More than 80,000 national petitions for abolition are signed… Political circles “review extension of ban”

Financial Services Commission “finish improvement of target system for resuming in March

With the KOSPI continuing an upward rally since last year and breaking through the 3100 mark for the first time in history, whether to resume short selling, which was temporarily banned until March 15, is again emerging as a concern both inside and outside the stock market. The financial authorities said they plan to lift the ban on short selling from March 16 as scheduled, but politicians and individual investors are insisting to extend or abolish the ban on short selling.

According to the financial investment industry on the 12th, the Financial Services Commission is scheduled to lift the ban on short selling from March 16th.

On March 16 last year, the Financial Services Commission banned short selling for six months in the KOSDAQ and KONEX markets as well as the securities market to alleviate the impact of the stock market caused by Corona 19. In September, the ban was extended for six months.

Short selling is an investment technique that realizes profit by borrowing and selling stocks when stock prices are expected to fall and then buying and repaying stocks when the stock price falls. Has been advocating abolition. According to the Blue House National Petition Bulletin on the 12th, I am petitioning for the ban on’perpetual short selling, which was posted on December 31st last year. Look at the stock market now. A total of 84,000 people agreed on the petition entitled’Is there a problem with the stock market that there is no short sale?’

In recent years, even in the political world, there have been claims that the ban on temporary short selling should be extended.

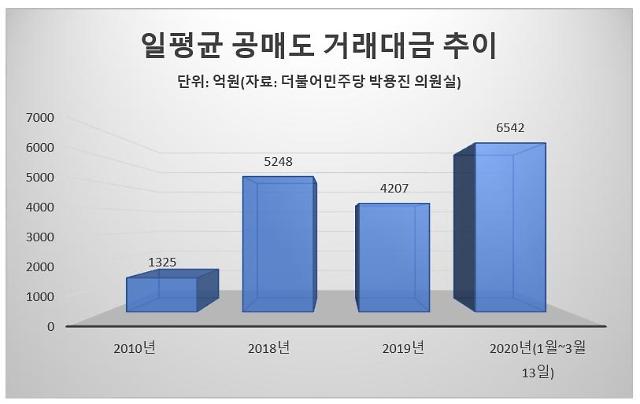

On the 5th, Rep. Park Yong-jin of the Democratic Party requested the Financial Services Commission for a careful review of the resumption of short selling scheduled for March.

Rep. Park said, “Despite the ban on short selling, which was enforced since March last year, it has been revealed that they have abused the position of market makers and have abused illegal short selling.” If it is resumed, there is a risk of serious illegal activities and fraudulent acts. The resulting decline in stock prices and stock market turmoil will intact to the public.”

In addition, the Democratic Party’s Supreme Council Member Yang Hyang-ja also said, “We have to seriously consider the extension of the ban on short selling. Over the past year, the ruling party of the government has prepared an institutional mechanism to minimize the dysfunction of short selling. “He said.

As the voices of the abolition or extension of the ban on short selling became louder, mainly by politicians and individual investors, the Financial Services Commission announced that it would finish improving the system with the aim of resuming short selling in March.

On the 11th, the Financial Services Commission said, “The ban on temporary short selling due to Corona 19 will end on March 15.” “I plan to finish it.”

Accordingly, Rep. Park raised the need to extend the ban on short selling again. Rep. Park said through Facebook, “To resume short selling without correcting injustice and institutional insolvency, it is abandoning the responsibility of the financial authorities.”

“It was said that it was institutionalized, but the current short selling is a slanted playground with many holes in illegal activities.” Tens of thousands of cases of illegal short sale were also confirmed.”

Although the FSC has announced its position to resume short selling as scheduled, it is difficult for the FSC to completely rule out this possibility as voices are growing about the extension of the ban in the financial investment industry.

In this regard, the Financial Services Commission is preparing a plan to increase the participation of individuals in short selling. A method of differentially granting investment limits, etc. after establishing the qualification requirements for short selling for individual investors is discussed. In relation to private equity investment, it is similar to the classification of general investors and professional investors. In addition, an integrated trading system that allows individual investors to trade loans in real time is being built with Korea Securities Finance.

An industry insider said, “As a result of the strong demands of individual investors, including the change of the stock capital gains tax imposition standard, the reorganization of the public offering stock subscription system, and the extension of the public offering stock ban, the voices of individual investors have increased more than ever. “It won’t be easy to do,” he said. “On the one hand, it won’t be easy to make a decision because it is not easy to object to the necessity of short selling, which is’form an appropriate price’.”

Stock prices see the resumption of short selling as one of the factors to adjust the stock market. Moon Nam-jung, a researcher at Daishin Securities, said, “Amid the controversy between the protection of investors and the net function of short selling, there is a strong possibility that the resumption will be allowed through system maintenance to reduce the market impact.”

Kim Young-hwan, a researcher at NH Investment & Securities, said, “The prospect of increased fiscal expenditures is a factor that raises interest rates, but the stock market will be adjusted when interest rates rise and the time to lift the ban on short selling approaches with stock prices rising.”

©’Five Languages Global Economic Daily’ Ajou Economics Prohibition of unauthorized reproduction and redistribution