The global smartphone industry has met a raging. Since Apple launched the iPhone in 2007, smartphones have been regarded as’the best it item’ among consumers, but the scale is shrinking in the last 3-4 years.

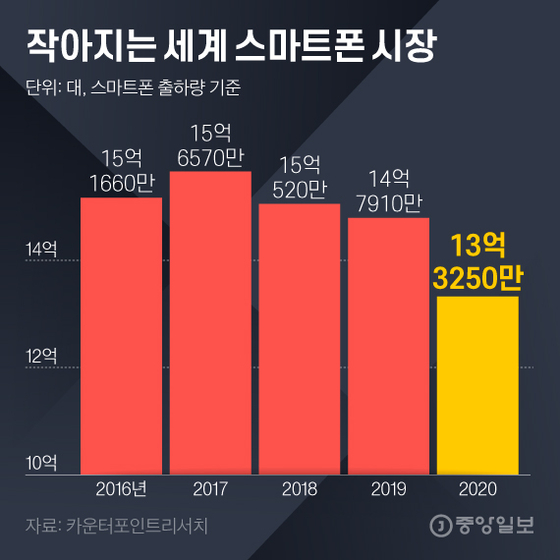

According to Counterpoint Research, a market research company on the 1st, last year’s global smartphone shipments were only 1,332.5 million units. After reaching 1.55 billion units in 2017, it has decreased to 155.2 million units in 2018 and 14,791 billion units in 2019. In 3 years, about 15% has taken a step backwards.

The biggest reason for the decline in the market size is the longer smartphone replacement cycle. In the past, when smartphone makers released new products every year, there was a lot of demand to buy new products even if the products they are using were not broken. That means that the consumer’s wallet has been opened with new designs and functions.

Replacement cycle 2→3 years due to technology upgrade leveling

However, with the recent technology leveling upward, the difference in performance of new products by company is not noticeable. Here, even compared to the previous work released a year ago, it is said that it is not trying to differentiate itself. Among smartphone makers, there is a saying that’the biggest competitor is not the competitor, but the previous work’. Consumers feel that they don’t have to change their smartphones. According to the Korea Internet & Security Agency, the domestic smartphone replacement cycle (as of 2018) was 33 months, an increase of 10 months from 2014 (23 months). This means that changing smartphones every two years has been extended to three years.

The global smartphone market is getting smaller. Graphic = Younghee Kim [email protected]

It was predicted that the 5th generation (5G) smartphone commercialized by Samsung Electronics in 2019 will be a spark to save the market, but it did not meet expectations. As the 5G network construction was not properly implemented, complaints arose among consumers. There is also a lack of specialized content suitable for 5G phones. There is no reason to switch to a new product while paying an expensive plan or equipment price for running speed alone.

The responses of the companies are diverse. The world’s No. 1 Samsung Electronics is being pursued by Apple. In the fourth quarter of last year, it released the iPhone 12 and gave the top spot to the popular Apple. The strategy that Samsung Electronics came up with was’price cut’. The price of the Galaxy S series, the flagship smartphone introduced last month, was lowered by 140,000 to 250,000 won from the previous one.

LG Electronics is considering withdrawing the smartphone business altogether. Samsung Electronics and Apple in the high-end market, and China in the mid-to-low-end market, the position is in an awkward situation. The MC division, which is in charge of smartphones, has suffered an operating loss for 23 consecutive quarters since the second quarter of 2015. By the end of last year, the cumulative operating deficit exceeded 5 trillion won. Considering that LG Electronics’ overall operating profit is around 2 to 3 trillion won per year, the burden is heavy. LG Electronics plans to announce plans to sell or reduce the MC division’s sale soon.

Lower prices and close business

World smartphone market share. Graphic = Younghee Kim [email protected]

China’s Huawei, which was growing at a frightening momentum, was at a crossroads due to US trade sanctions last year. Although domestic demand served as a support, it is said that the limit has been reached. In the third quarter of last year, it started going downhill, and shipments were cut in half in the fourth quarter. Local media reports that Huawei will sell the entire smartphone business following the mid-priced brand’Honour’.

Joo-wan Lee, a research fellow at the POSCO Research Institute, said, “Competition for smartphones is a’content fight’ that contends on what can be done with a new product. It is necessary.”

Reporter Choi Hyun-joo [email protected]