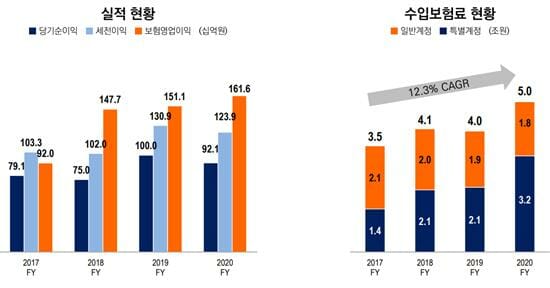

Mirae Asset Life Insurance announced on the 19th that it achieved net income of 92.1 billion won on a separate basis in 2020.

This is a 7.9% decrease from the previous year.

During the same period, sales increased by 3.5% to 3,518.9 billion won and operating profit increased by 6.4% to 111.8 billion won.

Mirae Asset Life Insurance explained that overall costs for revitalizing contracted operations and increasing new contracts increased, and net profit decreased as asset damage was reflected in the deterioration of the investment environment caused by Corona 19.

However, new contract APE (paid insurance premiums) recorded KRW 754.5 billion, a surge of more than 60% from the previous year. Among them, guarantees grew by 44.5% and variable investments by 77.5%.

In addition, it was found that the growth of the non-insurance sector continued, recording 57.9 billion won in’Fee-Biz’ commission income last year, achieving a variable reserve of KRW 12,500 billion and a retirement pension reserve of KRW 5,800 billion .

Related Articles

“It’s in front of the engraving separation”… Mirae Asset Life Insurance, Labor-Management Conflict Still Still

Mirae Asset Life Insurance delivers gifts to local low-income families ahead of the holidays

Mirae Asset Life Insurance opens variable insurance smart care service

Mirae Asset Life Insurance,’Exclusive Use Rights’, a special discount on cancer insurance premiums for women giving birth to multiple children

An official of Mirae Asset Life Insurance diagnosed, “We achieved achievements in line with our goals through the expansion of the non-insurance sector and the two-track strategy emphasizing guaranteed insurance and variable insurance.”

He added, “This year, we will respond to the business environment that is expected to change rapidly after the corona through sales channels and digital innovation,” he added.