|

| © News1 Designer Eunhyun Lee |

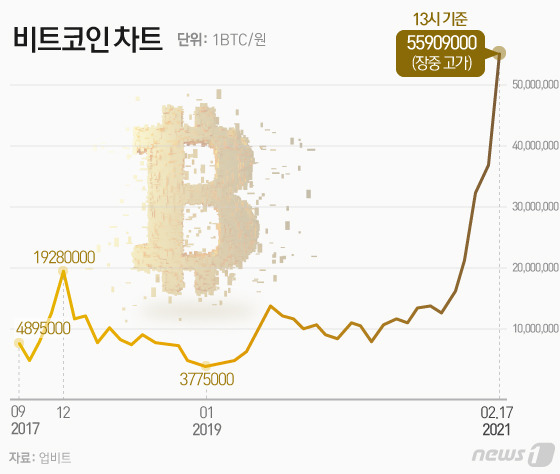

With the bitcoin price exceeding 50,000 dollars (about 55 million won) for the first time in history, attention is being paid to the reason for the price surge.

According to CoinMarketCap of the United States, which broadcasts the cryptocurrency (virtual currency) market, bitcoin, which reached its highest level on the night of the 16th (Korean time), surpassed $50,000 and fell slightly to $48,000 on the morning of the 17th.

It fell slightly as profit-taking sales poured out, but Bitcoin surged more than 70% this year alone.

The surge in Bitcoin this time is due to abundant liquidity due to the world’s ultra-low interest rates due to the novel coronavirus infection (Corona 19) and Wall Street institutional investors entering the market one after another.

This is different from 2017, when individual investors led the price increase, and there are many prospects that the uptrend will continue in the future as the big players on Wall Street are leading the current rally.

◇ Wall Street institutional investors lead bitcoin price rise: US economic media CNBC reported that Wall Street’s big players are behind the record high bitcoin price at the end of December last year.

Cryptocurrency analysis company’Chain Analytics’ analyzed that investors who bought at least 1,000 bitcoins (about $23 million, 25.4 billion won) in new accounts that have been opened for less than a year have generated record demand since September last year.

Accordingly, CNBC said that the bitcoin rally in 2017 was led by individual investors, while the rise was led by big Wall Street investors.

CNBC analyzed that this year’s rise in bitcoin was partly driven by Wall Street’s billionaires’ public support for bitcoin. “It has instilled confidence in mainstream investors who were skeptical of cryptocurrency.”

Billionaires such as Paul Tudor Jones and Stanley Druckenmiller made investments, and the aggressive adoption of cryptocurrency management solutions by Fidelity, JPMorgan, and PayPal also affected the price increase.

Square, founded by Twitter CEO Jack Doh, and NASDAQ-listed MicroStrategy, and Mass Mutual, a large US insurance company, also led the price hike by buying cryptocurrencies in bulk.

◇ Tesla 1.5 billion dollar investment… Burning price spikes: On the 8th, Tesla CEO Elon Musk announced that it will purchase $1.5 billion (1.6 trillion won) worth of bitcoin and add bitcoin payment as a payment method when purchasing its own products. It soared to $15,000.

|

| Elon Musk Tesla CEO-Tesla Twitter Capture © News1 Release Photo |

Tesla explained, “We bought bitcoin to maximize cash return and ensure flexibility,” and “there is a possibility to invest part of the company’s capital in cryptocurrency in the future.”

Musk’s move is a huge boon after Bitcoin’s Chicago Merchandise Exchange (CME) futures trading and institutional investors’ entry into the market, cryptocurrency experts are saying.

|

| The photo is a bitcoin chart reflected on Bithumb, a cryptocurrency exchange that day. 2021.2.9/News1 © News1 Reporter Lee Donghae |

◇ After Tesla investment, other banks entered the market one after another: As even Wall Street financial institutions have entered the cryptocurrency market, there is a prospect that cryptocurrencies such as bitcoin will increase further in the future.On the 10th, Reuters reported that New York Melon Bank plans to hold, transfer, and issue cryptocurrencies such as bitcoin for customers of asset management companies at the end of this year.

CEO Regelman told The Wall Street Journal (WSJ) that New York Melon Bank is in discussions with customers to introduce digital currency.

He explained that New York Melon Bank will issue cryptocurrencies by the end of the year through its new affiliate Digital Assets. It added that Mike Damish, CEO of subsidiary Advanced Solutions, will lead the digital assets segment.

Mastercard, a credit card company, also announced on the 11th that it plans to provide support for cryptocurrency, saying that it plans to include some cryptocurrency in its payment system within this year.

As companies as well as existing financial sectors are investing in bitcoin, experts are agreeing that bitcoin will continue to rise for the time being.