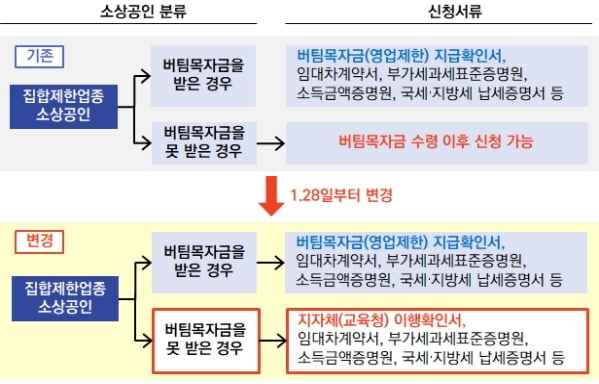

Beginning on the 28th, small business owners who do not have a confirmation of the payment of support funds can also apply for a special loan for small business owners who rent a limited group.

The Financial Services Commission announced on the 27th that it has improved the application process so that local governments can apply for a group-restricted special loan once they receive a confirmation of implementation of the executive order for social distancing measures.

Originally, it was possible to apply for a group-restricted special loan only if there was a confirmation of the support fund payment, but as the difficulty of small business owners who have not yet received the support fund increased, other documents were also decided to acknowledge the damage caused by the group restriction.

However, in order to receive a special loan, it is necessary to meet the criteria, such as average sales, which are different for each business type, so the bank goes through a verification process.

To apply for a special loan, 12 commercial and local banks (Kookmin, Nonghyup, Shinhan, Woori, Hana, Corporate You can visit Gyeongnam·Gwangju·Daegu·Busan·Jeonbuk·Jeju Bank).

Nine of these banks can roughly apply for a non-face-to-face application through their homepage or mobile phone application.

You can apply for a confirmation of local government implementation at the departments in charge of regional and basic local governments nationwide. You can check the detailed application information on the support fund website, the call center, and the Small Business Corporation website.

For academies, classrooms, and reading rooms, the Office of Education or Education Support Office, not the local government, issues a confirmation of implementation.

The group limited special loan is a program that provides loans of up to 10 million won to small business owners who have been subject to group restrictions since November 24 last year, and are currently operating business sites.

A total of 2648 cases (26.3 billion won) were received from the 18th to the 25th, of which 77.7 billion won worth of loans were executed.

In the case of the secondary financial support program for small businesses, whose maximum interest rate was recently cut by up to 2 percentage points, 21,729 cases (420.8 billion won) were received from the 18th to the 25th, of which 195 billion won was executed. .

Compared to Jeonju (11-15 days, 3,243 cases), the number of receipts increased by 6.7 times and the size of loans increased by 3.5 times from 55.8 billion won, the Financial Services Commission said.

/yunhap news

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution