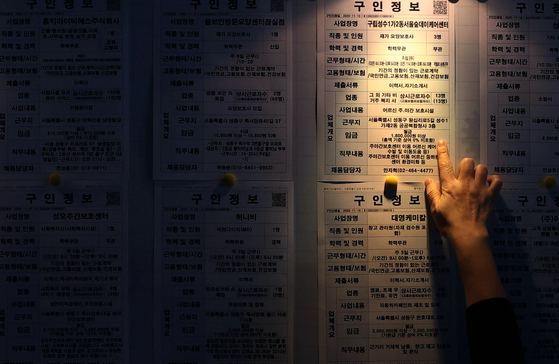

A cold wave of employment continues due to the prolonged impact of the novel coronavirus infection (Corona 19). In front of the Hope Job Center in Seongdong-gu, Seoul, a job seeker is looking at job information. yunhap news

In the first half of this year, it was found that the only places in the labor market that increased jobs were in the electronics, semiconductor and display industries. It is a business that benefits from the new coronavirus infection (Corona 19), such as the increase in non-face-to-face work. This does not mean that the number of employees employed will increase dramatically. The increasing number of jobs is expected to be modest.

The rest of the industries were predicted to be in a hurry to reduce or maintain jobs as they could not get out of the tunnel of recession.

On the 31st, the Korea Employment Information Service and the Korea Industrial Technology Promotion Agency (KAI) released the’Job Prospects for Major Businesses in the First Half of 2021′ on the 31st. We estimated job growth in eight major domestic manufacturing sectors, including machinery, shipbuilding, electronics, textiles, steel, semiconductors, automobiles, and displays, and a total of 10 industries including construction, finance and insurance.

In the machinery sector, demand for manufacturing equipment is expected to increase on the back of the semiconductor and display boom. However, the size of employment is expected to decrease compared to the same period last year due to economic uncertainty due to the aftermath of Corona 19.

The shipbuilding industry was hit hard by a 34% decline in orders last year due to global blockades and falling oil prices. This year, orders to replace existing ships are expected to increase due to the EU’s GHG emission regulations, but job reduction is inevitable as it takes a long time to place orders and production.

In the electronics industry, employment is expected to increase by 1.6% (11,000 people) due to recovery of growth, demand for replacement of 5G smartphones, and expansion of non-face-to-face work and services.

The textile industry is expected to face difficulties in general due to the improvement of the quality of Chinese products. In addition, the recovery of consumer sentiment is delayed, and jobs are expected to stagnate while maintaining the current level overall.

Steel has been hit by the lowest demand since the 2020 financial crisis. It is analyzed that this year, exports of steel materials will record 30 million tons or less due to the stagnation of the steel market in Southeast Asia and India. Accordingly, even under the premise that the domestic economic situation will improve, the number of jobs is expected to decrease by 1.4%.

For semiconductors and displays, demand for mobiles, servers and computers continues to expand, and jobs are 2.9% each due to the expansion of the non-face-to-face information and communication (IT) market and increasing demand for premium OLEDs. It is expected to increase by 1.4%.

It is expected that this year’s automobile production growth will be limited. Accordingly, the number of jobs is expected to decrease by 0.1% from the same period last year.

In the financial sector, loan growth is expected to continue. However, a decline in profits was expected as the loan-to-deposit margin declined and the bad debt cost continued to rise, as well as customers’ departure from preference for safe assets. In particular, life insurance’s operating yield is expected to decline as the low interest rate situation prolongs. The size of employment also decreases slightly accordingly.

The construction industry has been supported by an increase in private-sector housing orders last year, but the construction order market is expected to adjust this year. However, as investment in the public sector related to infrastructure will increase, the employment size will increase by 1.4%, the Korea Employment Information Service predicted.

Staff Reporter Kim Ki-chan [email protected]