In the wake of the U.S. GameStop incident, voices from minority shareholders, which are the number one short-selling balance among listed companies in the domestic stock market, are getting stronger and more supportive. In the recent US stock market, as individual investors (Robin Hooders) gather and buy stocks with large short selling balances such as Gamestop, AMC, Blackberry, etc., Celltrion will be a target of US Robin Hooders. In judgment.

According to the financial investment industry on the 2nd, Celltrion’s minority shareholders recently launched the’Nasdaq Relocation Promotion Committee’ and are pushing for a plan to submit it as an agenda at the regular shareholders’ meeting held in March. Shareholders are planning to actively promote the necessity of re-listing on the NASDAQ by collecting donations.

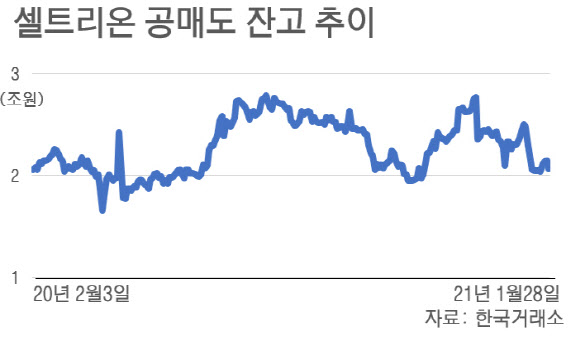

This is because Celltrion is a representative stock that has suffered from short selling. As of the 28th of last month, the short selling balance of Celltrion was 2,598 billion won, which is by far the first place. Compared to Samsung Electronics, which is the second place, at 3136 billion won, the difference is almost 7 times. The proportion of short selling balances to market capitalization is 4.56%, ranking third after Lotte Tourism Development (6.77%) and Doosan Infracore (5.04%). The short selling balance of Celltrion is largely held by foreign institutions such as Goldman Sachs, Merrill Lynch, and Morgan Stanley.

|

Since short selling was temporarily banned in March last year due to the Corona 19 pandemic, the short selling balance of Celltrion fell below 2 trillion won, but it once increased to 2.789.8 billion won as the stock price rose. Short selling is prohibited, but market makers or ETFs liquidity supply can be traded short.

The minority shareholders argued, “The force of short selling is not suitable for Celltrion, where the development of new drugs for COVID-19 antibody treatment and sales of existing anticancer drugs grow by 60% every year.” They are preparing to apply for a’National Audit Request’ to the Board of Audit and Inspection and are currently being signed by the Joint Register. It is a policy to actively inform the fact that Celltrion is the stock with the most short selling balances in the Korean stock market by accessing Reddit, where individual investors’ collective action on GameStop has recently begun.

In fact, a post was posted on Reddit, an American investment community, pointing out Celltrion as the next purchase target for GameStop. However, there was no response and some posts were deleted.

Earlier, the Korea Two-Investor Association (Han Tu-yeon) also announced that it would set up a KStreetbets (KSB) system that ties up Donghak Ant, Seohak Ant, and Robin Hood in the United States to compete against short selling. The plan is to cooperate with Celltrion and the HLB shareholders’ association, which have the highest proportion of short selling in the securities market and KOSDAQ, and to induce the liquidation of short selling with the support of Donghak Ant, and then solidify with Robin Hood, an American individual investor.

Celltrion has been selling badly for a long time. Celltrion Chairman Seo Jeong-jin declared a’war against short selling’ as the target of the short selling force amid the accounting controversy in 2012. did.

Meanwhile, Celltrion is trading at 358,500 won, down 3.37% from the previous day at 10:14 am on the 2nd. The previous day, as it was designated as the Korean version of the game stop, it rose by 14.51%, but it turned downward on this day.