For the time being, the market is unlikely to suffer from’austerity attacks’. This is because the Federal Reserve System (Fed) is expected to maintain its dove (currency easing) for the time being.

Fed Chairman Jerome Powell said in a webinar hosted by his alma mater Princeton on the 14th (local time), “I will certainly do that when the time comes, but that is not very close.”

“The lesson of the global financial crisis is that we need to be cautious without looking for an exit too soon,” he said. “We will communicate very clearly with the public long before we consider the start of a gradual reduction in asset purchases.”

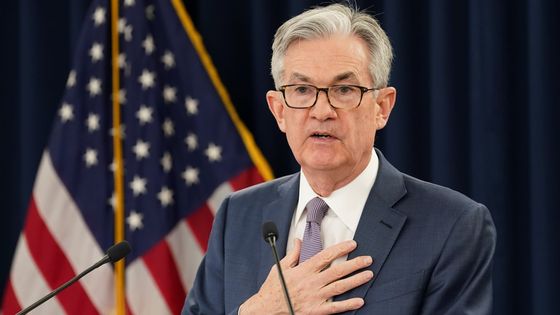

![Jerome Powell President of the Federal Reserve System (Fed). [로이터=연합뉴스]](https://i0.wp.com/pds.joins.com/news/component/htmlphoto_mmdata/202101/15/23ae4d3a-b778-4a7b-988e-c1cdd6f57f74.jpg?w=560&ssl=1)

Jerome Powell President of the Federal Reserve System (Fed). [로이터=연합뉴스]

“Even if the unemployment rate goes down, the interest rate will not increase”

Powell, who announced the maintenance of easing monetary policy, focused on job recovery. “We will focus our efforts on recovering the employment market,” he added. Market interpretation is in line with what the Federal Open Markets Commission (FOMC) said last month that “we will continue to ease monetary policy until significant further progress is seen” toward the targets for employment and inflation.

Regarding the decline in the unemployment rate, which is seen as an advance sign of inflation, Powell drew a line that “unless inflation or other imbalances appear, that would not be a reason to raise interest rates.” When the economy recovers, the unemployment rate falls, leading to higher wages and inflation.

In-hwan Ha, a researcher at KB Securities, said, “The emphasis on (Chairman Powell) will focus on the recovery of the job market means that it will take a considerable period of time for the Fed to change its position.” “Since October 2020, It will take longer for the unemployed to return to the job market.” In fact, the pace of improvement in the unemployment rate has slowed since October 2020. Powell pointed out that it will take considerable time for the job market to recover and monetary policy to normalize.

Powell said there is no plan to cut down on assets purchases by the Fed, which buys $120 billion worth of US Treasury bonds and mortgage securities (MBS) each month. “When talking about buying assets, you need to be very careful,” he said. “Now is not the time to talk about exits.” As interest rates on US 10-year Treasury bonds surged above the 1% range, there is also a prospect that the Fed could reduce the scale of quantitative easing.

Eco-friendly wine is contained in Biden’s’gift bag

In response to the central bank’s easing monetary policy, President-elect Joe Biden’s $2 trillion in additional support is also raising expectations from investors.

The size of this stimulus package, called the’U.S. Relief Plan’, totaled $1.9 trillion (about KRW 2085 trillion), which included an additional payment of $1,400 per person (about KRW 1,350,000), weekly unemployment benefit increase, and federal minimum wage increase. I put it. Next month, additional stimulus measures will come out that include job creation, infrastructure reform, and climate change.

Kim Il-hyuk, a researcher at KB Securities, predicted, “After Biden’s inauguration as president, a long-term economic stimulus plan centered on eco-friendly infrastructure investment plans will be announced, so there remains the possibility of rising economic sensibility and eco-friendlyism.”

Reporter Jiyu Hong [email protected]