Hyundai Motor’s operating profit in the fourth quarter of last year soared 40.9% compared to the same period last year. This is due to an increase in sales of high value-added models such as Genesis and Sports Utility Vehicles (SUVs).

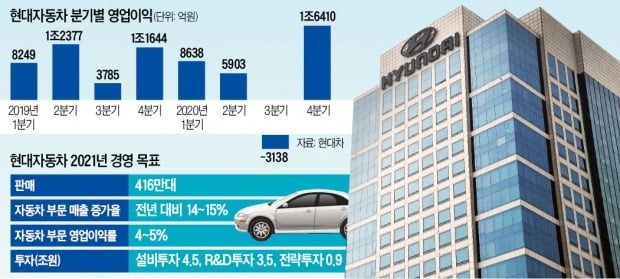

Hyundai Motor Company announced on the 26th that it sold 113,9583 units in the fourth quarter of last year, recording sales of 29,243.4 billion won and operating profit of 1.64 trillion won. Compared to the same period last year, sales decreased by 4.7%, but sales and operating profit increased by 5.1% and 40.9%, respectively. The operating margin in the fourth quarter was 5.6%, exceeding 5% for the first time since the third quarter of 2017. An official from Hyundai Motors explained, “The sales volume decreased, but the result of improving the product mix centering on new cars and conducting profit-oriented management. Last year’s annual operating profit was KRW 2.781.3 trillion, down 22.9% from the previous year. In the first half of the year, global sales were sluggish due to the aftermath of Corona 19, the plant was partially shut down, and in the third quarter, provisions for quality costs of over 2 trillion won in relation to the Theta 2 GDI engine were affected.

Hyundai Motor Company set its sales target this year to 4.16 million units, an increase of 11.1% compared to last year. It also suggested targets to achieve a 14-15% increase in sales and 4-5% operating margin in the automobile division. To this end, it plans to make an investment of 8.9 trillion won.

4th quarter operating income KRW 1.64 trillion

High value-added model sales increased significantly… Quarterly sales peak after IFRS introduction

Hyundai Motor Company faced great difficulties with its operating profit in the second quarter of last year plummeting 52.3% from the same period last year. This is due to major national movement restrictions due to the novel coronavirus infection (Corona 19) and partial shutdown of production plants. In the third quarter, an operating loss of 3138 billion won was incurred by reflecting the quality cost of 2,1352 trillion won in relation to the’Theta 2 GDI engine’ as a provision.

However, it succeeded in a dramatic rebound in the fourth quarter. Operating profit for the fourth quarter was 1.64 trillion won, a 40.9% increase from the same period last year. This is the highest performance since the second quarter of 2016 (1,761.8 billion won). The operating margin (5.6%) exceeded 5% in 13 quarters after the third quarter of 2017 (5.0%).

Excluding one-off costs, annual profits also improve

Hyundai Motor’s 4Q09 earnings improvement is attributable to an increased sales portion of high-end models such as Genesis GV80 and G80 and high-end models such as sports utility vehicles (SUVs). The portion of Genesis sales increased from 1.7% in the fourth quarter of 2019 to 3.7% in the fourth quarter of last year, and the portion of SUVs increased from 41.9% to 43.0% in the same period. Thanks to this, sales reached 29,243.4 billion won, the highest quarterly level after the introduction of the new International Financial Reporting Standards (IFRS) in 2010. Kang-Hyun Seo, Vice President of Finance Division, said, “We achieved high profits by improving the product mix despite the strong won.”

Last year’s annual operating profit was 2,781.3 billion won. Although it fell 22.9% year-on-year, real profits excluding one-off expenses in the third quarter improved. Last year’s sales were 103 trillion won, exceeding 100 trillion won for the second consecutive year following 2019. It was decided to keep the dividend at the end of last year at 3,000 won per share, the same as the previous year. The company explained that the speed of profitability recovery and the need for future investment expansion were balanced in consideration.

Ionic 5, March European sortie

Hyundai Motor Company also set high goals for this year. Specifically, △Genesis and Ionic settle in the global market △Expand SUV sales and optimize production and profits △Accelerate cost innovation. Through this, it plans to focus on improving profitability.

The global sales target was set at a total of 4.15 million units, including 740,500 units in Korea and 3,418,500 units overseas. It increased by 11.1% compared to last year. It also presented a challenging goal of increasing sales in the struggling Chinese market by 27.6%. In the US market, it plans to increase its market share by releasing the new Tucson in the first quarter following the GV80 and the new G80, which were introduced at the end of last year. In the second quarter, it was decided to release the GV70.

The electric vehicle division is also in full swing. At the end of March, Ioniq 5, the first electric vehicle produced on an electric vehicle platform (E-GMP), will be released in Europe. Next, it will be released to the Korean and American markets sequentially. The sales target for electric vehicles this year is 160,000 units, an increase of about 60% compared to the previous year.

Through this, Hyundai Motor Company proposed a goal of increasing its auto sales this year by 14 to 15% compared to the previous year (80 trillion won). This is the first time that Hyundai has provided an annual earnings forecast. The auto division’s operating margin target is also set at 4-5%. Considering that it was only 1.4% last year, it is three times higher. The total investment this year is 8.900 trillion won, which is to increase 500 billion won from last year. Facility investment is 4.5 trillion won, R&D investment is 3.5 trillion won, and strategic investment is 900 billion won.

Experts analyzed that Hyundai Motor has presented a fairly challenging goal considering that the global automobile industry’s business environment is not easy this year. Demand in the automobile market will recover this year due to the stimulus measures and base effects of each country, but it is difficult to expect a recovery to the level before Corona 19, and the difficult business environment is expected to continue, such as intensifying competition and a fall in the won-dollar exchange rate (strong won) to be.

Reporter Kim Il-gyu/Do Byeong-wook [email protected]