Enter 2021.01.18 12:00

On the 18th, the Financial Services Commission announced on the 18th that it has revised its supervisory regulations to introduce the 4th generation insurmountable medical insurance (indemnity insurance).

In December of last year, the Financial Services Commission decided to divert all the payment of real-loss insurance premiums for non-indemnity insurance items to special contracts, and introduce a premium differential system in which insurance premiums are paid more if you pay a lot of insurance money for non-coverage treatment. In addition, it is decided to increase the self-pay, which is currently 10-20% of the salary and 20% of the non-salary, by 10% points (p) to 20% of the salary and 30% of the non-salary.

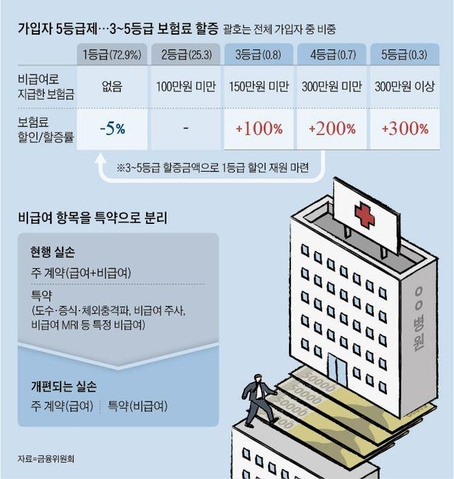

In addition, an insurance premium differential system will be introduced in which the premium will change later depending on how much insurance money has been paid for unpaid care. However, insurance premium discounts and premiums for non-indemnity treatment will be applied three years after product launch. In other words, the practical application of the non-payment differential system will be implemented from 2024.

The self-pay increases by about 10%p to 20% of wages and 30% of non-payment. The minimum amount for outpatient hospitalization is increased by 10,000 won as a basic salary, but 20,000 won for senior and general hospitals. The minimum amount for non-payment is 30,000 won.

The re-registration cycle is also shortened from the current 15 years to 5 years. For existing subscribers of real-life insurance, the content of coverage changes according to the re-enrollment cycle.