Where is the second CCIV?

Explore phase open spec investment

Chamas and other celebrities spec stock prices surge

Tesla’s investment enthusiasm in the US stock market is shifting to SPAC (Special Purpose Acquisition Company) for mergers and acquisitions.

In the second week of February alone, 26 specs filed IPO declarations with the Securities and Exchange Commission (SEC). 11 specifications announced a merger agreement with target companies, that is, a definitive agreement.

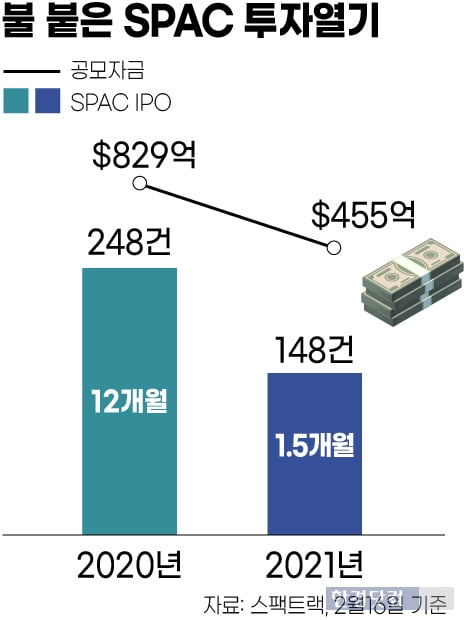

According to information company Spectrac, a total of 148 specs raised $45 billion through IPOs by February 16 this year. Compared to the 248 specs raised $82.8 billion through IPOs in 2020, when the specs blasted, it exceeded half the level of last year in a month and a half.

![Invest before finding a merger target? How to choose a promising specification (SPAC) [허란의 해외주식2.0]](https://i0.wp.com/img.hankyung.com/photo/202102/01.25463220.1.jpg?w=560&ssl=1)

The hottest sector in the spec is by far the electric vehicle and battery sector. So last time, we looked at EV startups that are in the stage of signing a DA Definitive Agreement with SPEC. This time, we are going to look at a promising specification in the’Searching’ stage, which is still searching for companies to be merged.

Navigation step specification

Why are we investing in exploration-level specifications that are not subject to a merger?

SPEC is a company for the purpose of acquiring a business and is called a blank check company. It is a company whose purpose is to relist the merged company after acquiring a company with funds raised by IPO within 2-3 years.

The specification can be divided into four phases of life cycle. After the establishment of the spec, before IPO is held in the stock market (Pre-IPO) → After listing, the step of searching for the merger (Searching) → The step of submitting a letter of intent (LOI) to the merged company → Merger with the target company It is divided into the stage of signing the agreement (DA) → completion of the merger and re-listing of the target company

Of the 412 specifications currently listed on the NASDAQ and the New York Stock Exchange (as of February 16), the search stage is the most at 329. There are 4 LOI levels and 79 DA levels. There are also 134 pre-IPO specifications.

As of February 16, 2021, there are 412 SPACs listed on the U.S. stock market, and 134 pre-IPO specifications are ahead of listing.

In terms of stock prices, after the announcement of LOI and DA, the sharpest rise followed by profit-taking sales came out and the stock price declined, and then the stock price rises again around the end of the merger.

On the other hand, the exploration stage specification stays at the offering price of $10, so you can earn more profits if you find a merger. In other words, the demand for investing in the cotyledon days of the growing tree is driven to the exploration stage specification.

Search step specification selection

How do you pick a promising spec in the exploration stage? The first way is to pick a spec with a famous person involved. For example, whether the former CEO of a startup was included in the SPEC management or board of directors, whether a prominent investment company on Wall Street has sponsored it, or whether the specification was established in a chain by the company that successfully merged the SPEC.

Spec is only a shell company until it merges with the target company. Therefore, it is the logic that seeing and investing in who runs the spec is a way to increase the likelihood of successful mergers with good companies in the future.

The specifications established by celebrities are immediately released as news. You can also easily find hot issues and news information posted by individual investors in SPACs of the American online community Reddit.

Official documents including the size of listing of individual specifications, major management, sponsors, etc. can be found at the SEC. Information company SPECTRAC can view all specification information in Excel format, so it is worth visiting if you want to study closely. You can also view the specification schedule and merger agreement information on the Spec Insider.

