Summarizing the prospects of many securities companies on the 11th, investment in the US SPAC (Special Purpose Acquisition Company) is booming and the inflow of funds is accelerating.

SPAC aims to find unlisted companies that meet the conditions and mergers and acquisitions within a certain period after financing through establishment and IPO.

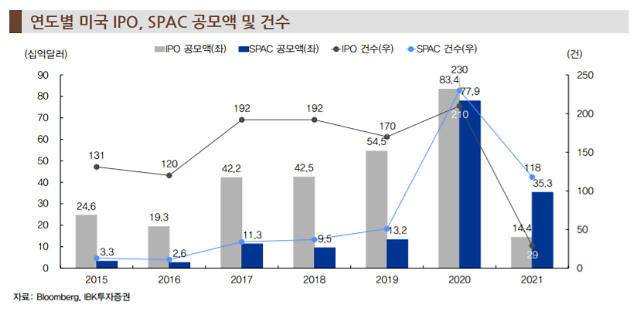

Last year’s IPO and SPAC public offerings amounted to 83.4 billion and 77.8 billion dollars, respectively, up to 93.4%. This year’s SPAC offering has already exceeded the IPO. Last year, IPO and SPAC public offerings were $54.5 billion and 13.2 billion dollars, respectively, and the proportion of SPAC to IPO was 24.3%.

Kim Soo-yeon, a researcher at Hanwha Investment & Securities, said, “As funds flow into the SPAC market, last year’s SPAC offer amounted to $78 billion, nearly six times that of 2019. Similar to the general IPO offer amount,” he said. “The SPAC merger is increasing and the merger timeline is shortening. Related ETFs are also being launched, and large investment institutions have begun to enter the SPAC market,” he said.

It is observed that the inflow of funds related to SPAC investment will continue to increase. In recent years, the number of SPACs that finalize mergers within 2-3 months after listing has increased, increasing the possibility of early performance. SPAC aims to merge within two years after listing (US standard), but previously announced mergers and acquisitions generally one year later.

While new industries such as electric vehicles, digital, and renewables are expected to grow, new industry-related stocks such as Open Door (online real estate brokerage app) and Quantumscape (related to auto parts) are continuing to be listed on SPAC, raising expectations for fund inflow.

However, individual SPAC investments have a limitation in that the opportunity cost for the holding period is large when the merger is not actually carried out. The cost of information required to track the schedule and identify issues such as listing and merger with SPAC is also daunting.

It is an advice that if you use ETFs, you can overcome the limitations of individual SPAC investment.

In-sik Kim, a researcher at IBK Investment & Securities, said, “Failure to merge with SPAC is a burden for ETF investors as well.”

As SPAC investment ETFs, △Defiance Next Gen SPAC Derived ETF (SPAK US) △SPAC and New Issue ETF (SPCX US) were recommended.

SPAK can track the performance of not only SPAC, but also companies that have shown solid share price trends after the merger, such as Draftkings (DKNG) and Virgin Galactic Holdings (SPCE).

SPCX, which invests in SPAC for less than a year from listing, is expected to produce results in the fact that the announcement of mergers and acquisitions is being accelerated.

[사진 = IBK투자증권]