Short selling is an investment technique in which a borrowed stock is sold and the stock price falls, buys stocks cheaply and pays off. It is mainly used as a means of avoiding (hedge) the risk of a decline because if the stock price falls after a short sale, it is possible to obtain a profit.

Short selling in Korea was banned on March 16 last year when the stock price plummeted due to Corona 19. The measure is set to expire on March 15th. As the KOSPI index broke through the 3000 line and showed a rapid recovery, the financial authorities judged that the conditions for resuming short selling were ripe. However, voices against the resumption of short selling are also difficult. There is an opinion that it is premature to resume short selling not only by individuals but also by political circles. The government and ruling parties have also begun to consider extending the ban on short selling for an additional 3 to 6 months. We have summarized the controversy over the ban on short selling.

Was short selling the main culprit of’Boxpie’

Some are concerned that the resumption of short selling will pour cold water on the long-awaited stock market. This is due to the perception that short selling is the main culprit in the stock market decline. “The biggest factor in the Korean stock market being locked up in’box pe’ until last year was short selling,” said Jeong Eui-jung, CEO of the Korea Stock Investors Association.

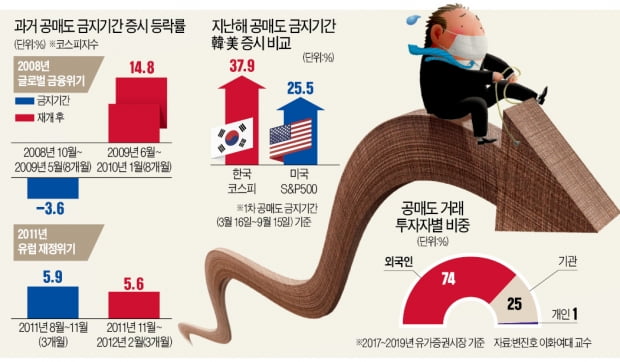

From March 16th to September 15th last year, when short selling was banned, the KOSPI index increased 37.9%. During the same period, the US S&P 500 index, which allowed short selling, rose only 25.5%. However, there is no clear’physical evidence’ that short selling has affected the stock price decline. From October 1, 2008 when short selling was banned due to the global financial crisis, to May 31, 2009, the KOSPI index fell 3.6%. In the eight months since June 2009, when short selling resumed, it rose 14.8%. Some analysts say that the KOSPI index increase rate last year recorded the highest level in major markets, not because of the ban on short selling, but because the economy was less affected by the success of the COVID-19 quarantine.

Short selling, why is it called a’tilted playground’

It is said that short selling is a’tilted playground’. This is because foreigners and institutions use short selling to make profits, while individuals have no choice but to lose intact if the stock price falls.

Foreigners accounted for 74% and institutions for 25% of short selling transactions in the securities market in 2017-2019. The proportion of individuals was less than 1%. Foreigners and institutions easily borrow stocks through the inter-institutional loan market worth 67 trillion won. Individuals can only use the lending market created with limited credit loan collateral. The Financial Services Commission is promoting a plan to expand the large stock market so that individuals can easily sell short.

Was short selling abused for unfair trade?

There are also doubts that foreigners and institutions may commit unfair trade activities such as using undisclosed information or manipulating market prices through short selling. Goldman Sachs’ large-scale un-borrowing short sale in 2018 fueled this perception. In some cases, securities companies in charge of market creation have been caught violating the’uptick rule’ (a regulation that prevents quotations below the price immediately before the sale).

Of course, it is unclear whether the illegal short sale was intentional. Financial authorities judged that Goldman Sachs’ short selling without borrowing and violation of the uptick rules of securities companies were simple mistakes.

Can I Prevent Illegal Short Selling with System Improvement?

The financial authorities are improving the system by strengthening penalties for illegal short selling. Currently, the penalty for illegal short selling is a fine of less than 100 million won. From March, he will be sentenced to more than one year in prison. A maximum of five times fines and penalties may be imposed on unfair gains obtained from short selling. Participation in the capital increase was also prohibited to prevent the short selling force from lowering the stock price by short selling to listed companies that are promoting the rights increase.

However, the Financial Services Commission gave up the development of a computer system to prevent non-borrowing short selling due to technical limitations. It is pointed out that it caused disbelief because it failed to keep its promise to systematically prevent non-borrowing short selling.

The ban on short selling is contrary to global standards

The industry is concerned that if the ban on short selling is extended again, Korea could become a’secluded island’ in the global market. This is because only Korea and Indonesia are the only major countries that ban short selling. Prolonged short selling bans are likely to adversely affect global capital inflows. Go Eun-ah, managing director of Credit Switzerland, argued that “in the long term, there may be an outflow of funds from passive funds that buy stocks along the index.”

Together with Democratic Party lawmaker Kim Byeong-wook, as a compromise, the’short sale designation system’, which designates stocks that can be short-selled mainly by large-cap stocks, as in Hong Kong.

Reporter Oh Hyeong-joo [email protected]