The timing of the KOSPI large, mid-cap and small-cap index changes is approaching. It is pointed out that interest in the replacement stocks is required as index-following (passive) funds flow in to newly added stocks.

◇ Advantageous to supply and demand for institutions, etc., strategy to keep the road

According to the industry on the 20th, there is a regular change in the KOSPI market cap (size) index on the expiration date of futures in March every year.

The KOSPI size index is calculated by classifying KOSPI-listed stocks into large, mid-cap, and small-cap stocks according to their market cap.

The large-cap index will include the 1st to 100th market capitalization of KOSPI, the 101st to 300th of the mid-cap index, and the 301st or less of the small-cap index.

The announcement of the exchange for regular change in size index is usually announced in early March, and the stock exchange date for this year is March 12.

It is analyzed that the securities industry should be interested in stocks that will move from large to mid-caps or from mid-caps to large stocks.

According to Shinhan Investment Corp, when looking at the proportion of pension funds held by type of domestic stock consignment management as of the first half of 2019, large-cap stocks reached 6.6% and small and mid-cap stocks reached 8.5%.

As of the third quarter of last year, the pension fund’s investment in domestic stock management was 68 trillion won, and assuming that the proportion of small and medium-sized stock investment was the same as in the first half of 19, the amount of investment was 5.7 trillion won.

Kang Song-cheol, a researcher at Shinhan Financial Investment, said, “Considering the large investment size of small and mid-cap stocks, it is advantageous in terms of supply and demand if the stocks included in large-cap stocks are changed to mid-cap stocks. In addition, it is necessary to have a selective approach to investment types and investment timing.”

◇ Benefit from moving stocks from mid-cap index to large cap index, interest in Shinpoong Pharmaceutical, etc.

Shinhan Investment Corp. proposed POSCO International, Hyundai Marine & Marine Corp., BNK Financial Group, and KCC as stocks that are advantageous in supply and demand as they move from large to mid-cap stocks and fall below the top 75% of the market cap.

We estimated Shinpoong Pharmaceutical, Green Cross, HMM, SK Chemicals, Doosan Heavy Industries & Construction, Doosan Fuel Cell, Kiwoom Securities, Dongseo, Mando, Daewoong, and CS Wind as expected to move from the mid-cap index to the large-cap index.

Jinwon Life Sciences, United Pharmaceuticals, Daelim E&C, Shinsung ENG, Hyosung Heavy Industries, Hyundai Electric, and Miwon Trading were selected as the expected movement from small-cap stocks to mid-cap stocks.

On the other hand, the items expected to move from the mid-cap index to the small cap index include Namhae Chemical, SeAH Besteel, Skylife, SBS, Hana Pharmaceutical, Hyundai Future Net, Songwon Industries, Lotte Food, Hwaseung Industries, JW Holdings, Shinhan Alparitz, and Samjin Pharmaceutical. Presented.

Experts advise that one should pay more attention to stocks moving from large to mid-cap indices.

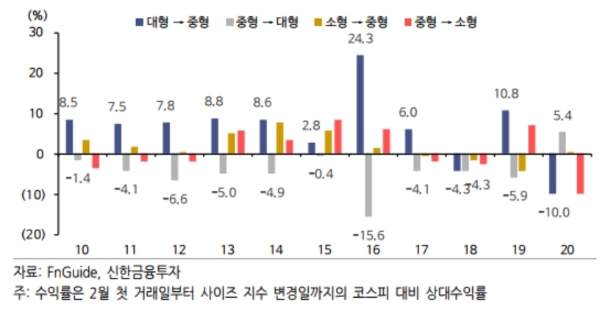

Lee Jeong-yeon, a researcher at Meritz Securities, said, “As institutional investors’ net buying pressure in the group moving from large to mid-cap stocks increased, the stock group recorded an excess return (6.2% points) compared to the 7th KOSPI out of 11 cases). “The effect of supply and demand for stock groups is still in effect, as patterns often appear and move from large-cap stocks newly added to the mid-cap index with a large weight.”

Samsung Securities researcher Jeon Gyun said, “From the perspective of institutional investors such as pension funds and asset managers, KOSPI mid-cap and KOSDAQ large-cap stocks fall under the’mid-cap investment group (universal)’ for active management.” “Rebalancing from the perspective of institutional investors “The stocks that run are either upgraded from small caps to mid caps (KOSPI mid caps) or moving from mid caps to large caps (KOSDAQ large caps),” he added.

Global Economic Reporter Choi Seong-hae [email protected]

[알림] This article is for information on investment decisions, and there is no responsibility for any investment losses based on this.