Based on the amount of new treatment in December last year… Balance-based cofix declines

(Seoul = Yonhap News) Reporter Shin Shin-kyung = COFIX (COFIX, financing cost index), which is the standard for the variable interest rate for mortgage loans in the banking sector, remained at 0.9%.

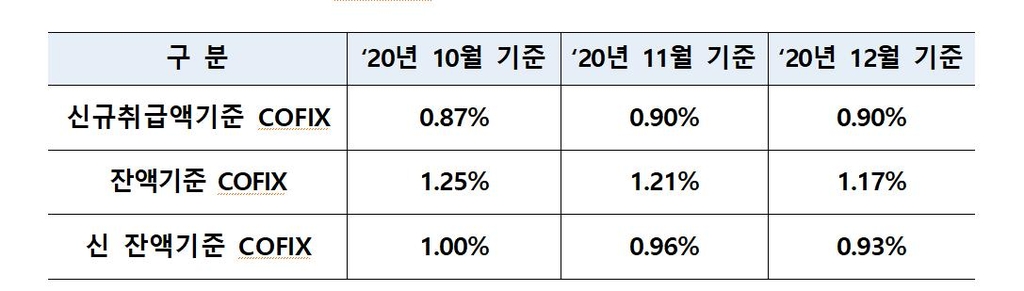

According to the Banking Federation on the 15th, the co-fix for December last year was 0.90%, the same as in November. COPIX, which has been walking downhill all the way, has been rising and falling in the range of 0.87~0.9% since the first rebound in 10 months in September.

Commercial banks will immediately reflect the October Cofix rate level, which was disclosed on the 16th, in the new mortgage loan rate.

COPIX is a weighted average interest rate of funds raised by eight domestic banks, reflecting changes in interest rates of received products such as deposits and savings accounts and bank bonds actually handled by banks. If the co-fix falls, it means that the bank can secure money with less interest, and if the co-fix rises, the opposite is the case.

The balance-based cofix decreased by 0.04 percentage points from 1.21% in November to 1.17% in December.

Co-fix based on the amount of new treatment and balance reflects the interest rates of the receiving products of term deposit, periodic deposit, mutual installment, housing installment, transferable deposit certificate, sale of bonds subject to redemption, sale of cover notes, and financial bonds (excluding subordinated bonds and convertible bonds).

The’new balance-based co-fix’, which was newly introduced from June 2019, was 0.93%, down 0.03 percentage points from November (0.96%). The new balance-based co-fix also includes interest rates such as other deposits, other borrowings and settlement funds.

[은행연합회 제공.재판매 및 DB 금지]

Unauthorized reproduction-redistribution prohibited>

2021/01/15 15:21 sent