Input 2021.01.25 15:26

75% of last year’s issued… subsidiary performance deterioration

Corporate bonds got hot, but chemical and shopping performance is key

Completeness of governance structure through’Hotel Lotte Listing’

Lotte Holdings (004990)On the 25th, it issues corporate bonds to raise 400 billion won. A trillion units of money were rushing into the demand forecast and the box office was successful, but the core subsidiary, Lotte Chemical (011170), Lotte Shopping (023530)According to the company’s performance, it is analyzed that future financing conditions may deteriorate. The listing of Hotel Lotte, the last button of corporate governance restructuring, will not be easy, so’New Lotte,’ drawn by Group Chairman Shin Dong-bin, faced a major crossroads this year.

The consolidation of money is due to the continued low interest rate and increased demand for high-quality corporate bonds. Among the AA0 ratings for Lotte Holdings, the private interest rate (average issuance rate evaluated by a private bond appraisal company) is higher. As of the 12th, the average of the 3-year interest rate for the 3-year bond was 1.299% for the AA0 grade and 1.454% for the Lotte Holdings.

Lotte Holdings plans to use most of its procurement to pay off corporate papers (CP), loans, and corporate bonds. The company increased the issuance of CPs, whose maturities are shorter than corporate bonds, as the performance of major affiliates such as Lotte Chemical and Lotte Shopping deteriorated sharply in the aftermath of last year’s coronavirus. As corporate bond investment sentiment improved this year, it seems that it aimed to convert the debt structure to long-maturated corporate bonds.

Experts pointed out that although demand is stable on the back of the warm blow of the corporate bond market, financing conditions may deteriorate in the future depending on the financial structure and cash flow of major affiliates. The main sources of revenue for Lotte Holdings are dividends, trademark use, and rental fees of affiliates.

Lotte Chemical’s earnings have been improving since the third quarter of last year, but in the case of Lotte Shopping in April and June of last year, the situation has hardly changed after the Korean Corporate Ratings and Korea Credit Ratings lowered their rating outlooks from stable to negative, respectively. Lotte Mart and Lotte Super also suffered as the trend of consumption from offline to online changed due to the continued low growth of the flagship department store division and the aftermath of the corona.

Lotte Shopping’s earnings are improving through aggressive store restructuring, but net debt continues to increase. As of the end of June of last year, net debt was 1.3 trillion won, an increase of 700 billion won compared to the end of the previous year. Han Tae-il, senior analyst Han Shin-pyeong, said, “In order to secure online business capabilities and escape from offline low growth, a certain level of investment is necessary.” “He said.

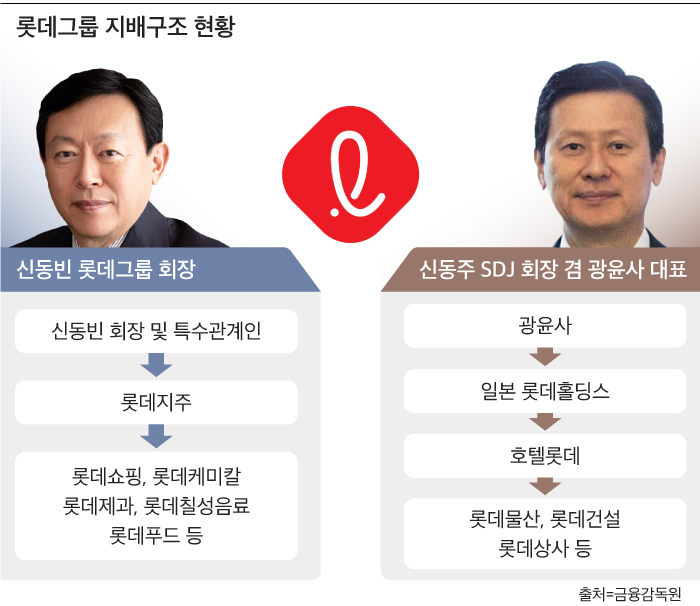

Another company that won the Lotte Group’s fortune this year is Hotel Lotte. Lotte Group is pursuing the conversion of a complete holding company through Lotte Holdings, but Hotel Lotte, a major shareholder of key affiliates such as Lotte Holdings, Lotte Shopping, and Lotte C&T, is an obstacle. Hotel Lotte has a 99% stake in Japanese capital such as Lotte Holdings in Japan, which is the main reason for being criticized as a Japanese group.

When Hotel Lotte is listed, the composition of shareholders will diversify and the stake in Lotte in Japan will decrease. This is because Japanese companies such as Lotte Holdings, Kwangyunsa, and L Investment Company make sales of old stocks (open sale of shares held by existing shareholders to general investors) during the IPO process. In the industry, the merger between Hotel Lotte and Lotte Holdings, whose stake in Japan has decreased significantly, is the final step in the restructuring of Lotte Group’s governance structure.

However, the listing of Hotel Lotte has been postponed indefinitely in the aftermath of the coronavirus. Accumulated sales in the third quarter decreased 48% year-on-year, resulting in an operating deficit as demand for hotels and duty-free, which is the flagship of the flagship, has prolonged. In November of last year, Shinpyeong Han lowered the credit rating of Hotel Lotte from AA0 to AA-.

Some speculate that if Hotel Lotte is recognized for a ransom of more than KRW 1 trillion in an IPO promoted by Lotte Rental, which holds a 42% stake, the financial soundness of Hotel Lotte will improve and the listing will speed up. However, unless Hotel Lotte’s duty-free and hotel business improves, it will be difficult to resume IPO. Kim Dong-yang, a researcher at NH Investment & Securities, said, “Hotel Lotte, located at the top of the Lotte Group’s governance structure, is the largest coronavirus company.”