invest in technology development or mergers and acquisitions rather than using corporate profits as cash dividends. Google, Amazon, and Facebook are hitting record highs, but so far they have never paid out cash dividends. This is because we believe that raising the stock price by investing in new businesses is a shareholder return policy.

In Korea, there are increasing cases where owners donate their property or return their annual salary. It is a part of ESG (environmental, social, governance) management, which has recently become a hot topic.

On the 18th, Chairman Kim Bong-jin, the founder of the Delivery Application People’s Family of Delivery, announced on the 18th that he would donate 50 billion won, half of his fortune, to society. Kakao Chairman Kim Beom-soo also donated 5 trillion won. SK Chairman Choi Tae-won decided to return last year’s salary and share it with employees. Chairman Choi’s annual salary is about 3 billion won in 2019.