The second method of screening is to look at the stocks of ETFs that mainly invest in the exploration stage specification. Among the three spec ETFs listed on the U.S. stock market, the SPCX ETF is a product that is diversifying into 80 specs before the merger agreement (DA).

Managers say they believe that the longer the performance is, the better the specifications with strong sponsors. After all, in the exploration stage, it is said that who made the specification is important.

So far, I have explained the methodology. Now, let’s get to the point, and look at the promising specs that include the specs that celebrities have participated in and the stocks held by the SPCX ETF.

![Invest before finding a merger target? How to choose a promising specification (SPAC) [허란의 해외주식2.0]](https://i0.wp.com/img.hankyung.com/photo/202102/01.25463568.1.jpg?w=560&ssl=1)

Spec King, Chamas

If AkInvest’s Cash Wood is the Wall Street operating industry star, the spec industry is Chamas Palihapitiya. He was a former vice president of Facebook and established a venture capital company, Social Capital Hedo Sophia, which is often compared with Warren Buffett and was called’Little Buffett’. Social Capital Hedo Sofia succeeded in merging SPECs one after another, and quickly became the’Spec King’.

Chamas Palihapitiya, who is called the’Spec King’, CEO of Social Capital / Source: The New York Times

Social Capital has released 6 specifications so far. SPEC No. 1 successfully merged with Virgin Galactic (SPCE), which is scheduled to start a space tour this year, and made a huge hit in the stock price. SPEC 2 has completed the merger with OPEN, an online real estate trading platform, and SPEC 3 is an online insurance service company in the US.

On January 7th this year, the 5th SPEC IPOE announced a merger agreement with a promising fintech company SoFi, confirming the reputation of Chamas once again. The remaining 4 and 6 specifications, IPOD and IPOF, are still in the process of searching for a merger. However, as the buying trend is already rising, the IPOD stock price is at $16 and the IPOF is at $15. The stock price has already risen by over 50-60% compared to the 10 dollar offering.

Among the specifications related to Chamas, which stocks are SPCX ETFs owned? SPCX has no stake in IPOE, which signed a merger agreement (DA) with SOFA as of February 16th. However, we hold 1.62% and 1.38% of IPOD and IPOF, respectively, before the announcement of the merger target.

Behaviorist investors also release specifications one after another

Wall Street’s activist hedge funds are also jumping into the spec market one after another.

Pershing Square Capital Management, led by Bill Ackman, a hedge fund industry star, founded Spec Pershing Square Tonteen Holdings (PSTH). In July 2020, we raised $4 billion in funding, the largest in the history of the specification. Rumors have circulated about the merger with Stripe, but they are still looking for acquisitions.

Daniel Loeb’s hedge fund Third Point, well known as an activist investor who recently asked Intel to eliminate the semiconductor manufacturing business, also listed Swiss currency exchange service company Global Blue (GB) last year through a spec merger.

Jeffrey Smith, CEO of Hedge Fund Starboard Value and Chairman of Papa John’s Pizza, is also a big hand in the spec. Jeffrey Smith launched the SPEC Starboard Value Acquisition Company (SVAC) in September 2020 and raised $345 million. It is being evaluated by the industry for having an investment strategy to acquire promising companies at an inexpensive price.

Jeffrey Smith, CEO of Starboard Value, Hedge Fund / Source: Starboard Value

Ajax I (AJAX), an IPO of $750 million in October last year, is also attracting attention as a spec created by the brilliant’Dream Team’. This specification is run by Daniel O and Glenn Furman, co-founder of MSD Capital, who founded the hedge fund O-Jeep Capital. Instagram co-founder Kevin Sistrom, Square co-founder Jim McKelbay, 23 Andy Co-founder Ann Wachsky, and Chippotle founder Steve Els were among the board members to attract investors’ attention. Ajax plans to acquire Chinese fintech and consumer sector companies.

Of these, what is the SPCX ETF holding? As of February 16, the stock that SPCX holds the most (4.33%) is Jeffrey Smith’s Starboard Value (SVACU). We are not investing in the specifications made by Bill Ackman and Daniel O.

SPECKCON Robinson Holdings (CRHC), who had an IPO of $828 million in September last year, is co-chaired by Gary Conn, former chief economic adviser to Trump, and Clifton Robinson, a partner of KKR. CRHC is also the second largest holding of the SPCX ETF (3.12%).

