|

| Employees are busy moving at Samsung Electronics’ Seocho office building in Seocho-gu, Seoul. /News1 © News1 Reporter Park Ji-hye |

It was found that Samsung Electronics recorded sales of about 56.2 billion dollars (about 61.5 trillion won) in the global semiconductor market last year.

With Intel of the United States defending the throne for the second year in a row following 2019, Samsung Electronics and SK Hynix, the domestic semiconductor industry’s’two headed horses’, followed in second to third place.

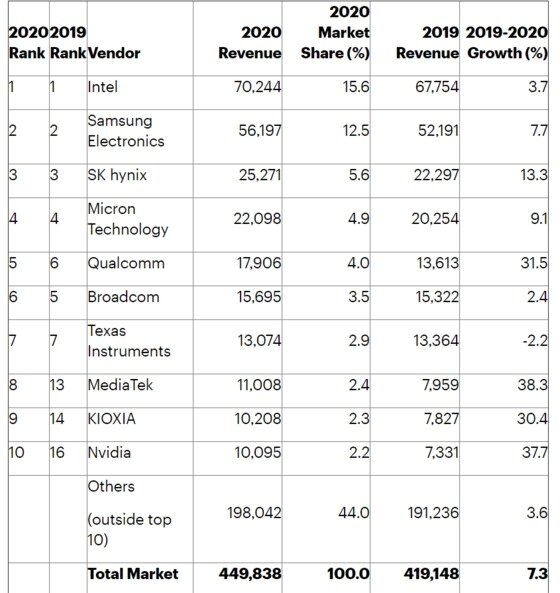

According to the ‘2020 Worldwide Top 10 Semiconductor Vendors by Revenue’ released by Gartner, a global market research firm on the 15th, Samsung Electronics ranked second with sales of $55.697 billion last year.

In 2020, Samsung Electronics’ semiconductor sales increased 7.7% compared to the previous year. The market share based on sales was 12.5%, maintaining the same level as the previous year.

During the memory boom in 2018, Samsung Electronics ranked first in the global semiconductor industry in terms of annual sales for the first time ever.

Then, as memory prices fell in 2019, Samsung Electronics’ ranking fell to second place, and it has maintained the ranking until last year.

Last year, the world’s number one semiconductor sales were Intel of the United States, recording $7024 billion. Sales increased 3.7% year-on-year.

|

| Samsung Electronics Vice Chairman Lee Jae-yong is inspecting the construction site of the 3rd plant in Pyeongtaek, Gyeonggi-do. (Provided by Samsung Electronics) 2021.1.4/News 1 |

Intel’s market share was 15.6%, down 0.6 percentage points from the previous year. It is analyzed that sales growth has been achieved in the CPU business, which is Intel’s core business unit.

Korea’s SK Hynix ranked third with semiconductor sales of about 25.3 billion dollars last year. SK Hynix’s sales increased by 13.3% from the previous year, and its market share increased by 0.3%p to 5.6%.

Then, US memory maker Micron ranked fourth with about $22.1 billion. Micron’s sales also increased 9.1% year-on-year.

According to Gartner, the rankings from No. 1 Intel to No. 4 Micron have not changed compared to 2019.

Qualcomm, which was ranked 6th in 2019, ranked 5th with sales of 31.5% soaring last year with 17.9 billion dollars. In addition, △Broadcom ($15.7 billion), △Texas Instruments ($13.1 billion), △Mediatek ($11 billion), △ Kioxia ($10.2 billion), and △Nvidia ($10.1 billion) were ranked in the’Top 10′.

|

| Samsung Electronics announced on the 12th that it has released a premium mobile AP’Exynos 2100′ that has significantly improved its performance. ‘Exynos 2100′, which is produced through the 5-nano EUV process, has improved CPU and GPU performance by more than 30% and 40%, respectively, by applying the latest mobile AP design technology, and on-device AI performance has also been greatly enhanced. . This new product is implemented with Samsung Electronics’ premium mobile AP’s first 5G modem integrated chip, providing the best solution in high-end gaming as well as complex multitasking environments. Samsung Electronics President In-yeop Kang (Head of System LSI Division) is introducing’Exynos 2100′. (Provided by Samsung Electronics) 2021.1.12/News 1 |

Compared to a year ago, three new locations were listed in the top 10: MediaTek, Kioxia, and Nvidia. In particular, MediaTek’s sales increased 38.3% last year, which is attributed to the increase in AP (application processor) sales as 5G smartphone sales increased worldwide in 2020.

Gartner also analyzed, “The expansion of 5G smartphone sales despite the sluggish overall smartphone market in 2020 helped to increase sales of semiconductor companies such as Qualcomm and Mediatech.”

In particular, despite the novel coronavirus infection (Corona 19) in 2020, the global semiconductor market was estimated to be $449.8 billion, an increase of 7.3% from the previous year.

Despite the sluggish sales of certain products such as automobiles and industrial semiconductors, it is interpreted as the effect of offsetting the boom in memory semiconductors driven by the expansion of’non-face-to-face’ life such as working from home or remote classes.

In fact, Gartner analyzed that the memory semiconductor market in 2020 was $135 billion, accounting for 44% of the total semiconductor market. In particular, NAND flash sales were $52.8 billion last year, an increase of $10.2 billion from the previous year, Gartner said.

|

| Global sales trend by semiconductor company in 2020 (Source = Gartner) © News1 |