“We promise to promote meaningful mergers and acquisitions (M&A) within three years.”

As Samsung Electronics Chief Financial Officer (CFO and President) Choi Yoon-ho formalized the M&A promotion at a conference call held on the 28th, the market’s attention is focused on the automotive semiconductor industry. This is because Samsung Electronics is a core business that can gain synergy through M&A. The investment banking (IB) industry is paying attention to President Choi’s remark that “a lot of preparations are in progress.” What Samsung has offered up to the deadline is also taking as a sign that the deal has progressed considerably.

○Why Automotive Semiconductor

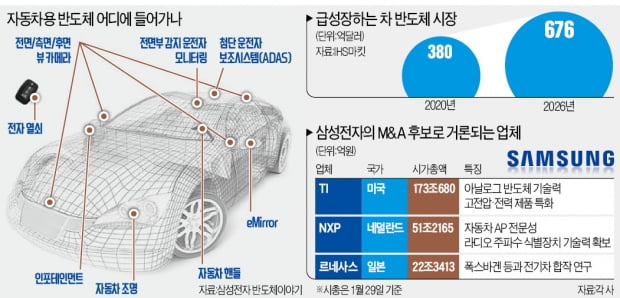

According to Samsung Electronics and the M&A industry on the 31st, the companies that are looking for an acquisition are NXP of the Netherlands, Texas Instruments (TI) of the US, and Renesas of Japan. In the industry, it has been steadily raised that Samsung Electronics is considering the acquisition of NXP, but it is known that Samsung Electronics has been searching for the most suitable target among multiple companies for a long time. An IB industry official said, “In 2019, Samsung Electronics has already conducted due diligence on NXP and TI business sites.” President Choi also explained in a conference call that “for the past three years, we have been continuously reviewing the targets of M&A very carefully.”

The reason Samsung Electronics has pointed out automotive semiconductors is because of its growth potential. According to market research firm Gartner, the amount of semiconductors in a single car in 2018 was about $400, but it is expected to exceed $1,000 in 2024 when autonomous vehicles become popular. Due to the conservative nature of the automobile industry, long-term verification is essential until semiconductors are delivered. It is analyzed that acquiring an existing company is more effective.

Each company Samsung is reviewing has its strengths. NXP, which has excellent technical capabilities such as automotive application processor (AP) and infotainment, is expected to have a great synergy with Harman. TI specializes in semiconductor manufacturing technology that is resistant to high voltage using analog semiconductor know-how. It is an essential technology for electric vehicle semiconductors where strong current flows.

Renesas is a leader in microcontroller units (MCU). It is a component that accounts for the largest share (30%) in the automotive semiconductor market. Renesas’ MCU share is 31%, which is on the shoulders of NXP. In 2018, it acquired IDT, a semiconductor design company, to increase its autonomous driving semiconductor capabilities. However, the skewed Korean-Japanese relations and differences in corporate culture are pointed out as obstacles.

○ There may be several big deals

A senior official at Samsung Electronics said, “We are in a state of being motivated by M&A.” In the industry, it is believed that progress has progressed to the extent that Samsung Electronics has presented the deadline. Samsung Electronics Vice Chairman Lee Jae-yong emphasized in a recent prison message that “Samsung must continue to follow the path that should be taken, regardless of the situation in which I am faced,” dispelling concerns about the suspension of the deal due to the head gap.

In the industry, predictions that the largest deal will be produced after the acquisition of Harman are dominant. TI’s market capitalization alone amounts to 177.3 trillion won. NXP (51,2165 billion won) and Renesas (22,341.3 billion won) are not too small. Samsung Electronics has plenty of room to spare. Cash assets alone amounted to 116 trillion won (as of the end of the third quarter of last year). There is a possibility that several M&As will be successful. An official from Samsung Electronics said, “We are positively reviewing M&As in various fields besides semiconductors.”

Professor Park Jae-geun of the Department of Convergence Electronics Engineering at Hanyang University said, “In 2030, 300 million new electric vehicles are poured out every year, so if only 3 high-speed APs are entered, 1 billion will be required.” It will be advantageous to preempt.”

Reporter Lee Soo-bin [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution