On the 15th, GS Group issued corporate bonds worth 200 billion won at an annual average interest rate of 1.3%. The issuance amount increased by 80 billion won from the time of demand forecast (pre-subscription). On the 7th, in the pre-subscription for institutional investors, the amount of issuance was increased as purchase orders worth 1.7 trillion won, 14 times more than the offer amount (120 billion won), poured out. GS, which has secured a thick livestock, plans to pay 100 billion won of the funds raised this time to pay back corporate bonds maturing, and use the rest as operating funds. Some of the operating funds are planned to be invested in GS Futures. It is a venture investor established by GS Group in July last year to discover promising startups.

Average corporate bond interest rate low of 2%

Hurry to issue before companies climb further

It’s a jackpot for the timing of the institutions to release money

GS 1.7 trillion, SKT 1.2 trillion, Hyundai Steel 2 trillion

“More attractive than government bonds, continued demand for the time being”

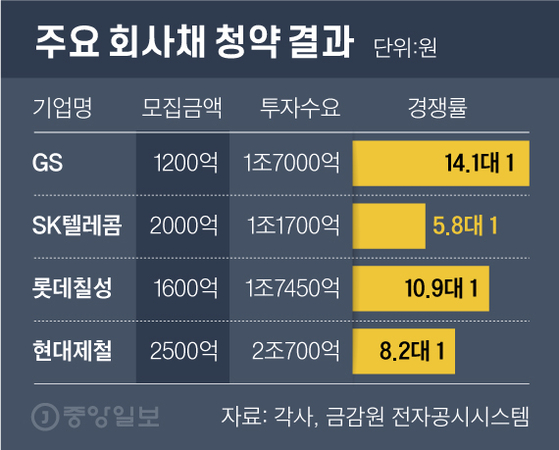

Major corporate bond subscription results. Graphic = Reporter Cha Junhong [email protected]

In the new year, the corporate bond market is hot. Each of the companies’ advance subscriptions is attracting trillions of dollars of money one after another. SK Telecom’s corporate bonds, which have the highest credit rating in Korea (AAA), are representative. Competition was also fierce during the demand forecast on the 7th. Buy orders of 1.17 trillion won were rushing, recording a competition rate of 5.8:1. In response to the pouring love calls, SK Telecom issued a corporate bond worth 310 billion won, an increase of 110 billion won from the time of demand forecast (200 billion won). Lotte Chilsung Beverage, one of the best corporate bonds, also received a purchase order of 1.74 trillion won in advance subscription with a target of 160 billion won. In terms of subscription competition, it is 10.9 to 1.

2% corporate bond interest rate. Graphic = Reporter Cha Junhong [email protected]

According to Samsung Securities, the expected issuance of corporate bonds by domestic companies this month is estimated at 3.2 trillion won. Tae-geun Park, head of global bonds at Samsung Securities, said, “If the demand increases further, the issuance can increase to 5.2 trillion won.” It can be interpreted that it has recovered to the state before coronavirus infection (Corona 19).”

Since the beginning of the year, corporate bond issuance by companies has been successful because the’appetite’ of issuers (supply) and investors (demand) has fallen. In recent years, companies are advancing the issuance of corporate bonds in order to secure a’live’ when interest rates are low. According to the Financial Investment Association, the average interest rate for 3-year AA-grade corporate bonds as of the 19th was 2.13%. Due to the Corona 19 pandemic (a global pandemic), the market interest rate has remained at the low 2% level for nearly a year amid the trend of ultra-low interest rates around the world. Corporate bonds issued by companies in a hurry are being bought by institutional investors with new operating funds.

The supply and demand situation is also good, coupled with the effect of the beginning of the year. In general, January is the time when institutions create new investment portfolios and release funds for new investments. As expectations for global economic recovery are growing, the preference for risky assets is on the rise. As a result, large hands (institutional investors) with abundant funds are putting high-quality corporate bonds in their portfolios instead of government bonds (three-year interest rates of 0.95%) below 1%. In addition, environmental, social and governance (ESG) bonds issued by companies are also attracting institutional funds. In fact, the National Pension Plan, the’brother’ of institutional investors, plans to invest half of its assets in ESG-related companies by next year. In reflection of this atmosphere, the so-called jackpot broke out in ESG bonds recently issued by Hyundai Steel. Hyundai Steel predicted demand for institutional investors ahead of the issuance of ESG bonds worth 250 billion won on the 18th. It became popular with 270 billion won of money that exceeded the recruitment amount 8 times.

However, the polarization of the corporate bond market is intensifying. This is because investors are concentrated only on high-quality corporate bonds with a credit rating of A- or higher. In the past, corporate bonds rated BBB+, which had been’selling out’ at high interest rates, are having difficulty in financing. For example, an auto parts maker Hwashin planned to issue corporate bonds last month, but immediately withdrew it. Although it promised a high interest rate of 4%, it was because there was not much demand for the investment risk of the credit grade BBB grade.

There is also increasing pressure on interest rates. The recent commercialization of the Corona 19 vaccine has shown signs of economic recovery. The US 10-year Treasury bond yield, a representative sign of a rise in interest rates, is also on the rise. Shin Hwan-jong, head of NH Investment & Securities FICC Research Center, said, “There is a high possibility that (corporate bonds) interest rates will rise as the second half goes up,” he said. An investment bank official who requested anonymity said, “As investors have increased rapidly recently, the interest rate for 3-year AA- corporate bonds traded in the actual market has dropped to 1.34%. Opportunity”.

Bond experts predicted that for the time being, investment fever will continue, mainly for high-quality corporate bonds. Tae-geun Park, team leader, said, “The atmosphere in which institutional investors are rushing to superior corporate bonds over government bonds with low interest rates will continue for the time being. It is difficult for the demand to disappear.” Kwang-Yeol Han, a researcher at NH Investment & Securities, said, “Companies can increase the issuance of corporate bonds until the global interest rate rises pressure.” Here, in terms of absolute interest rates, corporate bonds are more attractive than government bonds. “There is.”

Reporters Ji-Hyun Yeom and Sang-Eon Yoon [email protected]