|

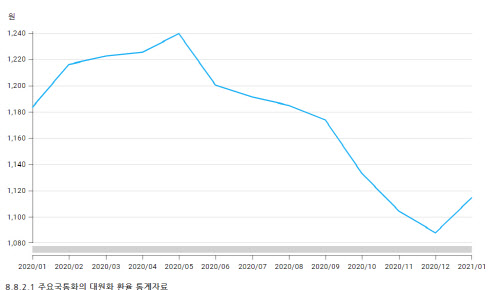

According to the’International Finance and Foreign Exchange Market Trends since January’ announced by the Bank of Korea on the 10th, the won-dollar exchange rate rose from 1086.3 won at the end of December last year to 1118.8 won at the end of January and settled at around 1,100 won in one month. The won-dollar exchange rate rose to 1123.7 won on the 5th and entered the 1120 won range for the first time this year.

The US dollar was strong in January due to increased hedging sentiment due to increased volatility in the New York stock market. In February, it expanded its strength as it was affected by the relatively good US economic indicators released. According to the BOK, the Dollar Index (DXY) index (March 1973 = 100), which aggregates the value of the dollar against six currencies, rose 1.1% from the first trading day of the new year as of the 8th.

The won recorded a current account surplus of $75.28 billion last year, an increase of $15.6 billion from the same period of the previous year, reaching the fifth place in history, but it is relatively weak compared to the dollar. This is because the US dollar index rose, the foreign exchange demand showed an advantage due to the liquidation of the selling position of offshore differential-settled futures (NDF) investors, and the net selling of domestic stocks by foreigners.

Foreign investors’ domestic securities investment funds showed net sales of 1.07 billion dollars in January following last December (2.3 billion dollars 60 million dollars). This is the effect of selling profit-taking and expanding stock volatility. Foreign stock investment reached a net outflow of $18.84 billion last year alone, the highest since the 2008 global financial crisis ($35.49 billion). However, foreigner’s bond funds converted to net inflow of $1.32 billion, mainly from public funds in January.

|

Accordingly, the government bond market is weak and the stock market is strong as the sentiment of preference for risky assets appears. The US 10-year Treasury bond rate has risen from 0.91% at the end of December last year to around 1% since last January. As of the 8th (local time), the 10-year U.S. Treasury bond interest rate rose to 1.2% during the intraday, and the 30-year bond rate also exceeded 2% for the first time since Corona 19.

The domestic bond market is also weak with rising interest rates. Ten-year KTBs, 20-year, and 30-year KTBs all crossed the connection point due to deteriorating supply and demand, such as pressure from the politicians to organize additional budgets for the 4th disaster support payment. As of the 8th, the 10-year Treasury Bond yield was 1.822%, up 0.031 percentage points (p) from the previous trading day. The 10-year KTB rose to its highest level in about 15 months after November 12, 2019 (1.842%).

The stock price is also on the rise. This is because the preference for risky assets in the global financial market has grown as the optimism of the economic recovery has grown. The Morgan Stanley International (MSCI) developed countries (DM) index hit an all-time high six times in January and recorded 2796 as of the 8th, up 3.9% as of the end of December last year. In particular, out of 300 companies that announced their 4Q results last year, 241 (80%) net profits exceeded market expectations, leading the share price to rise. In the domestic stock market, the KOSPI surged to 3266.23 during the intraday on the 11th of last month, but has repeatedly declined and risen for the fourth week due to the influence of foreign buying.

In particular, in the US, the Dow Jones 30 Industrial Average recorded 31,375 lines in the’Biden Effect’ and 4,000 in the Standard & Poor’s (S&P) 500 Index. The NASDAQ index broke through the 14,000 line for the first time, marking a new high.

On the other hand, the foreign currency borrowing conditions of domestic banks maintained a low level of short-term borrowings, while the mid- to long-term borrowings increased from the previous month due to prolonged borrowing. The additional interest rate for external borrowing in January remained at a short-term price of 3 for less than a year, and the mid- and long-term interest rate was 24, up 9bp from the previous month. The credit default swap (CDS) premium on a 5-year basis also recorded 25, a 4bp increase from the previous month.