The Financial Supervisory Service intensively inspects incomplete sales for banks and securities companies that have sold high-risk products such as private equity funds. The second financial sector is checked to see if it has accumulated enough provisions to prepare for the insolvency of the corona loan. The Financial Supervisory Service announced on the 21st the ‘2021 inspection service operation plan’ containing such contents.

Financial Supervisory Service

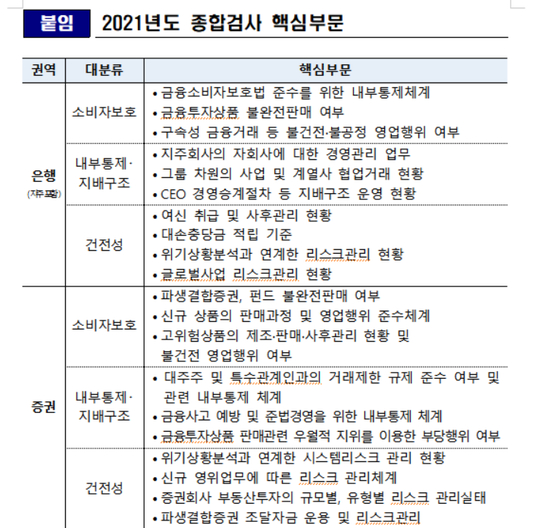

This year, the Financial Supervisory Service plans to intensively inspect incomplete sales of financial companies, such as whether there has been illegal business activities in the process of selling high-risk products and whether investor protection procedures have been followed. Financial companies that have received many complaints about the suspension of redemption are the first to be inspected. It also looks into the management of overseas real estate funds with high potential risk. The Financial Supervisory Service explained that if there are signs of unhealthy business behavior or consumer complaints pour out on certain products, it can lead to on-site inspection. The FSS prosecutor is focusing on preventing the recurrence of the private equity crisis this year following last year.

In addition, when financial companies sell products such as bancassurance and trust products, they plan to see if they sufficiently explained to consumers. This is because the sales strategy of the banking sector is changing as private equity sales contracted due to the Lime and Optimus crisis. Instead of private equity funds, banks focus on products such as bancassurance and trusts, but the intention is to determine whether any consumers have suffered damage in this process.

This year’s Financial Supervisory Service plan also contained a content that would evaluate the provisions of financial companies. Even if potential insolvency breaks out after the loan maturity extension for small business owners is over, financial companies are planning to respond in advance so that they do not suffer.

The number of inspections for financial institutions was 793, a 29.4% increase from the previous year (613). Among them, the comprehensive inspection, which looks at the business of financial companies, will be expanded from 7 times last year to 16 this year. Last year, tests were also reduced due to the aftermath of a novel coronavirus infection (Corona 19). However, the number of inspection personnel has increased from previous years, predicting high-intensity inspection. The number of personnel (annual number) to be used for the inspection this year was 23,630, an increase of more than 10% from the previous year (14,186) as well as 2019 (21,408).

Reporter Jiyu Hong [email protected]