With the KOSPI surpassing the 3100 line for the first time in history, a revival of short selling is emerging as a’hot potato’ in the stock market. Those who oppose that resuming short selling could add’cold water’ to the KOSPI rise, and those who argue that the ban on short selling should be lifted before the bubble grows due to overheating of the stock market.

Whether to resume short selling after two months

Donghak Ant “Institutions and Foreigners Playground”

40,000 people petition for’permanent ban’ signed

Expert “The stock market is overheating, resume immediately”

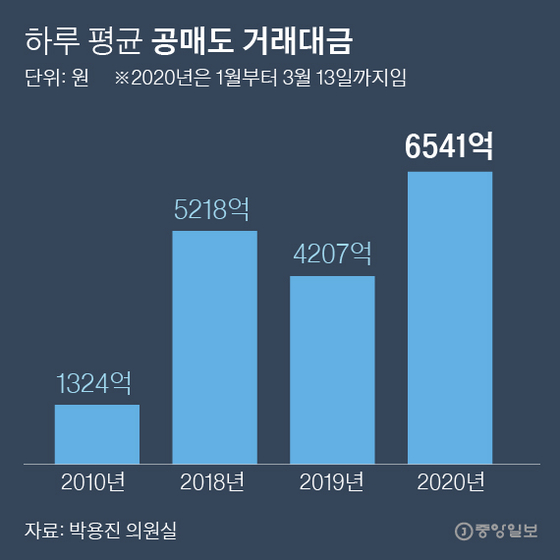

Short selling is an investment technique in which an investor who expects a stock price to fall is placing a’sell’ order without holding the stock. If the short-selling investor’s stock price falls as expected, it gains profits, but if the stock price rises contrary to expectations, it loses. According to Park Yong-jin on the 10th of the Democratic Party’s office, the average daily trading value for short selling was 6541 billion won until the Financial Services Commission banned short selling in March last year. Compared to 2010 (132.4 billion won), it increased 394%.

Average daily short sale transaction value. Graphic = Reporter Park Kyung-min [email protected]

The Financial Services Commission is scheduled to lift the ban on short selling on March 16. The Financial Services Commission banned short selling for six months in the KOSPI, KOSDAQ, and KONEX markets on March 16 last year to alleviate the impact of the stock market caused by the novel coronavirus infection (Corona 19). In September of last year, the ban on short selling was again extended for six months.

At the end of last year, a post titled “Petition for the permanent ban on short selling” was posted on the Blue House National Petition Bulletin. The author of this article argued that “(even without short selling) money goes into companies that are worth the investment, and companies that don’t have the investment value lose money.” As of 1 pm on the 10th, 44793 people agreed.

In the meantime, individual investors called’Donghak ants’ have called the short selling market’a playground for institutions and foreigners’. As it is difficult for individuals to place large-scale short sales orders, they argue that they have no choice but to endure unfair conditions such as a’tilted playground’. Considering the characteristics of short-selling investments, in which the stock price must fall, some argue that a revival of short-selling could hold back the KOSPI uptrend. In a press release, Rep. Park stated in a press release that “to prevent damage to individual investors, we should block illegal short selling and resume short selling after improving the system, such as raising the level of punishment.”

On the other hand, some argue that the ban on short selling should be lifted earlier than expected. Hwang Se-woon, a research fellow at the Capital Markets Research Institute, said, “The domestic stock market is rising too rapidly, and there is a growing concern about bubbles. We should not wait until March, but allow short selling right now.” This means that short selling may have a net function in removing the bubble of overvalued stocks.

Compared to the US and Japanese stock markets, the domestic KOSPI’s pace of rise is steep. In the last month (from December 8th to last year), the KOSPI soared by 17%. During the same period, the Dow index in the New York stock market rose 3%, and the Nikkei index in the Tokyo stock market rose 6.3%. The United States and Japan did not ban short selling despite the impact of Corona 19.

The Financial Services Commission, which has the authority to decide when to resume short selling, is cautious. An official from the Financial Services Commission said, “We have established a system for detecting illegal short selling and are improving the system by expanding opportunities for short selling to individuals, but setting investment limits.” I will decide whether to extend it.”

Reporter Yeom Ji-hyun [email protected]