Another jackpot broke out. This time, it is a dating application company. After the new coronavirus infectious disease (Corona 19) pandemic, the stock price surged after IPO (IPO), the formula newly established in the stock market worked without fail again.

■

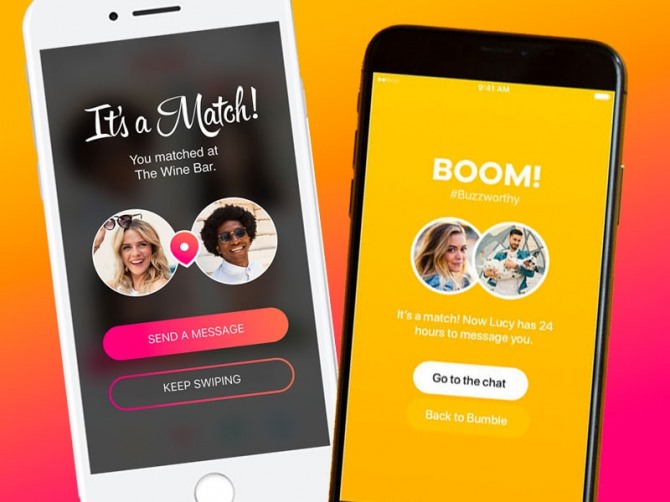

Dating app Bumble surges 77% on first day of trading

Bumble, an American dating application company, set a record of over 80% of the IPO offering price in the first transaction on the 11th (local time) when it first appeared in the stock market after the IPO.

Trading began at $76 per share.

This happened the next day, when the IPO sold 50 million shares for $43 per share the day before, securing $2.15 billion.

Bumble, which was set at an IPO with a market capitalization of $8 billion, surpassed $13 billion due to a soaring stock price that day.

Bumble shares remained high on the same day and ended their first trade at $70.31, up 27.31 (63.51%) compared to the offering price.

■

One of 20 female CEOs and the youngest

Bumble has some merits that will arouse market interest.

There are advantages to the Joe Biden administration’s emphasis on gender equality.

Bumble’s dating app went beyond the framework of the existing dating apps in which men search for a mate, and women took the lead in finding male partners.

Women, not men, have the right to be able to make initial contact after they become interested in each other in a dating app.

When meeting women, each person can send a message.

It is a dating app led by women.

Bumble, a subsidiary of the European dating app Badu, is also a startup founded by 31-year-old female CEO Whitney Wolf Heard.

It is one of just over 20 female entrepreneurs among Wall Street listed companies.

With the IPO, Hurd became a female self-made billionaire.

In addition, he has set the record for the youngest among female CEOs in US listed companies.

■

Pursuit buying should be careful

Amid the booming stock market, the price of the stock market was reaffirmed by reassessing the public offering price, and after appearing in the stock market at the recalculated public offering price, the stock market trend in which the stock price surged again was confirmed again.

However, there is no guarantee that the’jackpot’ will last. This means that you have to be cautious about investing.

Snowflake, a cloud-based software company known for hitting the jackpot after investing by Warren Buffett, the sage of Omaha, also surged more than twice as much in the first transaction after the IPO, surpassing $390 at the end of December last year, recording an all-time high. But now it has fallen to the $290 level.

That’s a good level.

Nikola, a U.S. hydrogen and electric truck company, which is mentioned as a representative case of IPO through SPAC, which is in the midst of a boom, has priced 80 dollars per share after listing. It crashed to the 22 dollar line.

Mi-hye Kim Global Economic Correspondent [email protected]

[알림] This article is for information on investment decisions, and there is no responsibility for any investment losses based on this.