Due to the new coronavirus infection (Corona 19) crisis, last year’s national tax revenue decreased by nearly 8 trillion won compared to a year ago. This is the first time that tax revenues have decreased for the second consecutive year.

Tax reduction for the first two consecutive years

Politicians in front of the elections and “Let’s remove taxes”

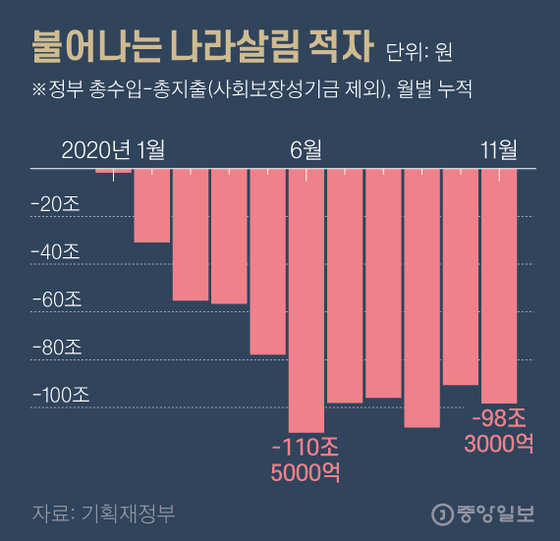

On the other hand, the expenditure of the country’s household has increased significantly. The government’s total revenue minus total expenditures (excluding the Social Security Fund) recorded a deficit of 98.3 trillion won from January to November last year. This means that the money spent by the government was nearly 100 trillion won more than the money it had collected. This is because it has invested the budget for responding to Corona 19 including emergency disaster support funds three times.

The growing national savings deficit.

The Ministry of Strategy and Finance released the results of closing the national accounting books (gross revenue and appropriations) last year. The government earned 28.5 trillion won in national taxes last year. Compared to 2019, it decreased by 2.7% (7.9 trillion won). This is because the company’s business performance and the domestic economy were hit directly by Corona 19. Last year’s corporate tax income was 55.5 trillion won, a decrease of 16 trillion won (23.1%) from a year ago. This is the poorest performance since 2016. Last year, VAT revenue decreased by 5.9 trillion won (-8.4%). The increase in local consumption tax rate (15→21% of VAT) has also affected the incorporation of some of the VAT previously set as national tax into local taxes.

The reduction in corporate and VAT is offset by taxes on real estate and securities. Last year, the government raised 7.6 trillion won (46.9%) more than a year ago in capital gains tax. The comprehensive real estate tax increased 9293 billion won (34.8%). Inheritance and gift tax also increased by 2 trillion won (24.6%). The stock market transaction volume increased sharply due to the stock investment fever of individual investors called’Donghak ants’, and the stock exchange tax also increased significantly. Securities transaction tax revenue last year was 8 trillion won, a nearly double (95.8%) increase from a year ago.

Kim Sun-gil, head of the Accounting and Settlement Division of the Ministry of Finance, said, “The transfer tax and securities transaction tax have increased compared to what was estimated while organizing the budget. Actually, the national tax revenue was 5.8 trillion won higher than the 4th supplementary budget (279 trillion won).”

The increase in tax revenues related to real estate and securities was insufficient to keep up with the rapidly growing government spending. Most of the insufficient money was paid up by the government in debt (by issuing government bonds). As of the end of November last year, the national debt was 86.2 trillion won. It is expected to reach 1,000 trillion won by the end of this year. This figure does not reflect the budget for supportive sentiment from women and nights ahead of the re-elections for Seoul and Busan mayors in April and the presidential elections in March next year.

Together with the Democratic Party leader Lee Nak-yeon, he insisted on the payment of the 4th disaster support fund, which required a budget of 20 to 30 trillion won. Prime Minister Jeong Sye-gyun is promoting a self-employment loss compensation system. Gyeonggi Governor Lee Jae-myeong came up with a’Korean basic income system’ that pays 500,000 won per month to all the people. It is a very large project that costs as little as 100 trillion won to 200 trillion won per year.

As the domestic economy has subsided and the tax situation is tight, there is no answer other than’debt party’ to support the patronymic policy. Tae-gi Kim, professor of economics at Dankook University, said, “Because of being buried in the competition for approval ratings, major leaders are pouring out their pledges of populism without thinking about tax revenue at all.” He said, “With the ruling party dominating the National Assembly, deputy Prime Minister Hong Nam-ki and Minister of Equipment and Materials and Bank of Korea Governor Lee Ju-yeol have no choice but to join forces to defend themselves. I am more concerned about the financial situation,” he added.

Sejong = Reporters Jo Hyun-sook and Lim Seong-bin [email protected]