A method of approaching the loss compensation system, which compensates for losses suffered by small business owners due to business restrictions and prohibitions, is being sought in the form of’special support’. The law stipulates the state’s compensation for losses, but details are put in the enforcement ordinance or enforcement regulations to secure flexibility and speed.

According to the Ministry of Strategy and Finance and the Ministry of SMEs and Startups on the 31st, a plan to institutionalize self-employed loss compensation in this manner is being discussed within the government. First of all, the government is considering amendment of the’Small Business Support Act’ rather than enacting a special law. In the Small Business Support Act, if the state restricts business in special circumstances such as Corona 19, it is under consideration to reflect the phrase “can be compensated” in the law.

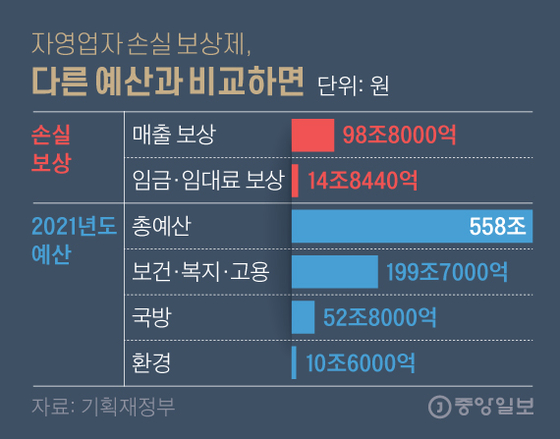

![Self-employed loss compensation system, graphic image compared to other budgets. [자료제공=기획재정부]](https://i0.wp.com/pds.joins.com/news/component/htmlphoto_mmdata/202101/31/7be0daf7-8018-44cb-899c-8d699fdd2699.jpg?w=560&ssl=1)

Self-employed loss compensation system, graphic image compared to other budgets. [자료제공=기획재정부]

Here, the legal nature of government support places weight on the nature of’special support’ rather than’loss compensation’ for the state’s administrative actions.

The basis is that the Constitutional Court made a constitutional decision (October 2015) in response to an application for an unconstitutional legal trial submitted by slaughterers who had been suspended from business due to foot-and-mouth disease. At the time, the Constitution interpreted, “The compensation is a beneficiary benefit paid to alleviate the economic burden of slaughterhouse owners due to orders to suspend or restrict the use of slaughterhouses and to induce compliance with such orders.” It is intended that the government’s compensation for these is not compensation for losses, but support.

Considering that the actual compensation period will be delayed if support for business restrictions or prohibitions is prescribed as compensation for losses. This is because the procedure for accurately determining the amount of loss and determining the compensation ratio for this must be applied individually according to the compensation target.

Another problem is that it becomes difficult to respond flexibly. Self-employment is difficult to accurately identify sales, and fixed costs such as rental fees and labor costs vary by industry and business site. For this reason, when the type of disaster to compensate for the loss and the target/content of compensation are nailed, the target of support is narrowed.

In addition, if compensation for losses becomes a legal obligation of the government, large and small lawsuits over the adequacy of compensation may lead to other social costs. It takes a long time to establish standards for social consensus and to institutionalize them. An official from the Ministry of Science and Technology said, “Because of these various problems, it is easier for the government to compensate for some business losses, but to have the legal character as’support’.” “We still have to go through a lot of procedures until we lose.”

Meanwhile, the criterion for evaluating the loss of self-employed people is likely to be operating profit, not sales. This is a method of differentially supporting the operating profit loss caused by government measures in 30%, 50%, and 70% for each ban/restriction measure.

Sejong = Reporter Cho Hyun-sook [email protected]