Virtual image of Bitcoin, a cryptocurrency leader. Reuters Yonhap News

The price of bitcoin, the leader of cryptocurrency (virtual currency), has exceeded $50,000 each in the United States.

On the 16th (local time) at Coinmetrics, a US cryptocurrency exchange, the price of bitcoin at 7:30 am (9:30 pm KST) recorded $5487 per piece. It is the first time since the first successful payment in 2009 that Bitcoin exceeded $50,000.

Bitcoin is known to have been created in October 2008 by a person named Sakashi Nakamoto (pseudonym). Up to 21 million can be mined. Currently, the distribution volume is about 88% of the total.

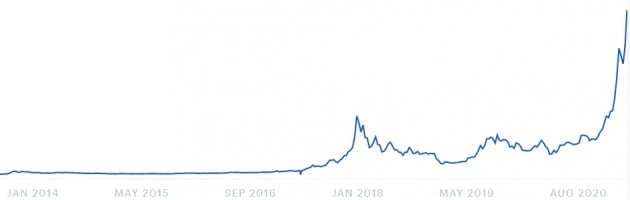

In March last year, when the new coronavirus infection (Corona 19) spread, the price of bitcoin, which was only $4,000 per piece, started to rise sharply in the second half of last year. Last December, it broke the $20,000 wall for the first time ever. It surpassed $30,000 in early January of this year and $40,000 in the beginning of this month, and reached $50,000 on the same day. It has jumped 12.5 times in less than a year since March last year.

It’s not just Bitcoin. Altcoins (alternative cryptocurrencies) such as Ethereum Tether Cardano Ripple EOS Neo Dogcoin are also rising rapidly.

On the 16th, the bitcoin price set a new record, exceeding $50,000 each.

The vertical rise in cryptocurrency prices is due to the spreading outlook that it will play a role as a’financial asset’ in earnest. Traditional financial companies, such as Mass Mutual BNY Melon Fidelity, have announced their involvement in the cryptocurrency market one after another. The intention is to preoccupy the related market. In Canada, an exchange-traded fund (ETF) based on Bitcoin was the first in the world to be approved by financial authorities.

In an interview with CNBC on the 14th, Daniel Pinto, co-president of the largest financial company in the United States, said, “The demand for bitcoin will surge to the point where the big financial companies on Wall Street must intervene.” I do.”

Elon Musk Tesla, the CEO of Tesla, who has a big voice in the stock market, made several comments in support of cryptocurrency. did. Earlier, Tesla announced that it had bought $1.5 billion worth of Bitcoin last month.

There is also an analysis that the US government has increased interest in cryptocurrencies that can avoid (hedge) a decline in the dollar value as the US government pushes for an economic stimulus plan worth $1.9 trillion.

The objection is also difficult. One representative point is that cryptocurrency is premature to play a proper role as a financial product. It is said that its versatility is weak and the risk of sharp price fluctuations is not small. Although the Chicago Merchandise Exchange (CME) bitcoin futures transaction has expanded to a scale of $2 billion, there are also observations that the price may drop sharply if a hedge fund for short-term arbitrage ends.

US Treasury Secretary Janet Yellen said at a confirmation hearing held last month that “it is necessary to consider (regulation) measures to prevent money laundering through Bitcoin.”

“It looks like the cryptocurrency market such as Bitcoin is overheating,” said Matt Deep, co-founder of Stack Fund, a cryptocurrency-related fund. On the other hand, Block Tower Capital’s Chief Investment Officer Ari Paul (CIO) predicted on Twitter that “it may have some adjustments, but it will see a much bigger surge than before.”

New York = Correspondent Jae-gil Cho [email protected]