[사진=연합뉴스]

The Financial Services Commission renews the ban on short selling. It was originally decided to extend the ban on short selling until March 15th. As individual investors continue to have concerns about the resumption of short selling, financial authorities and politicians plan to resume short selling after devising measures to improve it.

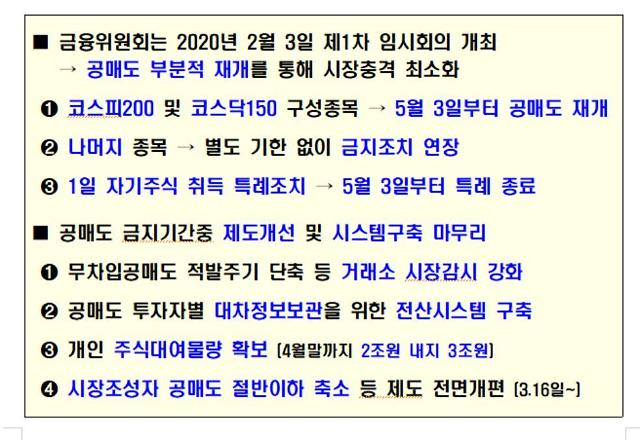

On the 3rd, the Financial Services Commission announced an extension of the ban on short selling based on these details. However, from May 3, the short selling of the stock index constituents of KOSPI 200 and KOSDAQ 150 will be partially resumed. Short selling of KOSPI and KOSDAQ large stocks such as Samsung Electronics and Celltrion Healthcare will resume. For the remaining 2037 stocks, the ban will be extended without a separate deadline. There is no set deadline for the resumption of short selling for these stocks.

On that afternoon, the Financial Services Commission held the first extraordinary meeting to discuss whether to extend the ban on short selling. The members who attended the meeting gathered opinions on inducing a soft landing of the short selling system through partial resumption, despite the inevitable situation to resume short selling. In particular, as Korea is the only developed country to ban short selling, it is difficult to completely ban or indefinitely ban short selling, which is a’global standard’, so it has partially resumed with large stocks.

In response, Eun Seong-soo, chairman of the Financial Services Commission, said, “As the market is concerned about the resumption of short selling, we decided to minimize the market impact through partial resumption.” I will try to do the homework given to us.”

Chairman Eun said, “From May 3rd, we have decided to resume short selling from the KOSPI 200 and KOSDAQ 150 index constituents that are familiar to domestic and foreign investors.” , In consideration of the market situation, etc., it was decided to separately determine the method and timing of resumption in the future.”

Meanwhile, the special measures for acquiring treasury shares on the 1st, along with the ban on short selling, were extended until May 2. This action will also resume on May 3.

The Financial Services Commission plans to finish improving the system and establishing the system until short selling resumes in May. The Financial Services Commission recently revised the law to improve penalties and criminal penalties for illegal short selling. In addition, in order to block illegal short selling attempts in advance, it has been mandated to keep the information on the purpose of short selling loans through a computer system for 5 years. In addition, the detection cycle of non-borrowing short sales will be shortened from 6 months to 1 month, and the detection and surveillance of illegal short sales will be strengthened through advanced detection techniques.

The Financial Services Commission plans to make every effort to improve the system until the date of short selling resumes. An official from the Financial Services Commission said, “As a result of continuing close discussions and persuasion with securities companies and insurance companies, we have secured a large stock volume of about 2 trillion won to 3 trillion won. We will try to increase the number of securities companies that provide loan service in the future. “He said.

©’Five Languages Global Economic Daily’ Ajou Economics. Prohibition of unauthorized reproduction and redistribution