Samsung Electronics announced a merger and acquisition (M&A). In February 2017, it officially formulated the’Big Deal’ four years after acquiring Harman, an American automotive electronics company.

Last year’s operating income of 36 trillion won, semiconductors 19 trillion

Shareholders First… Dividends that exceed market expectations

“Meaning scale M&A, facility investment”

Big deal officialized after 4 years of acquisition of Harman

On the 28th, Yoon-ho Choi, head of Samsung Electronics’ Management Support Dept. (President), announced last year’s business performance on the 28th. It has been carefully reviewed, and a lot is ready.”

President Choi continued, “Amidst uncertainties such as the global trade conflict and the spread of Corona 19, competition intensifies and technological difficulties have increased. You have to have it.”

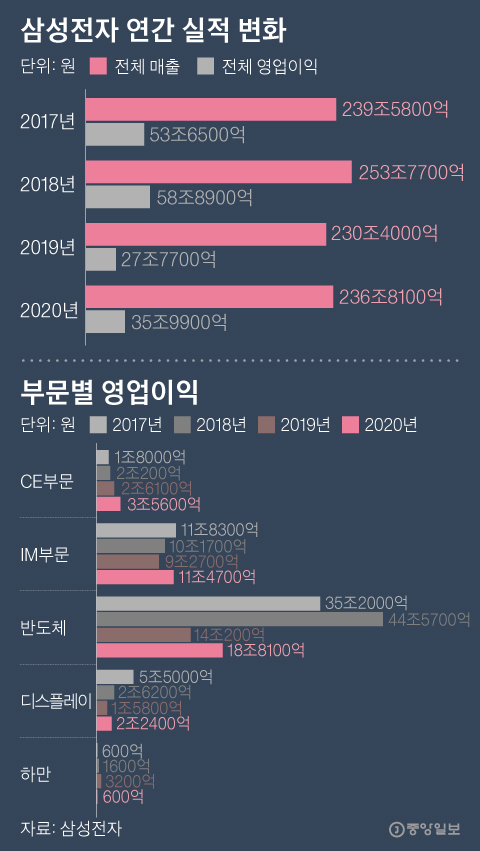

Samsung Electronics’ annual earnings change. Graphic = Reporter Park Kyung-min [email protected]

In the financial investment and information technology (IT) industry, it is predicted that semiconductor companies will be the targets of the’meaning-scale M&A’ disclosed by Samsung. This is because the cash holdings have increased as much as M&A has stopped virtually over the past four years. As of September last year, Samsung Electronics’ cash and cash equivalents amounted to 26.65 trillion won. President Choi said, “In the past shareholder return policy period (2018-20), M&A was not carried out properly, so the cash holdings increased, and it is true that the continuous increase in cash also burdens the company management.”

Samsung Electronics announced today that it achieved sales of 61,551.5 billion won and operating profit of 9.47 trillion won in the fourth quarter of last year. Last year’s sales were 23.61 trillion won and operating profit was 3,599 trillion won. It is the third best in terms of sales and fourth in terms of operating profit. Even in the aftermath of Corona 19 and the trade conflict between the US and China, it exceeded expectations. In addition, it also announced a dividend plan of 13 trillion won, the largest in history.

Samsung Electronics has introduced a three-year shareholder return policy since 2018, saying that it will expand communication with the market. It is said that the dividend will be expanded using half of the free cash flow during this period.

This time, the semiconductor was also a’filial son’. It earned 1,810 trillion won, which is half of the total operating profit (52%), from semiconductors. Semiconductor operating profit increased by 4.79 trillion won from 2019 (14 trillion won).

The IT and mobile (IM) division, which is in charge of smartphones, also made a profit with an operating profit of 11.47 trillion won. It is the highest performance ever, surpassing 2018 (10.17 trillion won). The consumer electronics (CE) sector left 3.5 trillion won. This is thanks to the increased demand for home appliances such as TVs and IT products such as laptops and tablet PCs as the culture of working from home and non-face-to-face has spread due to Corona 19.

In addition to this, there is also a’large dividend’. On this day, Samsung Electronics announced a settlement dividend and shareholder return policy for 2021-23. The existing settlement dividend is 354 won per share based on common stock, but it is said that it will pay 1932 won per share by adding 1578 won as a special dividend using the remaining resources. Preferred stocks receive 1933 won per share. The special dividend is 50% more than the 1,000 won per share expected by the financial investment industry. The total amount of dividends, including special dividends, is 13,124.3 billion won.

In order to pay dividends that exceed market expectations, it is interpreted that the background of the’shareholder-first’ policy proposed by Samsung Electronics Vice Chairman Lee Jae-yong was the background. As social responsibility toward Samsung is more emphasized than ever, we can expect to form a friendly public opinion.

Reporter Choi Hyun-joo [email protected]