Til Capital, which initially invested in PayPal and Palantier, participated as a sponsor, and Bridgetown Holdings established two specifications, BTWN and BTNB. It plans to acquire Southeast Asia Fintech. Matthew Danjaygen Teal Capital Partner, chair of the SPEC Board of Directors, has also invested in the domestic private equity fund Crescendo. Among them, BTNB ranks in the top 5 stocks held by SPCX ETF.

Jason Robinson, CEO of Draft King, a sports betting company that was listed through a spec merger last year, also entered the spec market by creating Horizon Action. Todd Boehly of Eldridge Industries, a media group that owns Billboard Magazine, is participating. Horizon Acquisition listed the first specification HZAC in August 2020, followed by the IPO of the second specification HZON in October. HZAC ranks in the top 10 stocks held by the SPCX ETF.

Reinvent Technology Partners (RTP), a $690 million IPO last September, is co-leader of LinkedIn co-founder and PayPal CEO Reid Hoffman, and Mark Pincus, chairman of online game company Zynga. . On the 11th, news about the merger between RTP and Jovi Aviation, an urban aviation mobility company, came out. RTP is not included in the holdings of the SPCX ETF as of February 16th.

Jovi Aviation’s urban aviation mobility, which is rumored to be merged with SPEC RTP / Captured by Jukonomi TV

Newbie spec week

Among the newest specs listed in February, there are many specs with celebrities participating.

Dennis Mullenberg, former CEO of Boeing, who was disgraced by the crash of the 737 Max, made an IPO for $240 million on February 16 at New Vista Exquisite (NVSA). It plans to acquire companies in the aerospace, telecommunications, aviation mobility, and logistics sectors.

Series specifications are also listed one after another. Churchill Capital’s 6th (CCVI) and 7th (CVII) specifications were also listed on February 12th. Spec 7 CVII’s IPO is worth $1.2 billion.

ApolloStrategic Growth Capital also IPOed APGB No. 2 with a value of 690 million dollars on the 9th. Lazard Growth Acquisition, created by Lazard Management, IPOs LGAC worth 575 million dollars on the same day.

Major specifications recently listed on the US stock market (SPAC)

Top SPCX Stocks

What are the specifications of the SPCX ETF? When you enter the SPCX homepage, 86 holdings are updated daily as of the previous business day. It is not an index-following method, but an active ETF that fund managers buy and sell from time to time.

You can see how active it is. As of February 9th, as of February 9, as of the rumors of a merger with Lucid Motors, CCIV, whose stock price soared, was among the number one holdings.

During the same period, the holdings of DCRB, which signed a merger agreement (DA) with Hyzen Motors, a hydrogen battery truck company, were cut in half. As SPCX is an ETF that focuses on investing in the specs in the exploration stage before the merger agreement, it seems that I’m not interested in the specs that have some kind of engagement.

Looking at the top 10 SPCX stocks, there are PRPBs made by Black Stone Management in addition to the specifications described above. GRSV, created by Gore Group founder Alex Gore, also went up, and on February 13th, rumors of a merger with Arda Group’s beverage can company were spread. SVFA made by Softbank, HCIC, which is trying to acquire infrastructure companies such as solar, and AVAN, which are looking for European companies, have also been listed.

SPCX ETF holdings that focus on investing in the exploration stage SPAC

How to invest

SPAC with celebrity participation is not an investment target for SPCX ETF.

Since SPEC usually takes more than a year to find a merger after listing, it is highly likely that the stock price will remain at the public offering price level. As that is an opportunity cost, ETF fund managers are investing in specs that are more likely to be explored for mergers rather than in early stage specs.

In addition, if the spec stock price rises to one of the famous ones before the merger agreement is signed, it can be considered a risk factor because it suffers a disadvantage in the merger ratio.

With new IPOs and merger rumors and merger schedules pouring out every day, ETFs that focus on exploration specifications seem to be a convenient way to enter the dynamic M&A market.

However, if you are an investor who is not satisfied with the ETF rate of return, you should open up a specification list of good management and sponsors, follow the news, and select investments.

Even if it’s a promising spec, it’s not easy to beat stock price volatility if you buy it too expensive. Several experienced people advise that the exploration spec, which is looking for mergers and acquisitions, will be able to withstand volatility even if the stock price falls 20% to the public offering level if invested within $12.

Next time, I will explain the spec’s warranty, how to invest in common stock, and points to note when investing.

Reporter Hurran [email protected]